It’s mid-April and we are finally seeing some nice warm weather (emphasis on some). But how about a market shift?

Let’s start by talking about March 2022.

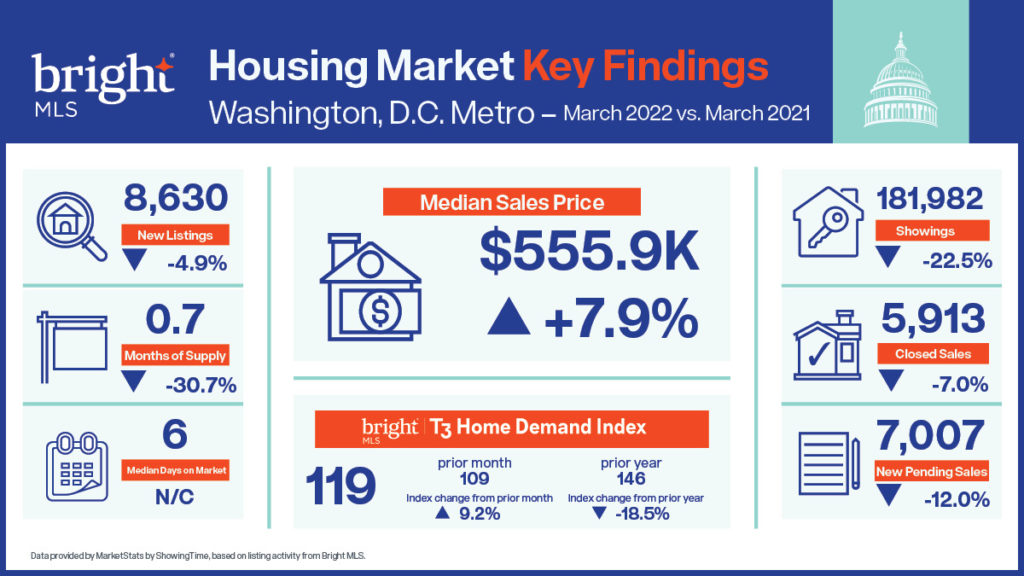

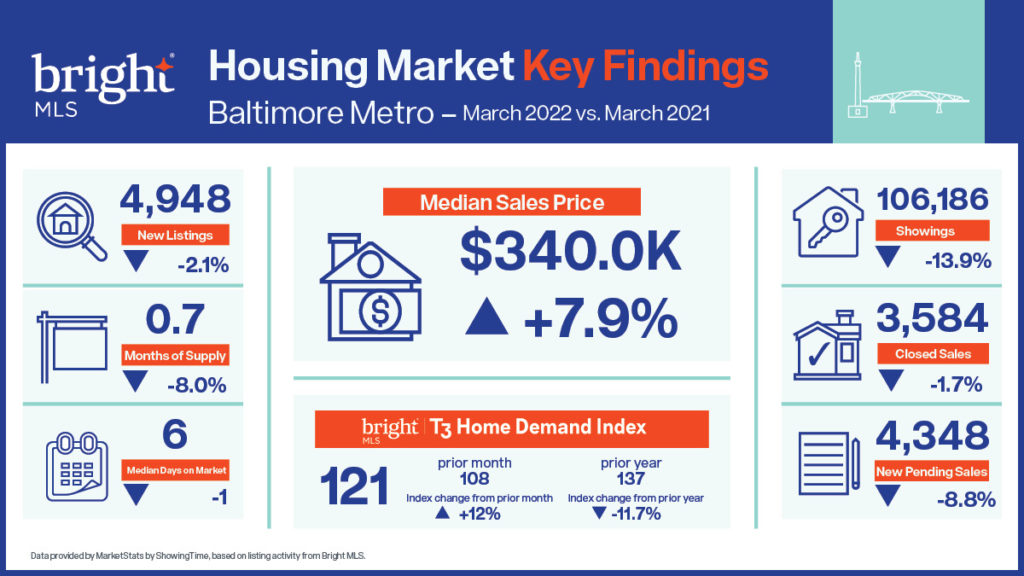

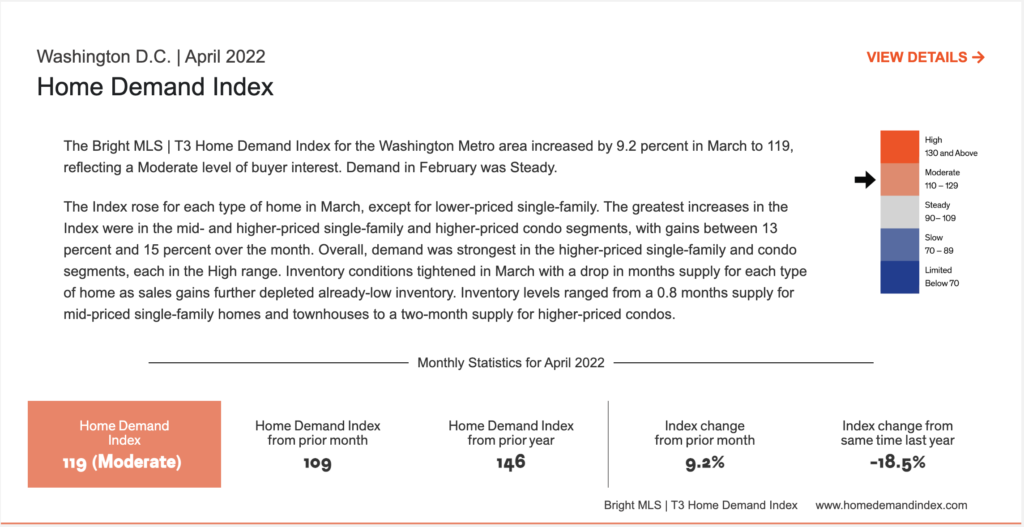

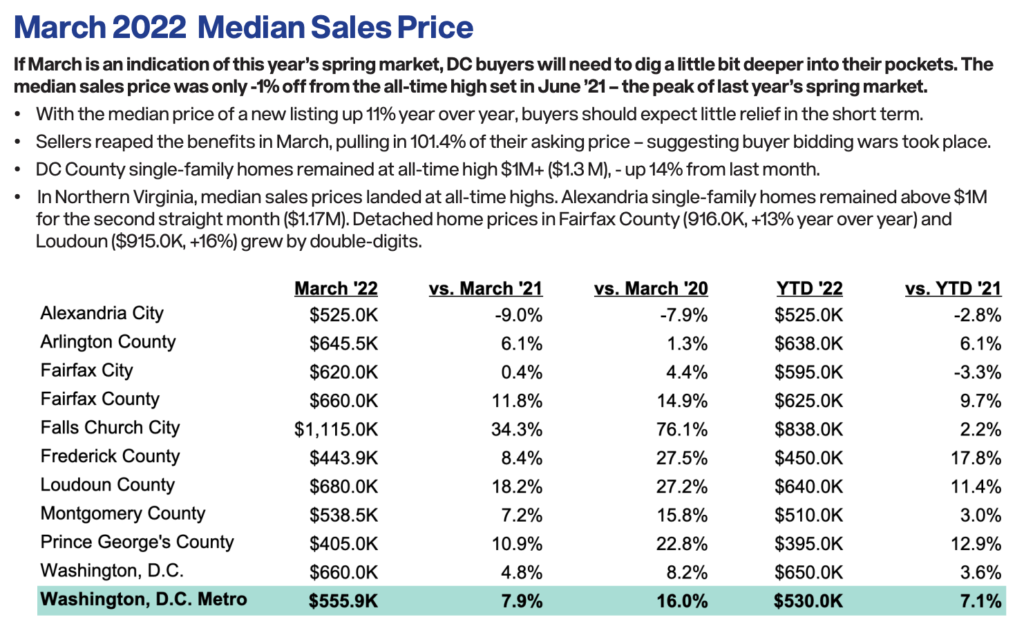

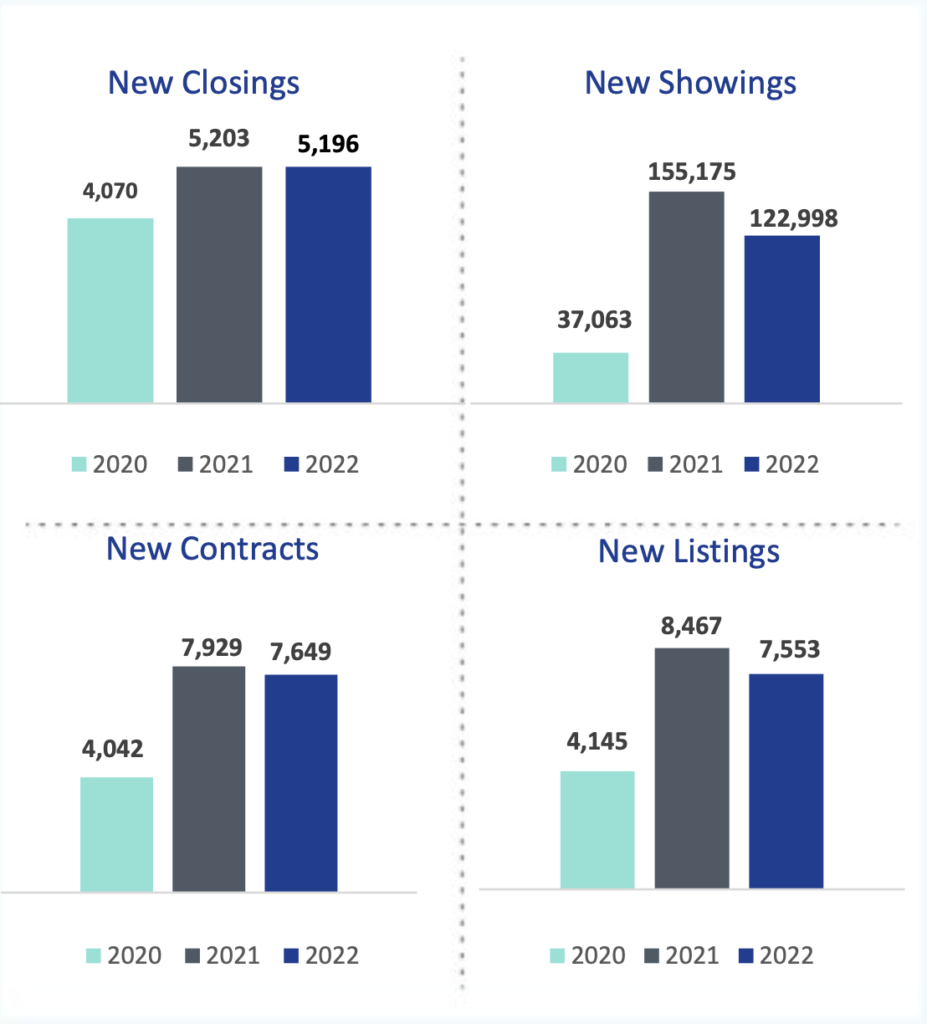

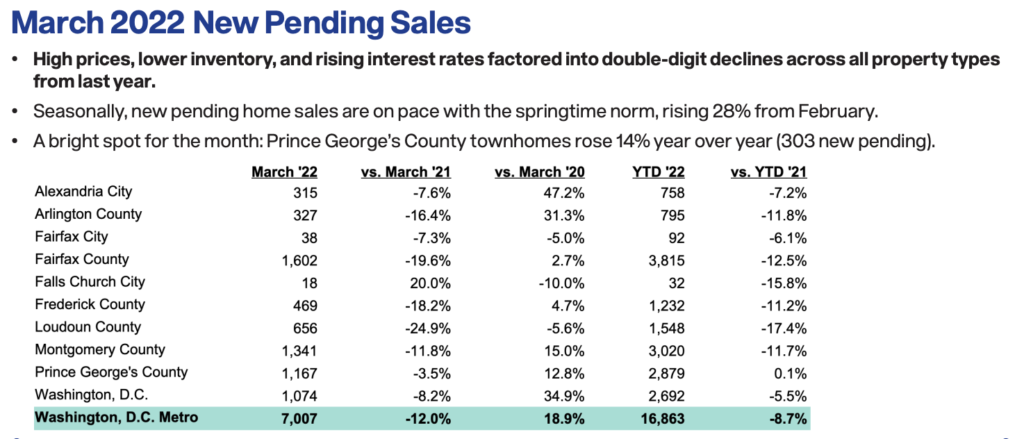

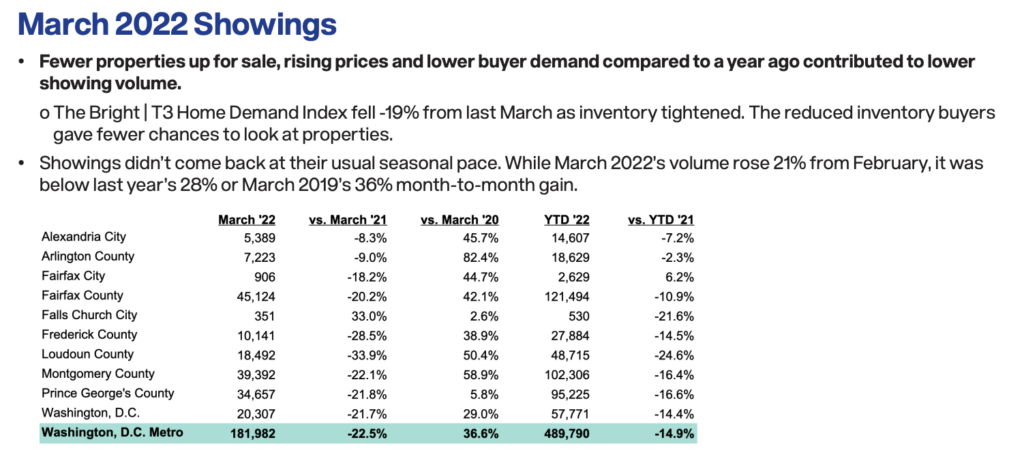

The Bright T3 Home Demand Index is 119 or moderate. The median sales price is at the record high from last year (under the high by ~1%). Days on market are at all-time lows. Inventory levels are still low. And yet buyers are less active than last year – both showings and pending sales.

Montgomery County’s median home price in Mar 2022 was $538,500. Prices are up 7.2% from last year. Washington DC’s median home price was $660,000, up 4.8% from last year.

Montgomery County new pending sales was down 11.8% and DC was down 8.2%.

Montgomery County showings were down 22.1% and DC was down 21.7%.

Is the market slowing down?

Pending home sales are down 12% over last year and home showings were down 22%. These are both indications of a slow-down. We will need to keep watching these to see if this becomes a consistent trend.

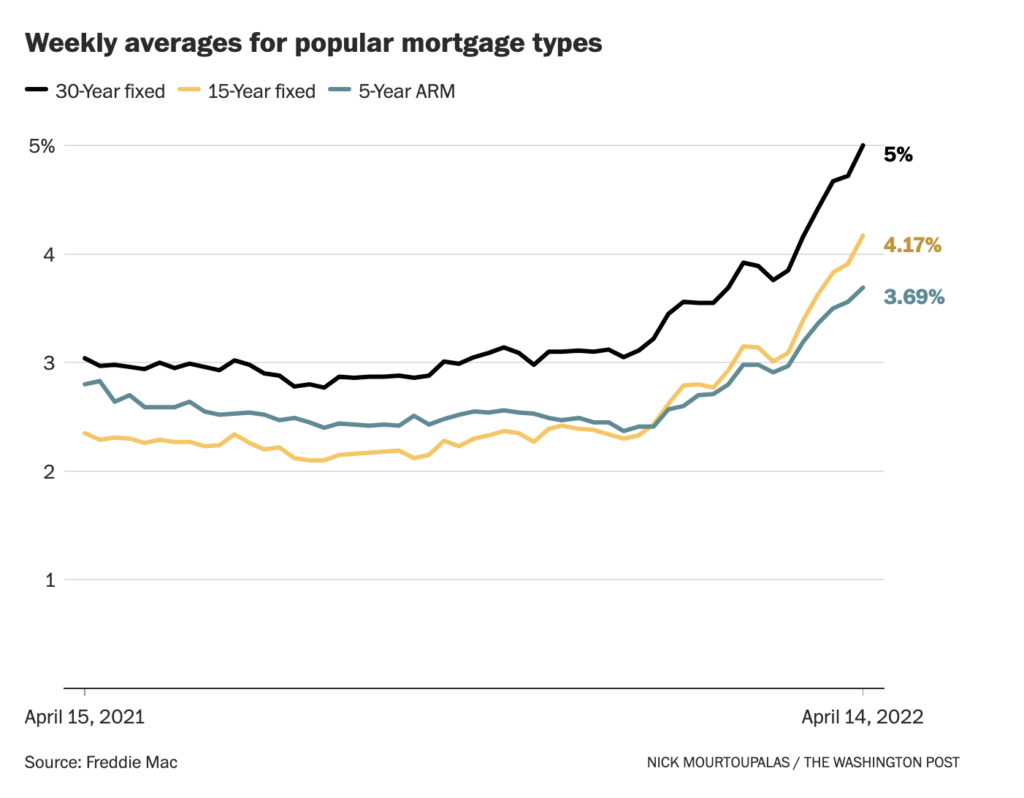

Interest rates rose in March. March’s 30-year fixed-rate mortgage interest average was 4.67%. It was 3.18% a year ago. This is the highest we have seen since December 2018.

Markets are anticipating more aggressive actions by the Federal Reserve, based on comments from many officials after the March [Fed] meeting. Consensus is now predicting several 50-basis-point hikes to the federal funds rate this year, which will lead to further upward pressure on mortgage rates,” said Paul Thomas, vice president of capital markets at Zillow.

We are going to continue watching mortgage rates to see how this affects April and beyond.

Is there a market slow down? It is too soon to tell, but it is possible.

Sources:

- “The DC-Area Housing Market May Finally Be Slowing Down,” UrbanTurf. April 13, 2022.

- Bright MLS Data

- Home Demand Index

- “Mortgage rates hit highs not seen since December 2018,” Kathy Orton, Washington Post. Mar 31 2022.