Let’s close out 2023 with a quick recap and then talk about 2024 Predictions!

This is our first post of the new year, but please check back each month for a quick look at what is happening in the economy that affects the real estate market AND a review of the local market conditions you can expect.

Looking back at 2023

At their December 2023 meeting, the Federal Reserve held rates where they were and hinted at three rate cuts coming in 2024. Dr. Lawrence Yun (NAR’s Chief Economist) thinks it will be more like 4-5 cuts. The next meeting is Jan 30-31.

Consumer spending during the holidays was strong and outperformed expectations. New claims for unemployment are down, less than September 2022 levels. Low inventory and affordability continue to be the buzz words in our real estate market.

Inflation

Core Personal Consumption Expenditures (PCE) was down to 3% for October and 3.5% for the year-over-year reading. This is the lowest level in more than two years. The Fed’s target is 2%.

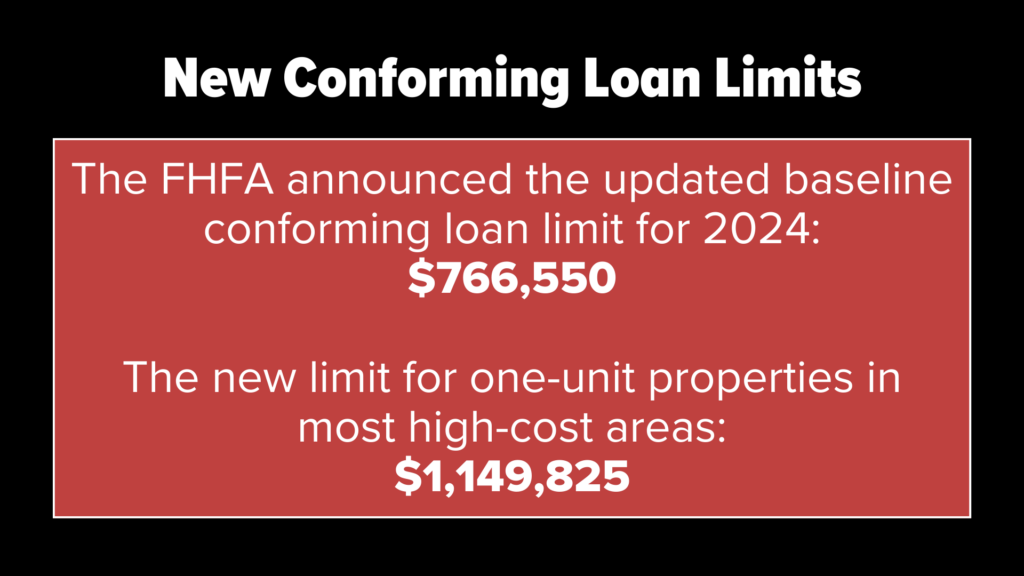

The Case-Shiller Home Price Index, which is considered the “gold standard” for appreciation, shows that prices nationwide have increased 0.7% and the Federal Housing Finance Agency’s (FHFA) House Price Index also shows prices up 0.6%. Prices are predicted to appreciate between 6-8% this year.

What About Our Local Markets?

In the national news, you will hear that prices are coming down, but not in our local markets. In Montgomery County, homes are selling for over 100% of their list price. Arlington has the fastest days on market (DOM) in the area. Showings are still on track with 2022 levels. The months of supply in DC are approaching normal levels. We are still seeing low inventory in Montgomery County and Alexandria.

Where are Interest Rates?

2024 Predictions

Rents will calm down further than they are now. If CPI also stays down then the Fed will cut interest rates. Community banks are not currently doing well in this high interest market. They will do better when rates come down. There is a spread between the 10year Treasury and the 30 year Mortgage is abnormally high. It is a little above 4%. That means today’s rate should be 6% with a normal spread. If community banks are in better shape then the gap can narrow. This spread should decrease slowing which will bring down mortgage rates. This will also lead to more buyers entering the market. This will also increase the number of listings. Sellers with existing 3% mortgages will be more likely to sell closer to 6% than 8%.

Sources

Bloomberg, Bloomberg Markets: The Close 01/18/2024, https://www.bloomberg.com/news/videos/2024-01-19/bloomberg-markets-the-close-01-18-2024-video

Dr. Yun, January 22, 2024, 2024 Economic Forecast webinar.

Interest rates from Guaranteed Rate.