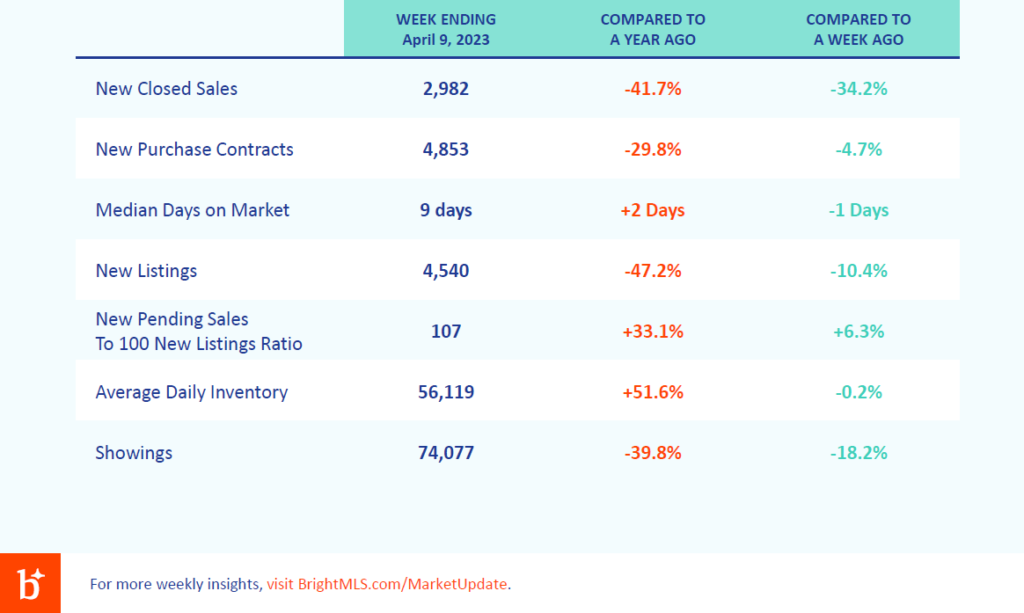

Let’s start with a general description of the market. The Bright MLS T3 Home Demand Index is 83 or Slow. Buyers are restricted to significantly fewer listings on the market than they saw prior to the pandemic housing frenzy. Demand is strongest for luxury single family home and luxury condos. Limited inventory and higher interest rates will continue to hold back market activity in the Mid-Atlantic and across the country.

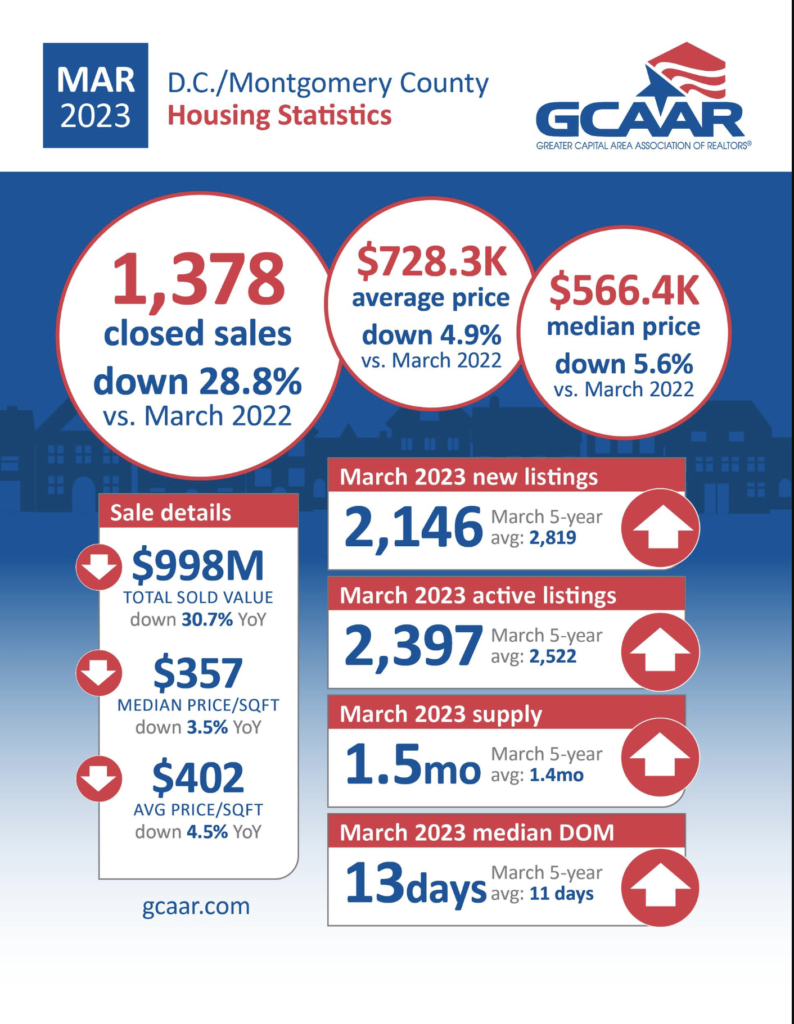

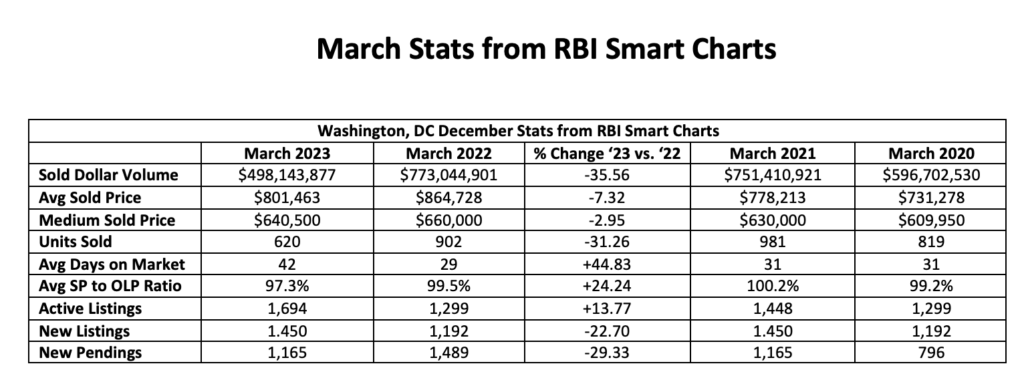

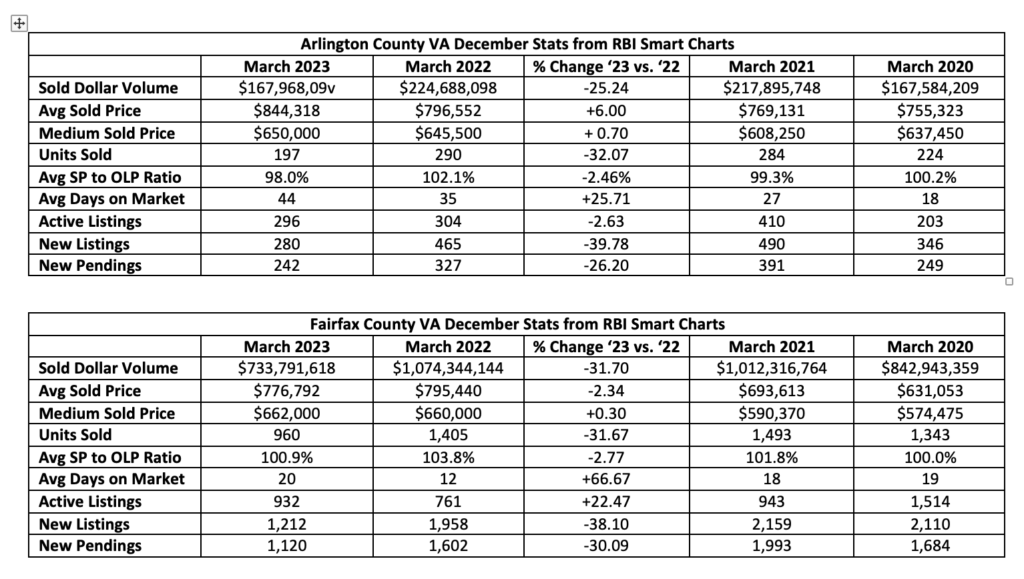

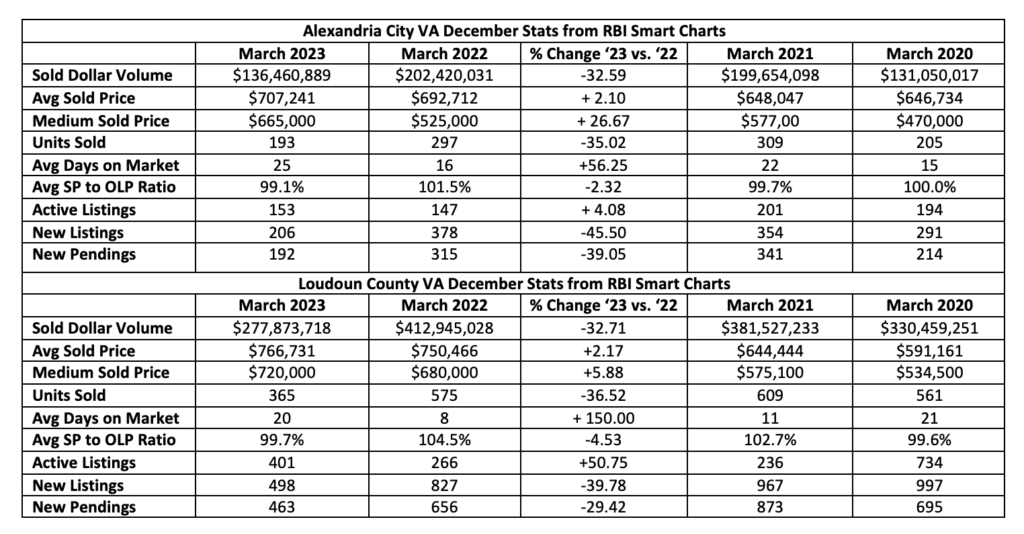

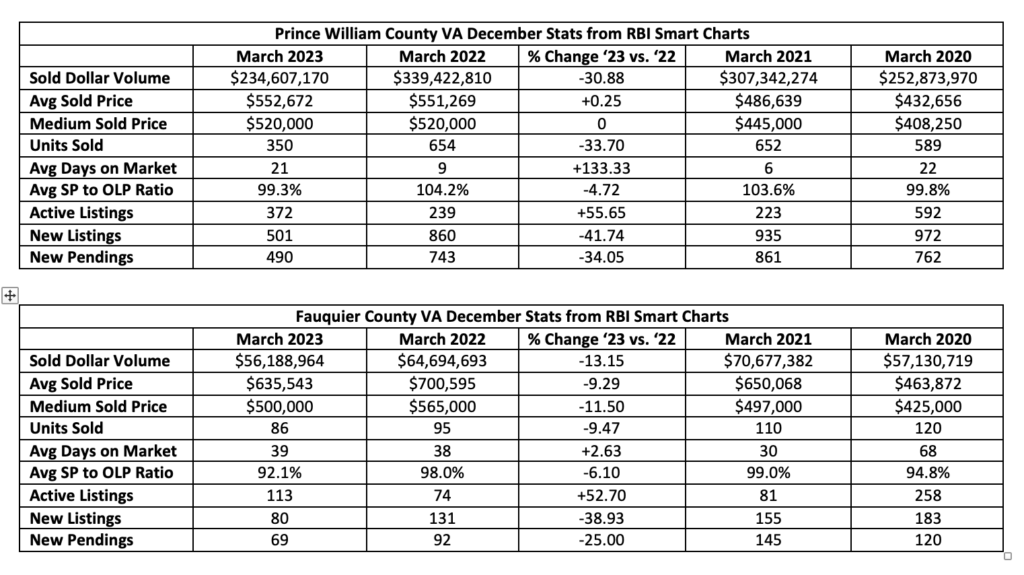

The number of sold units is down 30% from last year. This is mainly an inventory issue. The demand is out there, there is just no inventory.

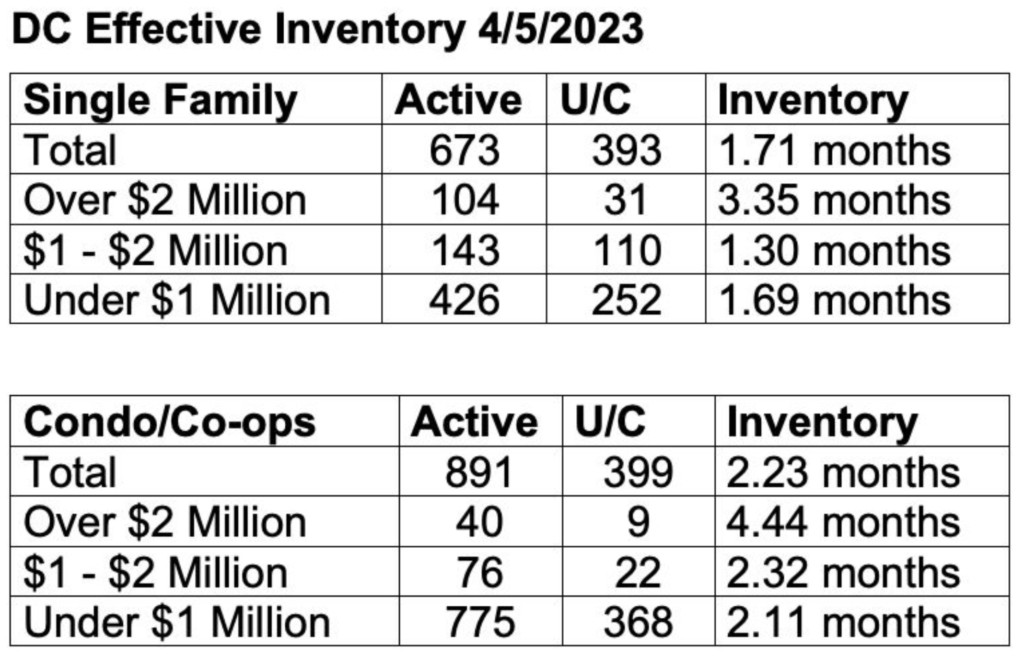

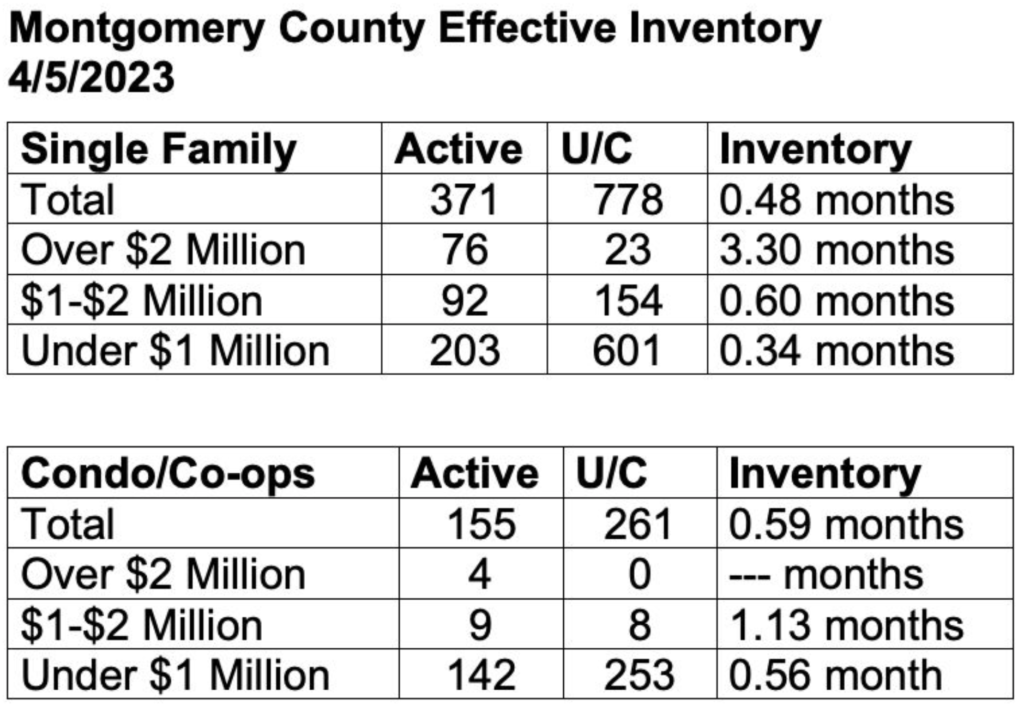

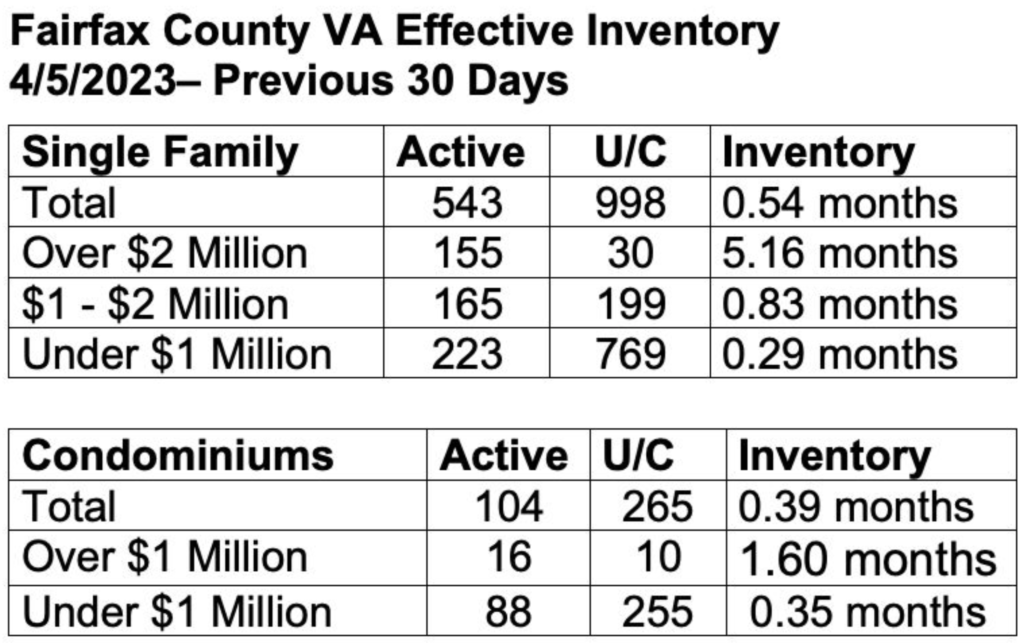

Inventory

Inventory is flat. We are not seeing increasing inventory in our area. Inventory is lower than the 1st of the year. DC is at 1.7 months of inventory and condos are at 2.25 months. This is the highest months of inventory we have in the area. Moco and Fairfax are at 1/2 month of inventory. Remember 6 months is considered a balanced market.

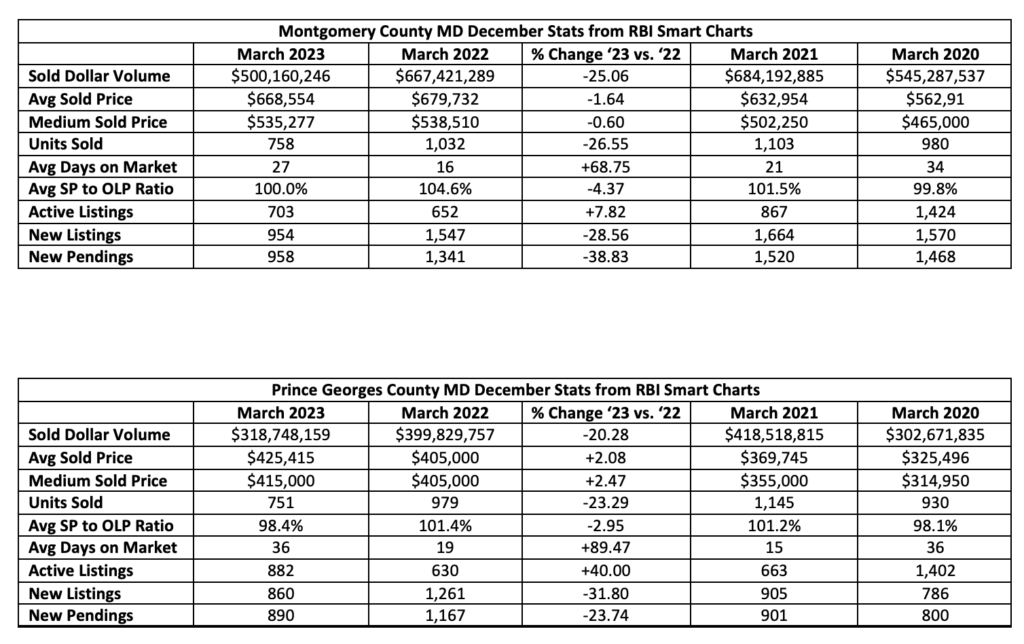

Pricing

Prices are starting to decrease in the Montgomery County and Washington, D.C. area. The average sold price holds at $728,301, a 4.9% decrease from March 2022 and a 1.7% increase from February 2023.

Inflation

The March Consumer Price Index (CPI) showed that inflation was up 0.1%. This was less than expected. Inflation is now 5% (down a year ago from 6% and down from its peak of 9.1%). The inflation goal is 2%.

Shelter is 60% of the total increase in CPI. As we discussed above, prices are starting to decrease in our area and across the nation. As this is a lagging indicator, we expect to see decreasing prices putting downward pressure on inflation.

Incoming data suggest inflation remains well above the desired level but showing signs of deceleration. These trends, coupled with tight labor markets, are creating increased optimism among prospective homebuyers as the housing market hits its peak in the spring and summer.”

– Sam Khater, Freddie Mac’s Chief Economist

Mortgage Rates

Mortgage rates are averaging 6.43% right now. Mortgage application volume is up.

Although incoming data points to a slowdown in the U.S. economy, markets continue to expect that the Fed will raise short-term rates at its next meeting, which have pushed Treasury yields somewhat higher. As a result of the higher yields, mortgage rates increased for the second straight week to their highest level in over a month, with the 30-year fixed rate now at 6.55 percent.”

– Joel Kan, MBA’s Vice President and Deputy Chief Economist

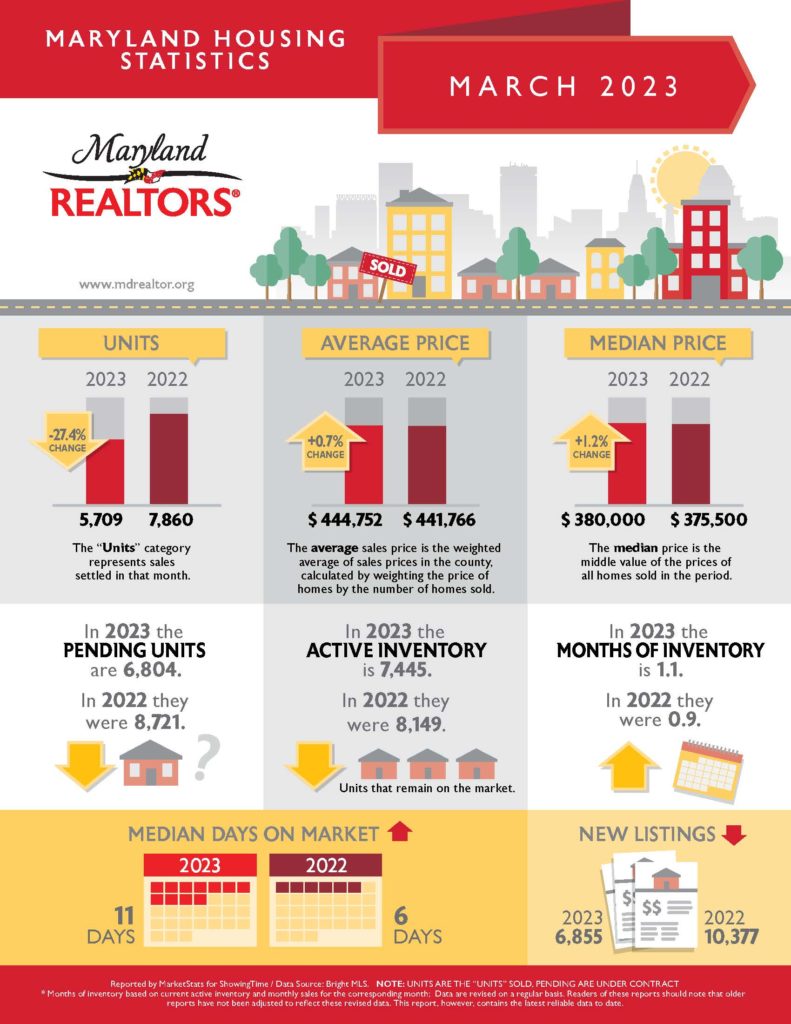

Maryland My Maryland

Sources

Lisa Sturtevant, Bright MLS. “Weekly Market Report: Week Ending Apr 9.” April 10, 2023.

Lisa Sturtevant, Bright MLS. March 2023 Market Report. April 12, 2023.

Bright T3 Home Demand Index. DC. April 2023.

Lisa Sturtevant, Bright MLS. “Weekly Market Report: Week Ending Apr 23.” April 24, 2023.

March 2023 Housing Stats. News from Maryland Realtors. Apr 21, 2023.

Urban Turf, April 26, 2023, “Prices Over Rates? Mortgage Demand Rebounds.”

Urban Turf, April 13, 2023, “6.27%: Mortgage Rates Drop for 5th Straight Week.”

Urban Turf, April 27, 2023, “Are Lower Mortgage Rates on the Horizon?”