To answer this question, let’s start by looking at the year end. Since the recession, consumer confidence has increased as the economy has stabilized. Interest rates and mortgage rates are expected to increase throughout the year. In November, a new President was elected. The market is currently adjusting to expectations of policies his administration will… Continue reading How’s the Market?

Your real estate wealth rescuer

Category: Buying a house

Spring Housing Market: Get Ready for the Spring Housing Market

Welcome to my new series – “Get Ready for the Spring Housing Market”. Are you looking to buy or sell a home this spring? Let’s talk about the market. Our local spring market has the most sales of the year, which is why so many sellers time their home sale for the spring market (which… Continue reading Spring Housing Market: Get Ready for the Spring Housing Market

Bond Loans: What is a bond loan? What are available in the DC Metro Area?

Continuing my series, “Understanding Financing,” with this video on bond loans. What is a bond loan? And what bond loans are available to home buyers in the DC Metro Area? This video features my special guest, Ron Schwartz, Senior Loan Officer with Embrace Home Loans. Hannah: Hey everybody, I’m here today with Ron Schwartz of… Continue reading Bond Loans: What is a bond loan? What are available in the DC Metro Area?

What is a Pre-Approval? And why should you do it?

We are continuing my series, “Understanding Financing,” with this video on the pre-approval process for a mortgage. What is a pre-approval and why should you get one? I interview Rich Godbout of Caliber Home Loans. Hannah: Hey everybody! I am here today with Rich Godbout of Caliber Home Loans. I have known Rich my entire real… Continue reading What is a Pre-Approval? And why should you do it?

Loan Products: An introduction to loan products for buying real estate

We are picking up our series “Understanding Financing” with today’s post, where we will look at the main loan products that most buyers use in the purchase of real estate. There are a lot of products on the market, various criteria to qualify for each, and different requirements from different lenders. My goal today is… Continue reading Loan Products: An introduction to loan products for buying real estate

Income and Assets & How they affect your ability to secure financing

Welcome back to my series, “Understanding Financing.” Let’s turn to income. Lenders will want to see your pay stubs, W2s, and tax returns for the last two years. Are you a W2 employee or self employed? If you are self employed, you will need to show two years of income. Lenders will then average them… Continue reading Income and Assets & How they affect your ability to secure financing

FHA Reduces Mortgage Insurance Premiums

Mortgage Insurance Premiums | The Federal Housing Administration (FHA) reduced mortgage insurance premiums by a quarter of a percentage point (from 0.85% to 0.6%) starting January 27. (0.25% for 30-year loans and 0.20% for 15-year loans.) HUD says that this should decrease borrowers costs by $500 a year on average (a $200,000 loan). While this… Continue reading FHA Reduces Mortgage Insurance Premiums

Credit & How it affects your ability to secure financing

Credit and Security Financing In my last post, I discussed real estate financing 101 – what is a mortgage? and how will lenders evaluate you (the 3 C’s – credit, collateral, capacity)? Today, we are going to be talking about credit and how it affects your ability to secure financing. I said we were going… Continue reading Credit & How it affects your ability to secure financing

Financing a Real Estate Purchase 101

Financing Real Estate Purchase | Welcome to my new series, “Understanding Financing.” This is the first blog in this series and I am going to be covering the basics of financing a real estate purchase. As the series continues, I will cover a variety of topics related to securing financing for your real estate purchases, including info… Continue reading Financing a Real Estate Purchase 101

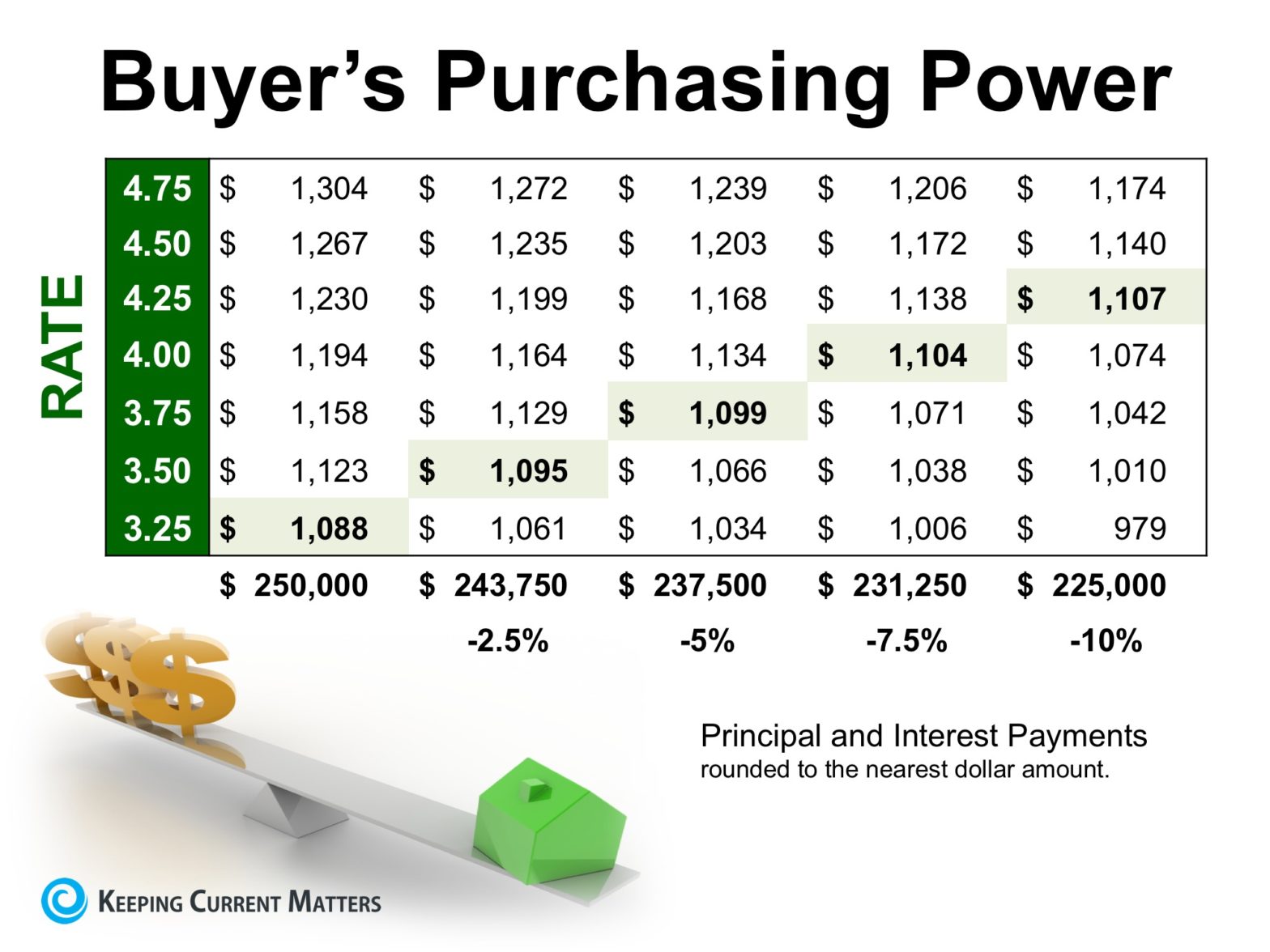

The Fed Raised Rates, What Does This Mean for You?

The Federal Reserve raised the Federal funds rate by 0.25%. They did not raise mortgage rates. Mortgage rates did respond to this though with an increase. Today, the 30 yr fixed-rate mortgage rate is 4.16%. The Fed has said that they will continue to increase the Fed funds rate maybe two or three more times this… Continue reading The Fed Raised Rates, What Does This Mean for You?