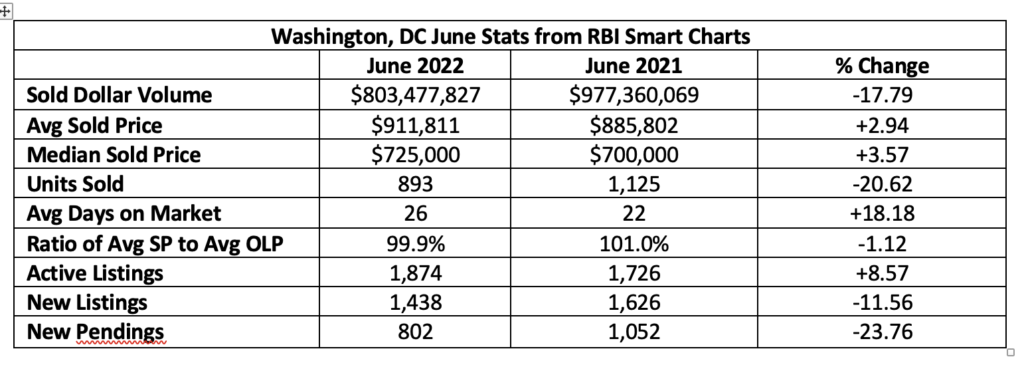

Welcome back for your July Market Update (Data from June 2022).

Market Trends

Home sales are slowing. The number of pending contracts is down 21% compared to last year. This is the largest decline since the spring of 2020 (original covid slowdown).

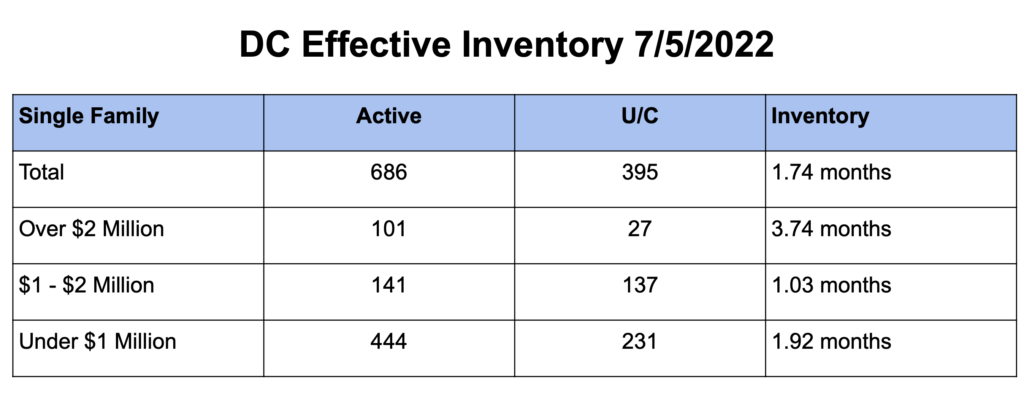

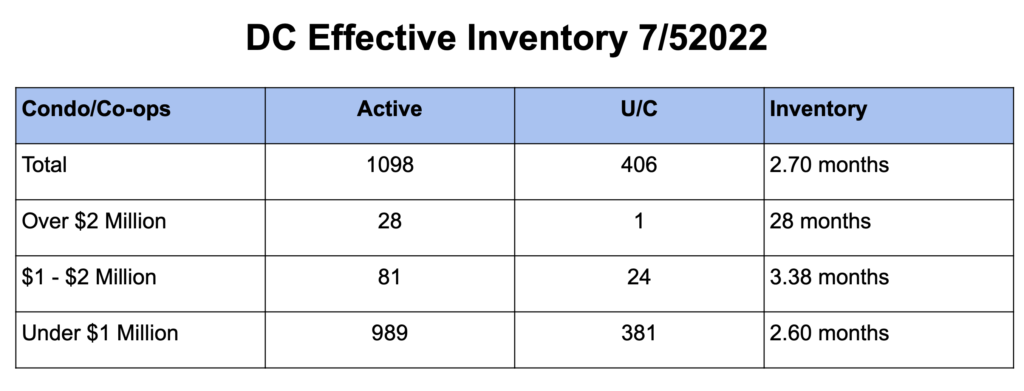

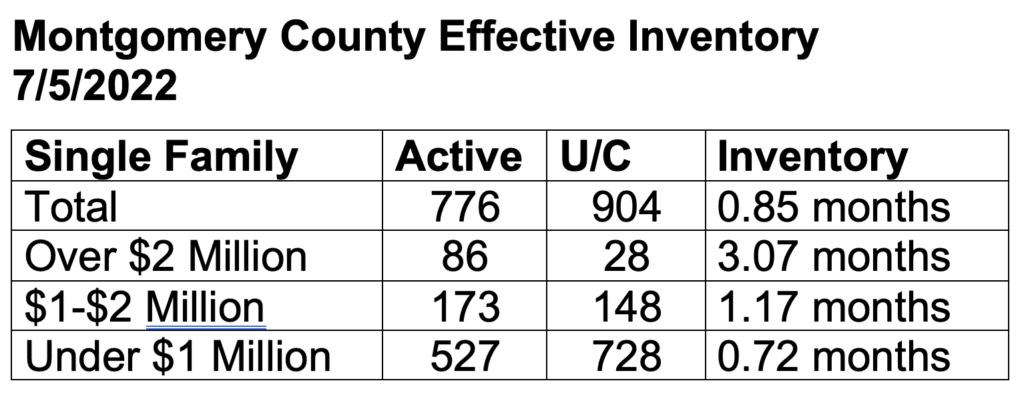

Inventory is increasing in some submarkets, but still decreasing in other markets. This is a local issue — National housing inventory trends should not be applied as a blanket position in this area.

Active listings are up 9.4%. This is two months of increases. (Inventory has previously been decreasing for 7 years.) There is less buyer activity. This will mean more options and less competition.

Median sales prices are up 7.8%.

Market Demand

The home demand index is 120/moderate. Demand is highest for high price single family homes and high price condos. Low priced single family homes did the least well. There is a moderate level of demand for all other types of housing.

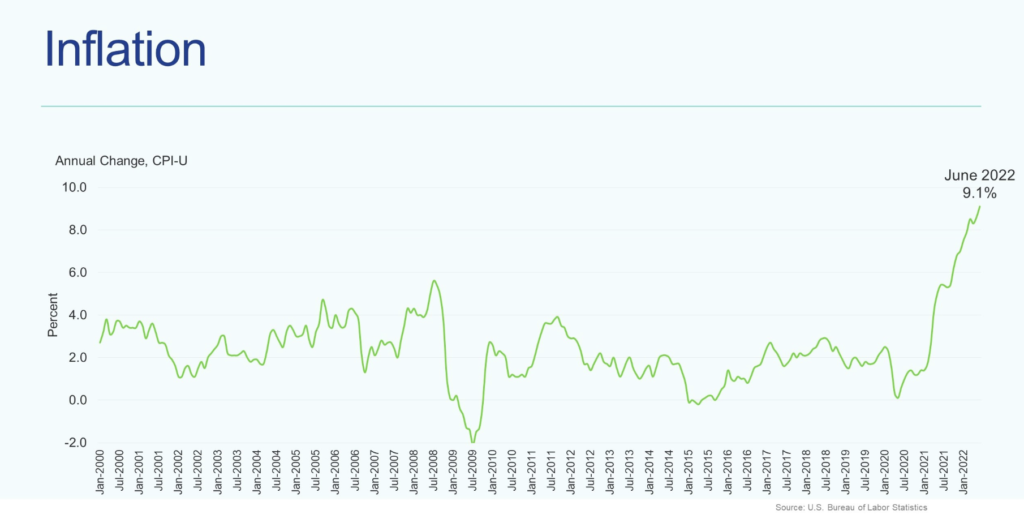

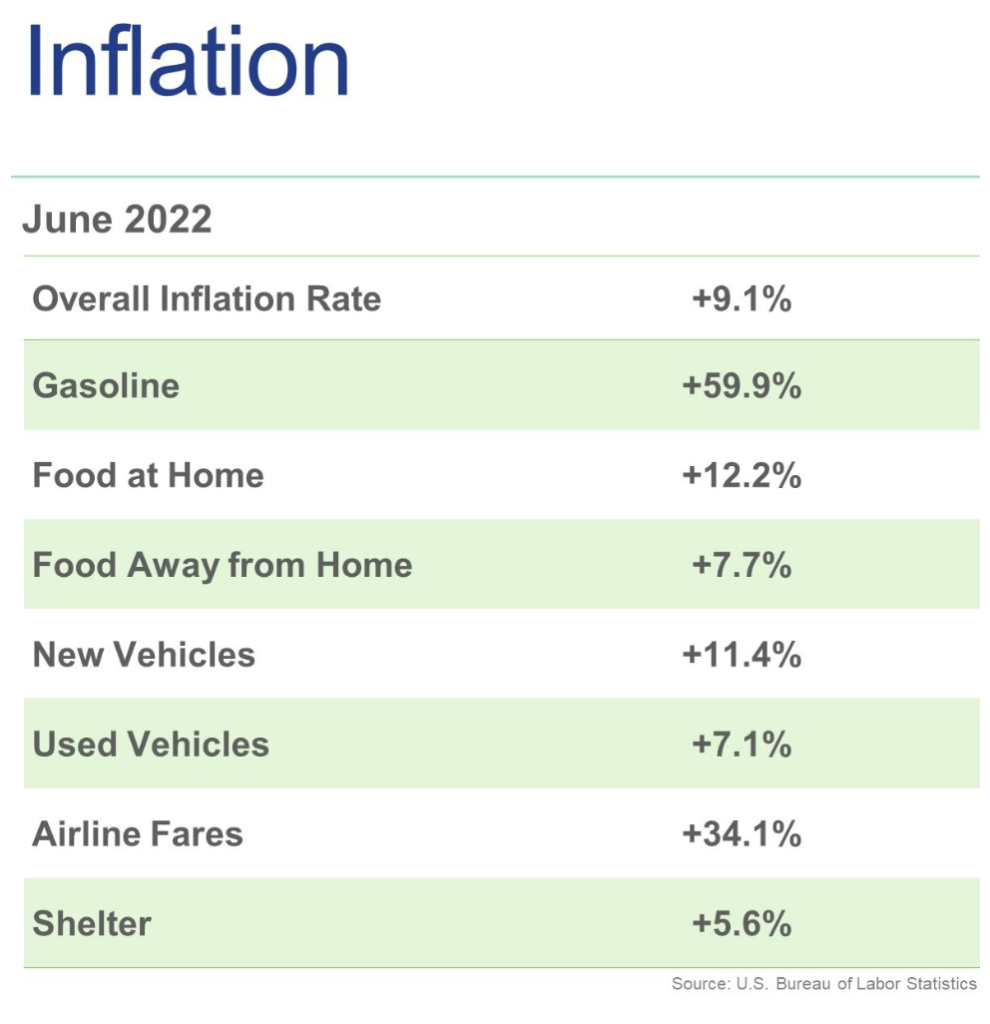

Inflation

In June, inflation was 9.1%. This is a 40 year high.

The Federal Reserve is meeting later this month and they are talking about another aggressive rate hike.

We still don’t expect mortgage rates to have a steady upward trend. We expect them to be the most volatile for the next few months and then steady out. The predictions I am seeing say 5-5.5%.

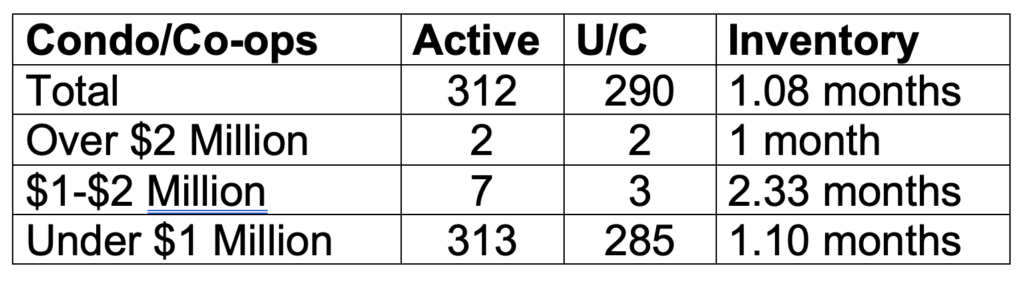

Inventory

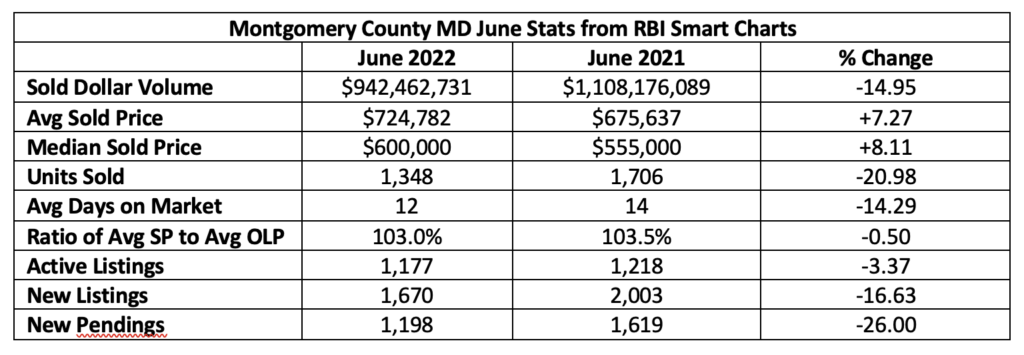

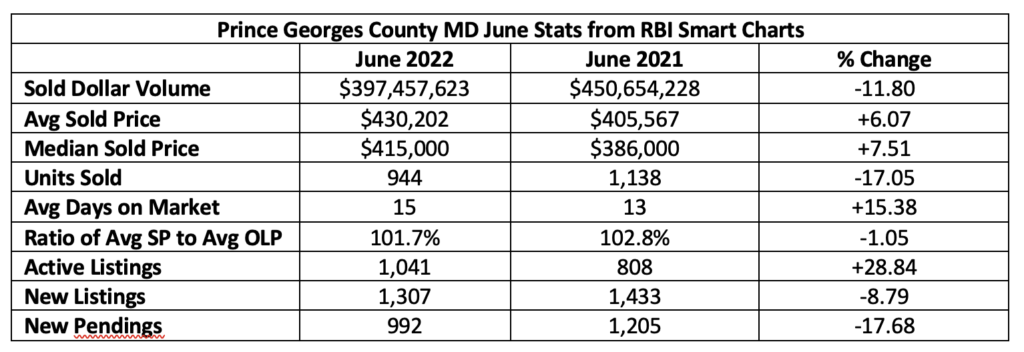

Maryland My Maryland

2022 inventory is 23.2% less than 2021. The average price is up 10.1%. There is 1.1 months of inventory (compared to 1.3 months in 2021). This is solidly still a seller’s market.

Sources:

Bright MLS. Lisa Sturtevant. “Mid-Atlantic cools, smaller markets hold stronger.” July 14, 2022.

Bright MLS T3 Home Demand Index. 2022 July Report

Bright MLS. Lisa Sturtevant. “Inflation Up Again in June.” July 13, 2022.

TTR Sotheby’s International Realty internal inventory graphs.

RBI Smart Charts. June stats.