We have a rebounding market in our region. There has been a lot of change and buyers are beginning to come back out. Let’s take a look at what that means.

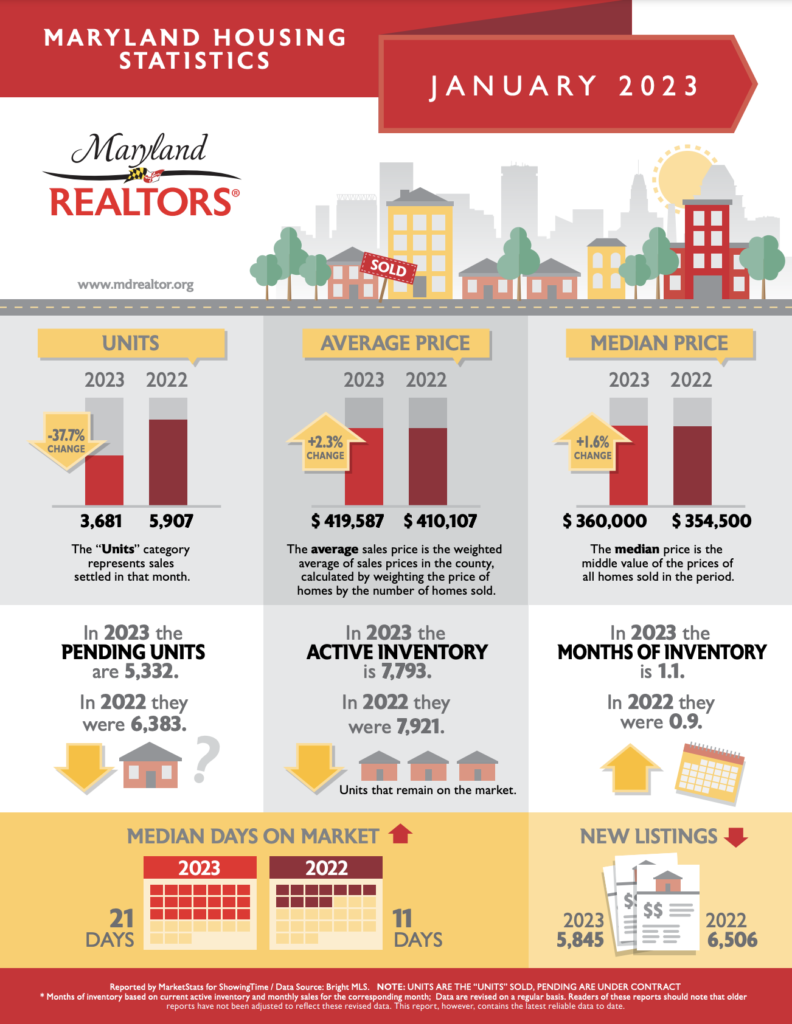

According to Yolanda Muckle, 2023 President, Maryland REALTORS®, January’s numbers may indicate a market that’s getting used to current conditions.

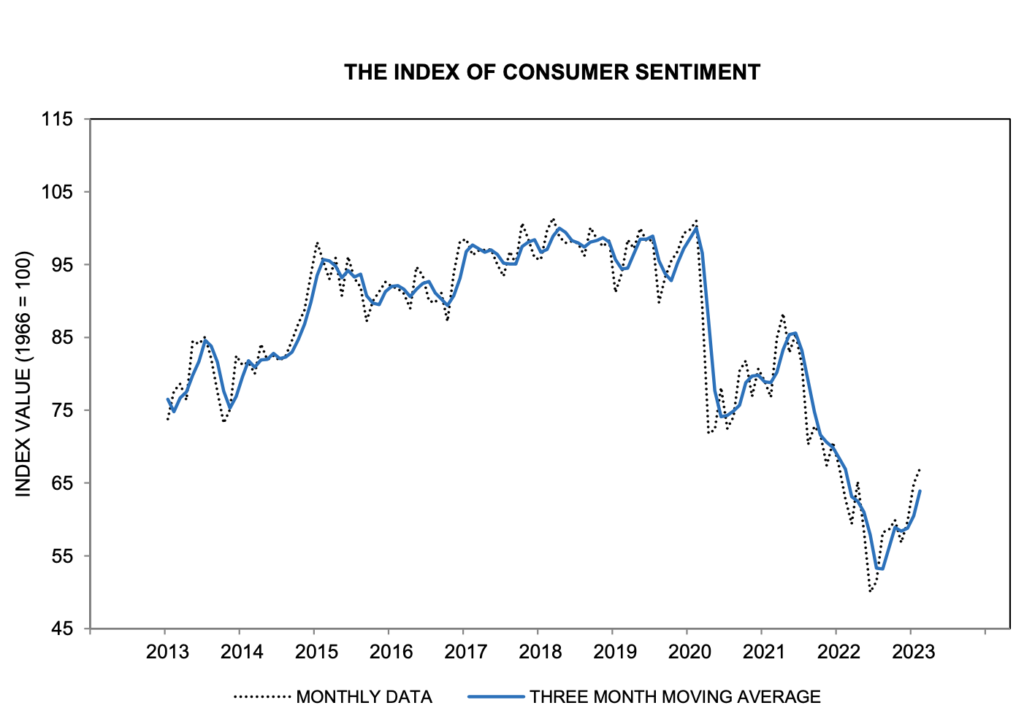

Last November, the 30-year fixed mortgage rate peaked at 7.08%. In January, the rate was as low as 6.13%. While this pales in comparison to rates in the early part of 2022, consumers have recognized that conditions are more favorable now than in late 2022, so yes, we’ve seen some movement but certainly not enough to offset the current drop in home sales.”

– Yolanda Muckle

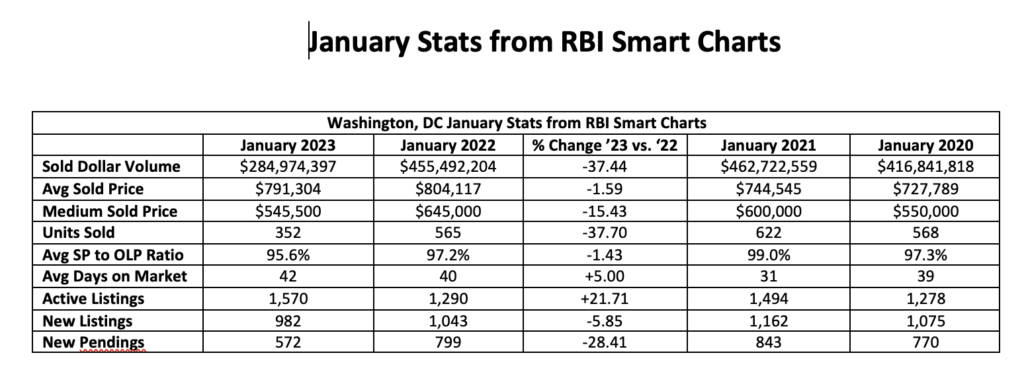

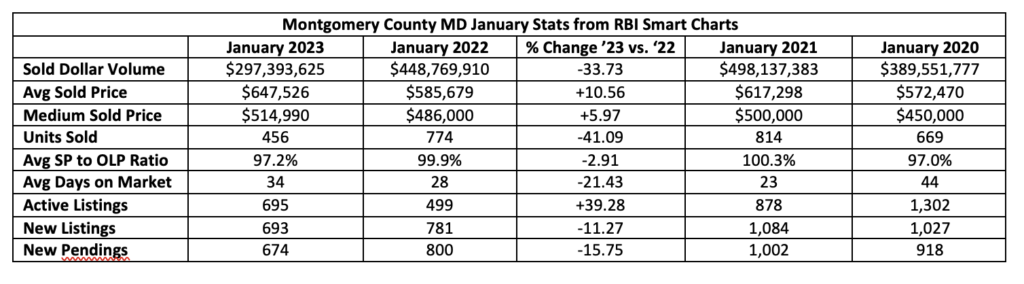

What did January look like compared to the last 3 Januarys

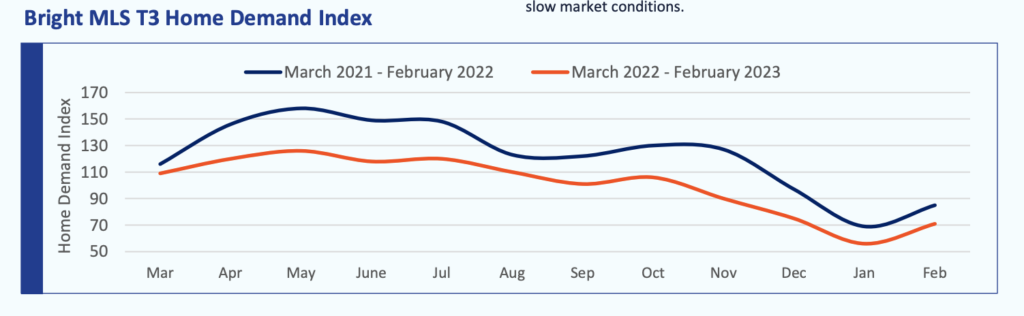

Mortgage rates steadily fell, with rates lower than we had seen since September. Rates are likely to continue where they are for the spring market.

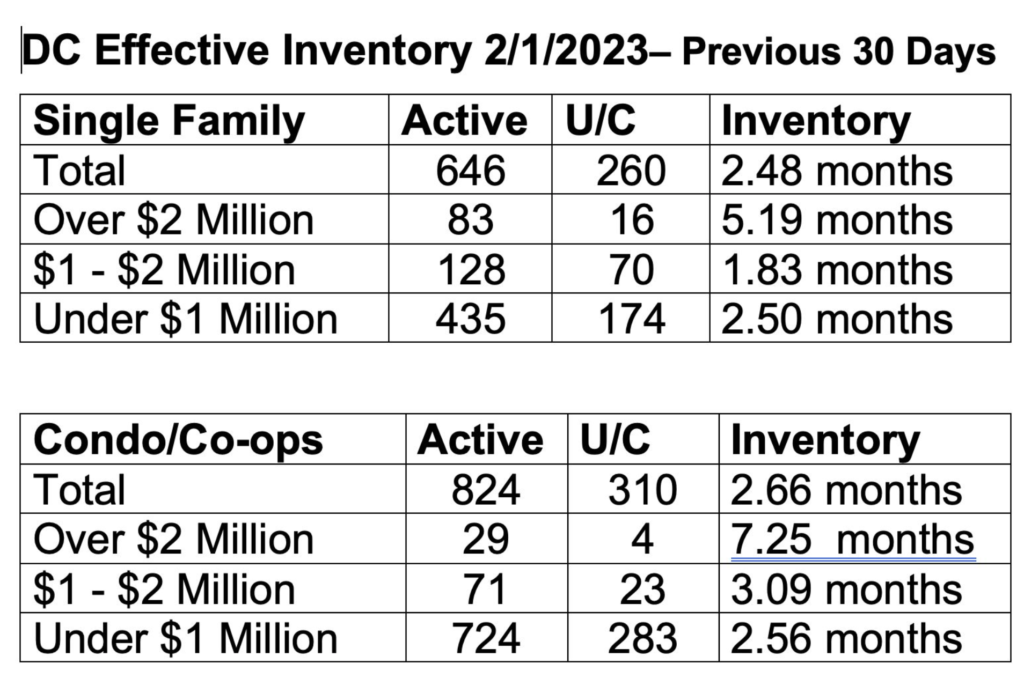

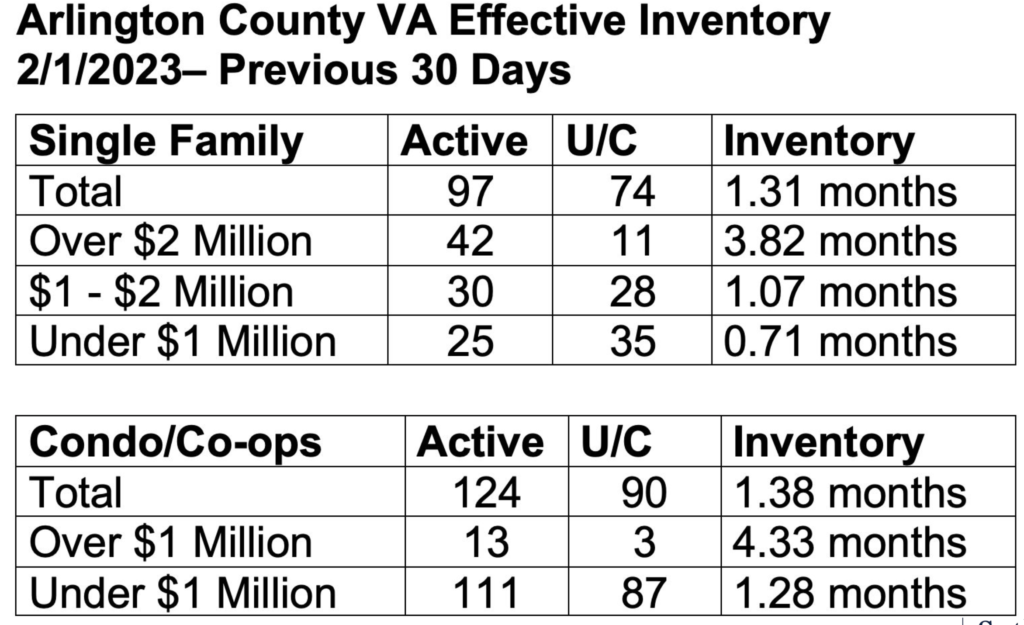

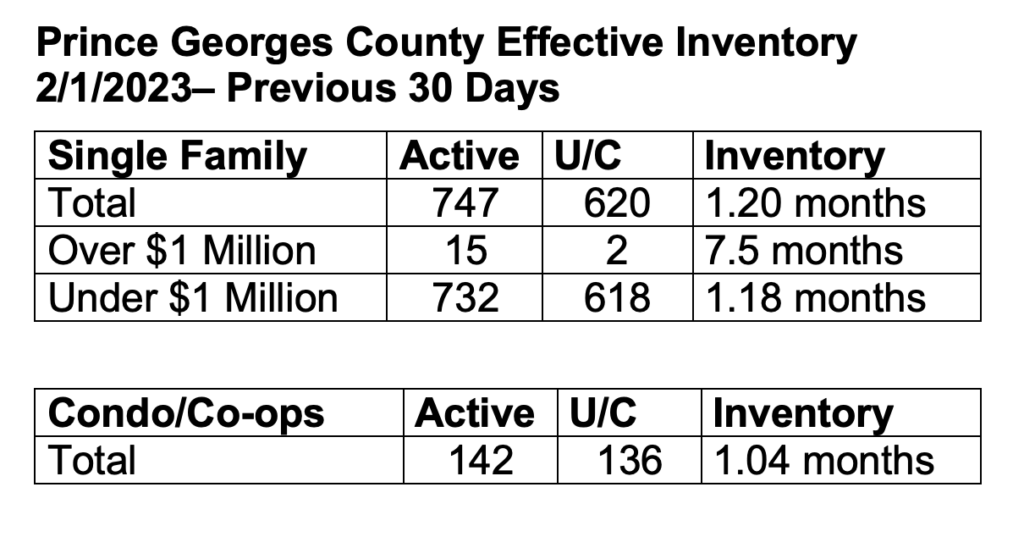

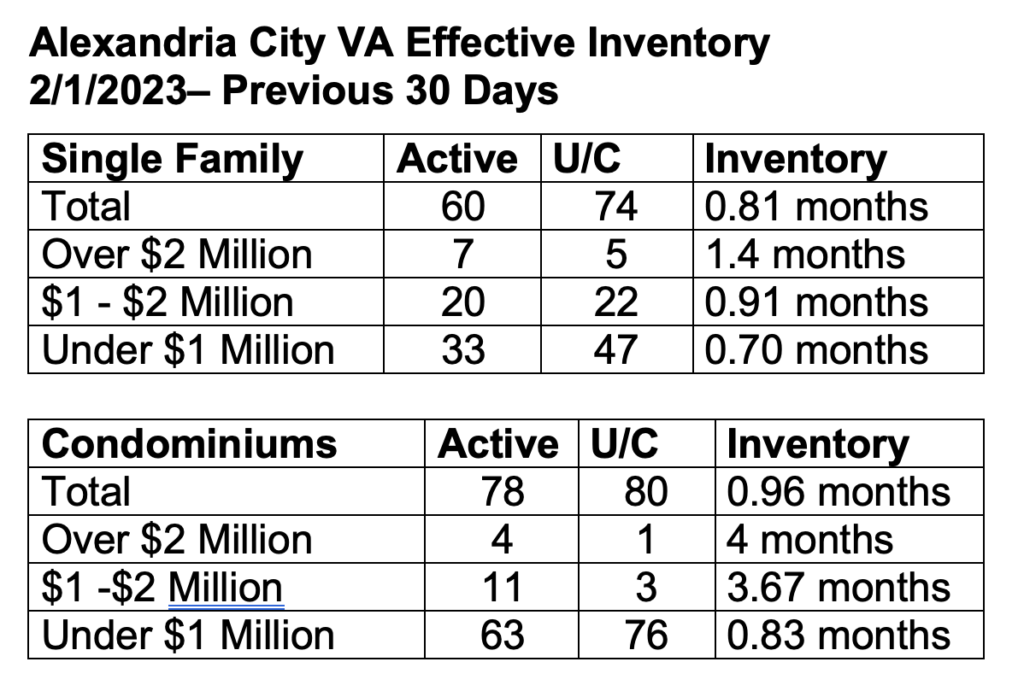

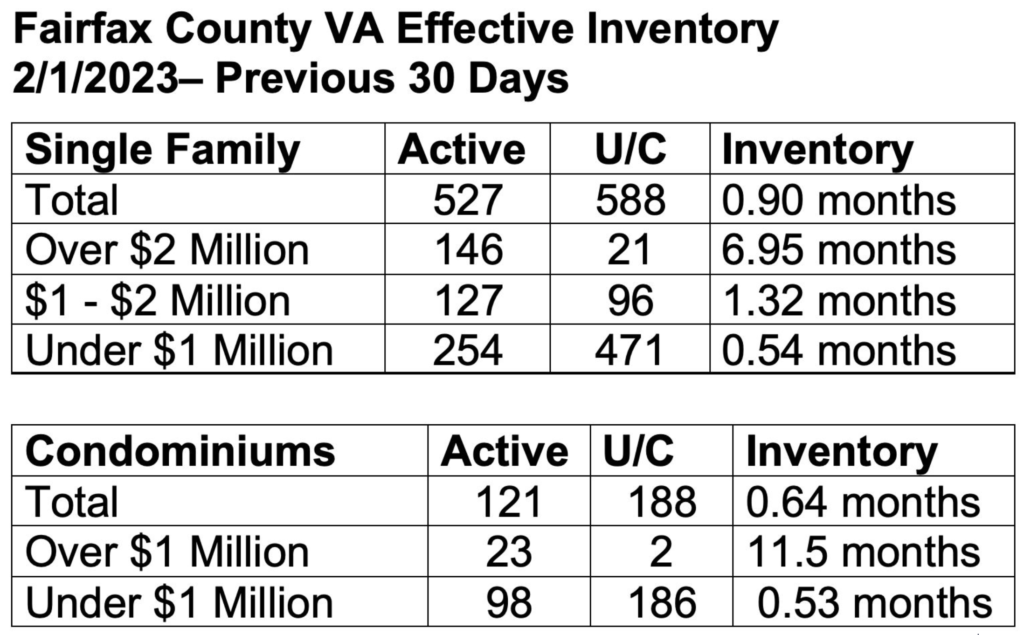

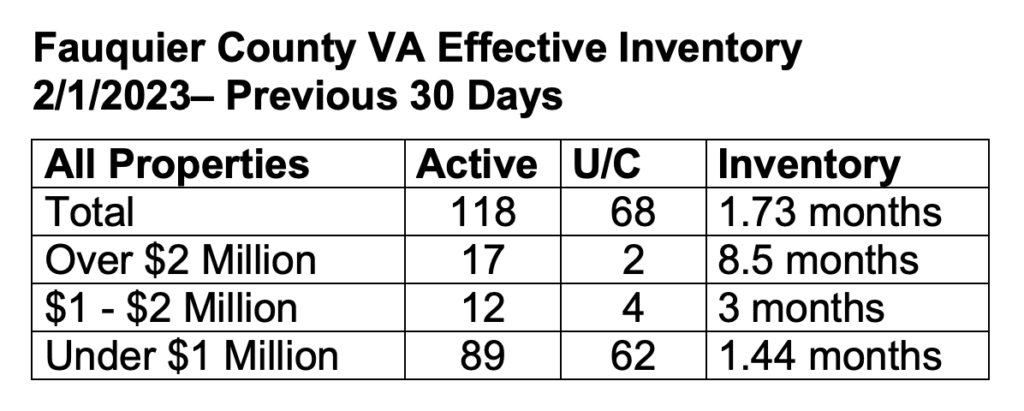

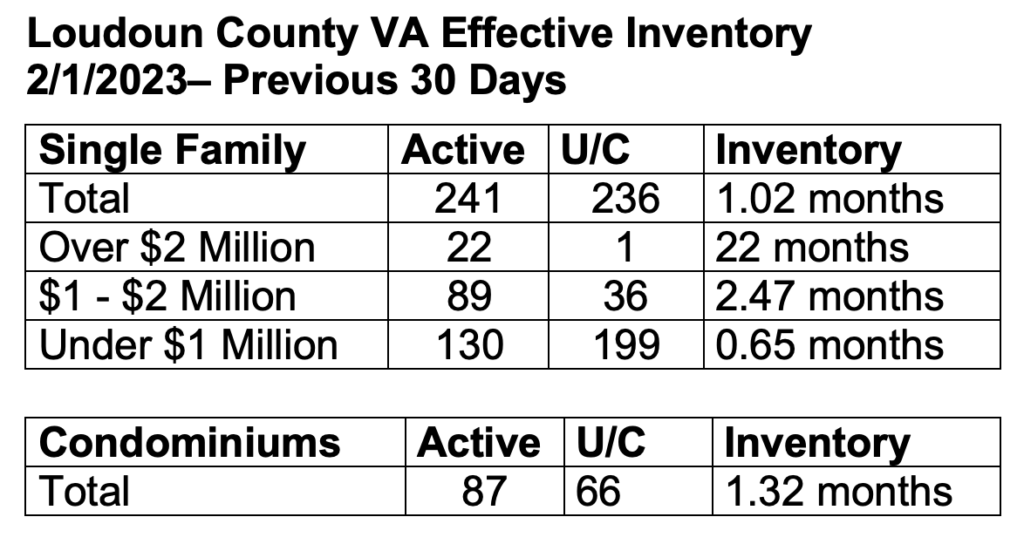

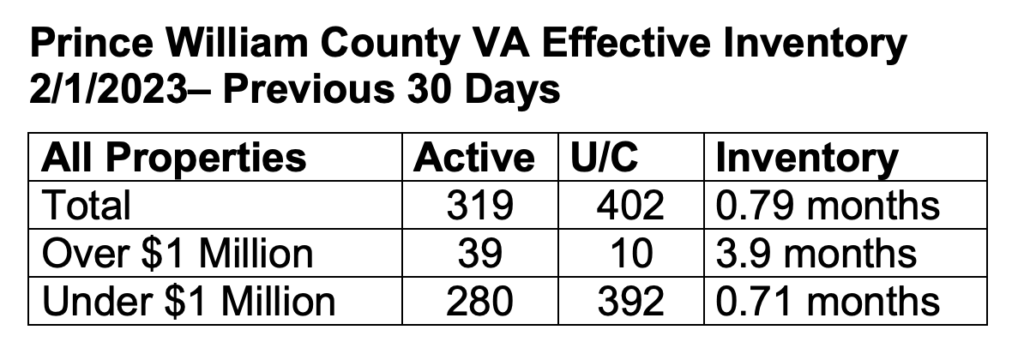

Inventory and Demand

The number of listings/inventory is still down quite a bit. DC is still on an upward trend and we are seeing increased contract activity compared to last year. There is an increasing number of multiple offer situations and buyers doing pre-inspections.

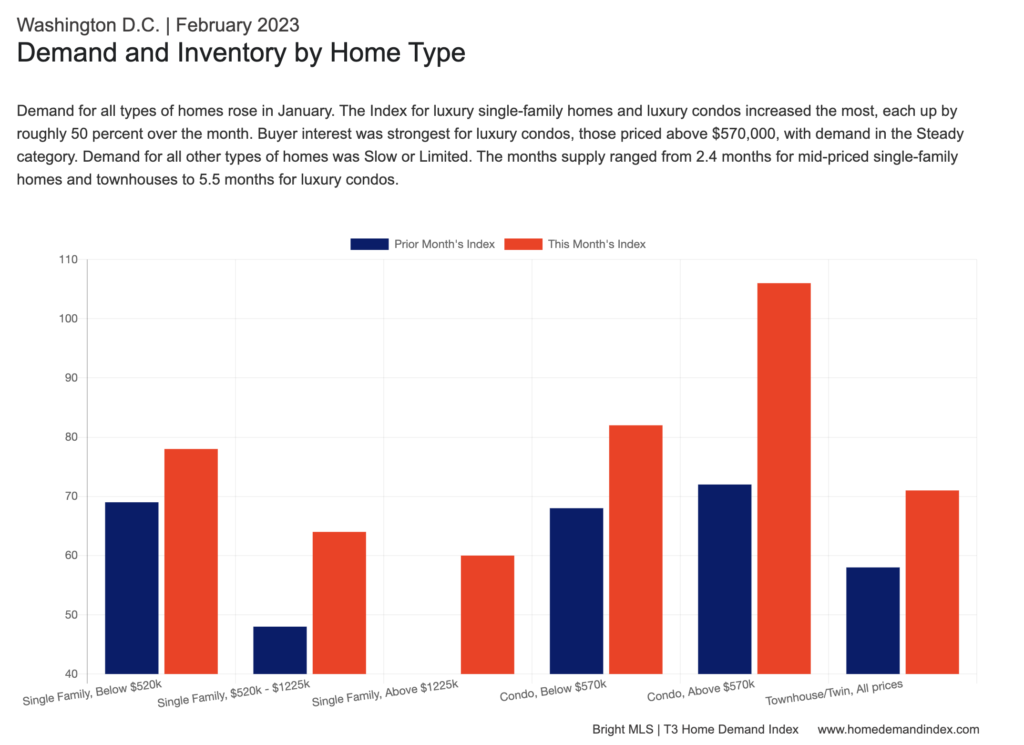

Demand for all types of houses increased in January but increased the most for luxury single-family homes and luxury condos.

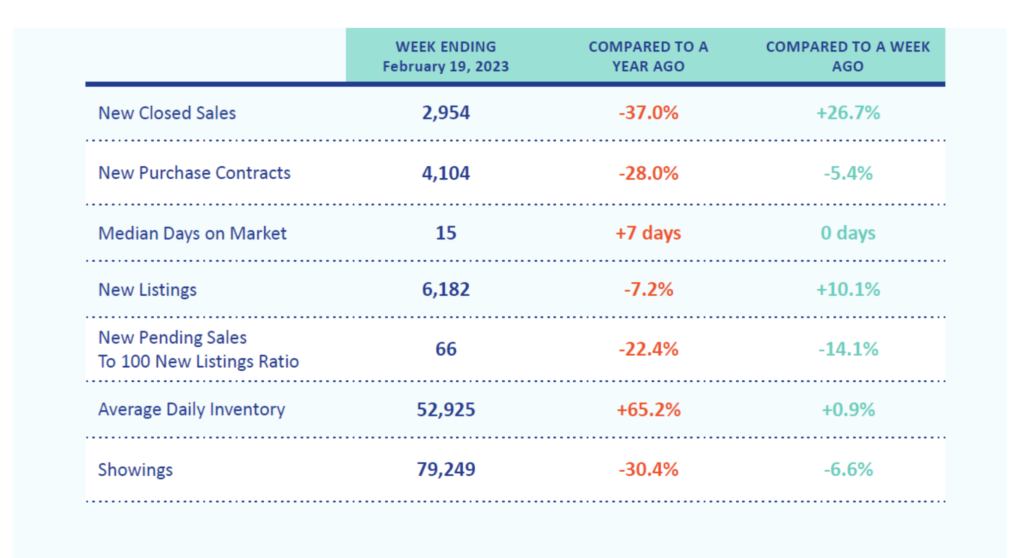

Showing Activity

Buyer interest is still solid. The week ending February 19 is the third week in a row where showing activity is above 2019 levels. Maryland and DC had 30% and 10% growth in showings compared to the same week in 2019, respectively.

Maryland, My Maryland

Sources

January 2023 Market Report. Bright MLS. February 10, 2023. Written by Lisa Sturtevant.

TTRSIR Internal review of market statistics with Fred Kendrick.

Weekly Market Report: Week Ending Feb 19. Bright MLS. February 21, 2023. Written by Lisa Sturtevant.

January 2023 Housing Stats. Maryland Realtors. February 13, 2023.