Looking back at April 2022 data and results. Here are some quick snap shots:

Demand

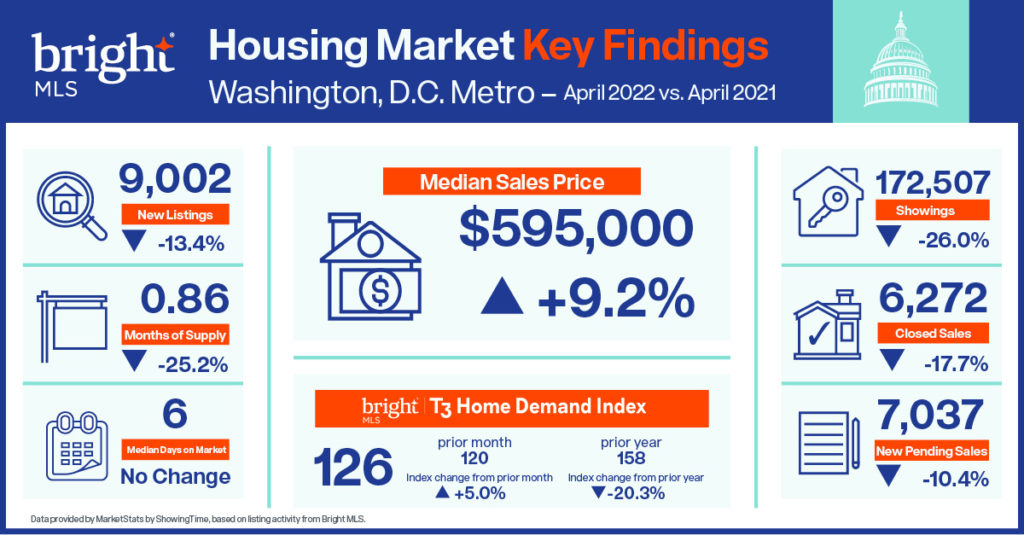

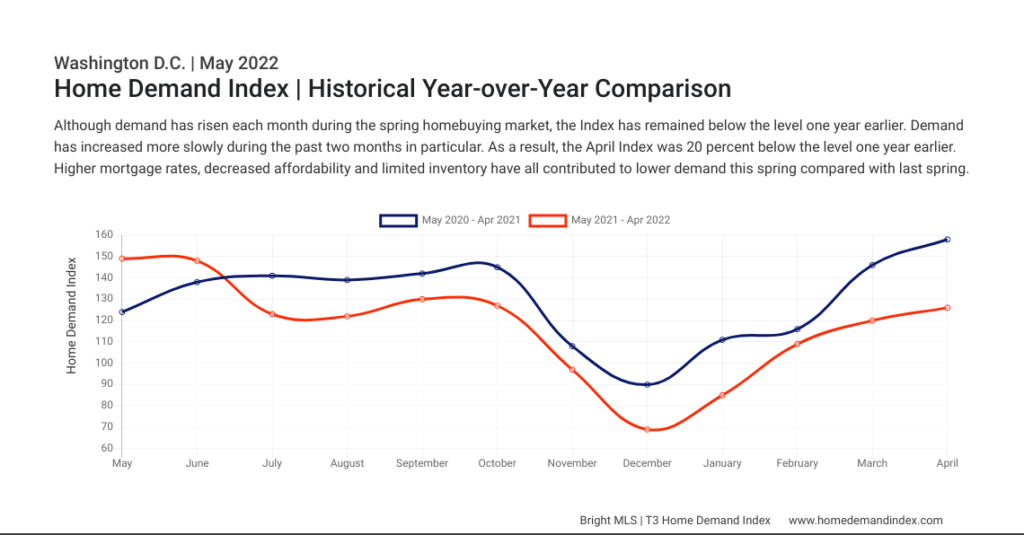

The Bright MLS T3 Home Demand Index rose to 126 (Moderate demand) since last month.

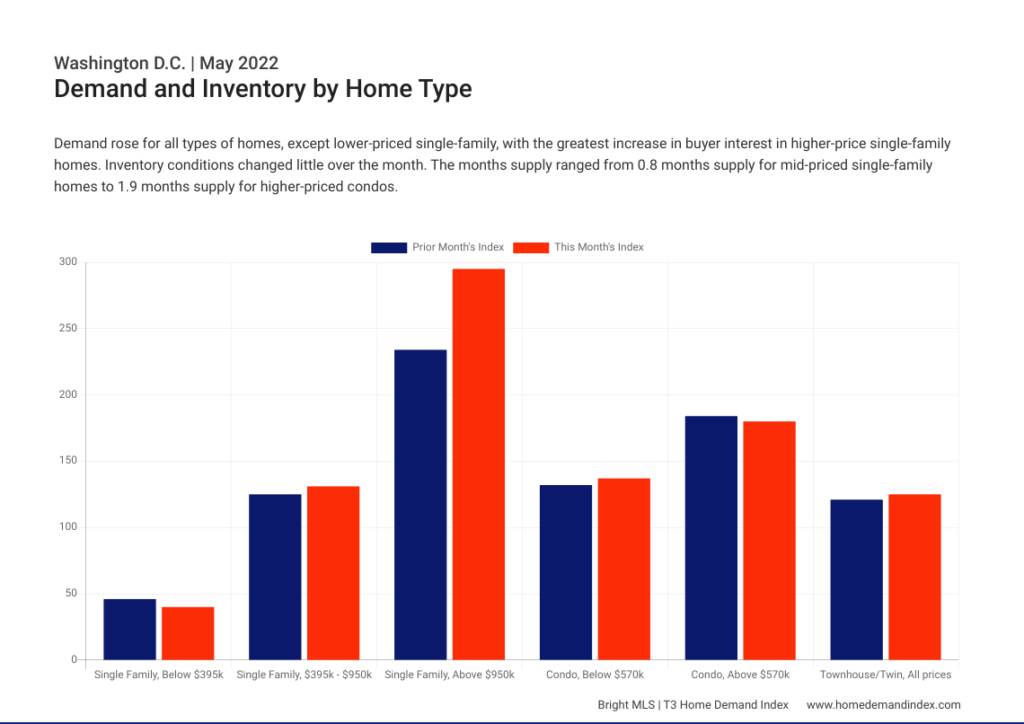

Demand rose for all types of homes, except lower-priced single-family, with the greatest increase in buyer interest in higher-price single-family homes. Inventory conditions changed little over the month. The months supply ranged from 0.8 months supply for mid-priced single-family homes to 1.9 months supply for higher-priced condos.

The index for mid-priced single-family homes increased to 131 (High). The months of supply is 0.8 months.

The index for single family homes above $950,000 is 295 (High). Demand is up 26%. Demand in this category has stayed consistently high throughout the spring market.

Prices

Over the coming 12 months, CoreLogic predicts U.S. home prices will rise another 5.9% and the Mortgage Bankers Association 5.2%.

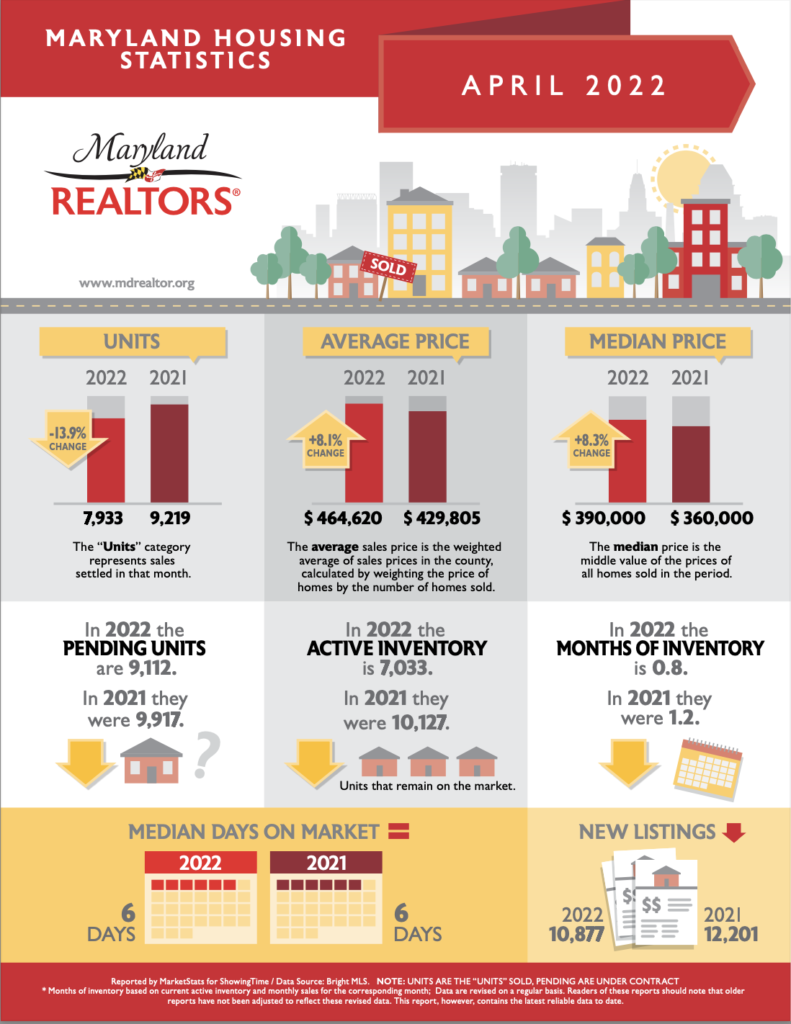

Pricing in Maryland are rising with the average sales price increasing 8.1% and median sales price 8.3%.

Update on Mortgage Rates

This week Freddie Mac’s data on mortgage rates shows that average 30-year fixed-rate mortgage is 5.30%.

Homebuyers continue to show resilience even though rising mortgage rates are causing monthly payments to increase by about one-third as compared to a year ago,” said Sam Khater, Freddie Mac’s Chief Economist. “Several factors are contributing to this dynamic, including the large wave of first-time homebuyers looking to realize the dream of homeownership. In the months ahead, we expect monetary policy and inflation to discourage many consumers, weakening purchase demand and decelerating home price growth.” (FreddieMac)

NAR has calculated that purchasing a home is now 55% more expensive than a year ago.

Sources:

Bright MLS T3 Home Demand Index. May 2022.

FreddieMac. “Mortgage Rates Continue to Increase,” May 12, 2022.