The Big Picture

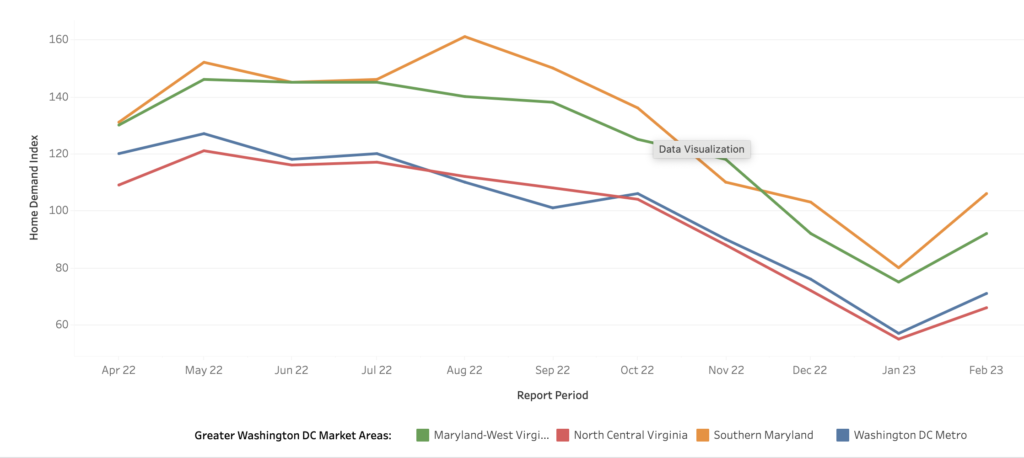

Housing demand is increasing in our area for all types of homes. Luxury homes and condos are increasing the most (condos above $570,000). The months of supply is around 2.4-5.5 months (single families at the low end and condos at the high end). But overall the market is fairly slow. The T3 demand index is 71 which is in the Slow category.

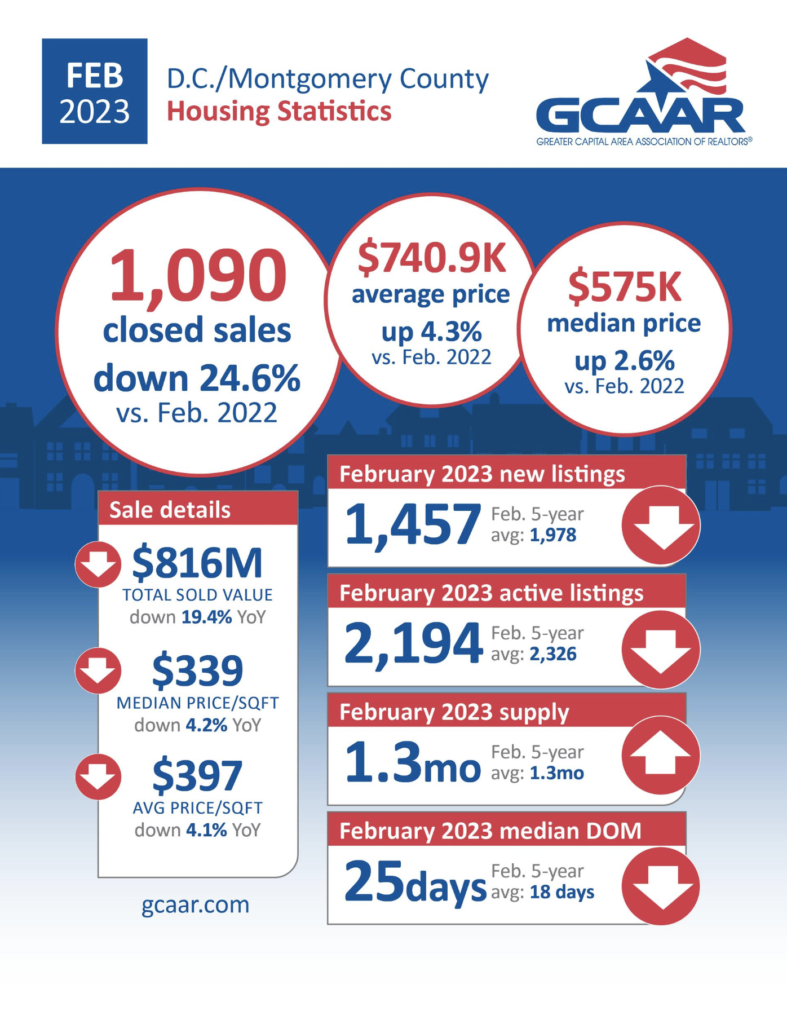

- The median home price in DC in February is $535,000, which is up 1.7% from one year ago.

- The median days on market is 20 days; it was 13 days a year ago.

- The number of new listings on the market is 37% down from last year.

- There is a 28% decrease in the number of pending home sales as well.

- The total number of home showings is down in the region 36% as well.

Collapse of Silicon Valley Bank

Silicon Valley Bank collapsed March 10 following a VC-spurred bank run. The bank was forced to sell $21 billion of securities at a $1.8 billion loss, which was the biggest bank failure since 2008. SVB was taken over by the federal government. The FDIC covers $250,000 in deposits but many of the people using SVB were high cash businesses like Silicon Valley tech companies. This meant a large portion of their deposits would not be covered.

Signature Bank closed (heavily invested in crypto currencies) and First Republic (large amount of high net worth customers) was just behind it. First Republic Bank is the fourth largest lender in America and does mainly jumbo loans.

Congress met over the weekend and ensured that all customers would be ensured for all deposits, even those over the $250,000 FDIC protected amount. President Biden announced that all senior-level bank leadership in government-controlled banks would be fired. This was done to prevent a run on other banks.

“It’s been a hectic 72 hours for the markets, and we need to take a breath to consider what the Fed will do next on rate hikes after the banking system needed several emergency all-hands-on-deck meetings over the weekend,” Logan Mohtashami, HousingWire’s lead analyst, wrote in his Housing Market Tracker.

Is this a one off event?

The Federal Reserve and FDIC took measures to protect savings and confidence in the banking system. The Bank Term Funding Program can borrow reserves from this program. This is meeting the funding needs and ensuring liquidity. The worry is that a lack of confidence in the system will cause other banks to fail or other problems in the banking sector.

Subdued growth is expected this year (0.4% growth in GDP this year is expected). Inflation is well above the 2% goal and inflation pressures continue to run high. There is a lot of work to do here. Inflation continues to affect people’s purchasing power.

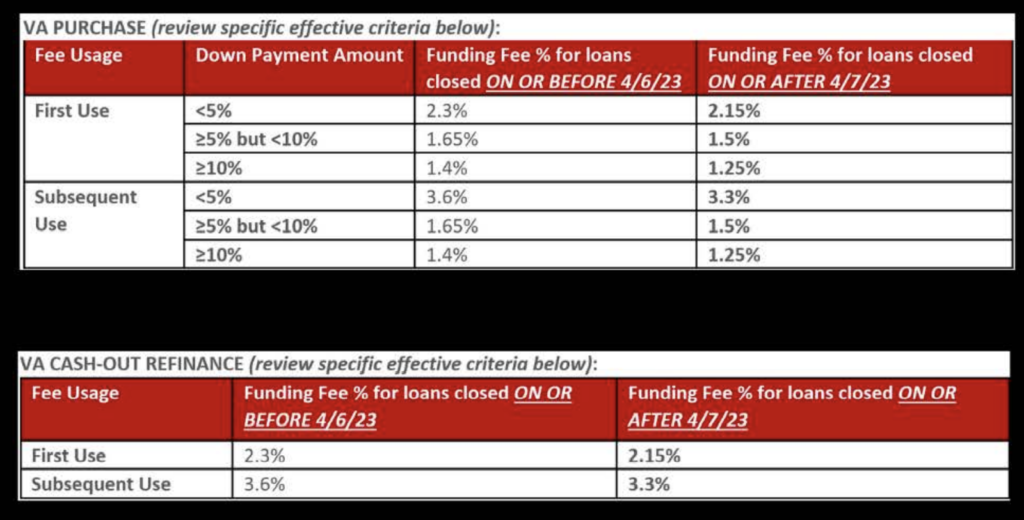

Funding Fee Updates

The VA has decreased the funding fee for all purchase and cash-out refinance closings on or after April 7, 2023.

FHA has decreased the monthly MIP for all FHA purchase and rate/term refinances on or after March 20, 2023.

How could this affect buyers?

A $300,000 mortgage will save $900 per year.

A $400,000 mortgage will save $1,200 per year.

A $500,000 mortgage will save $1,500 per year.

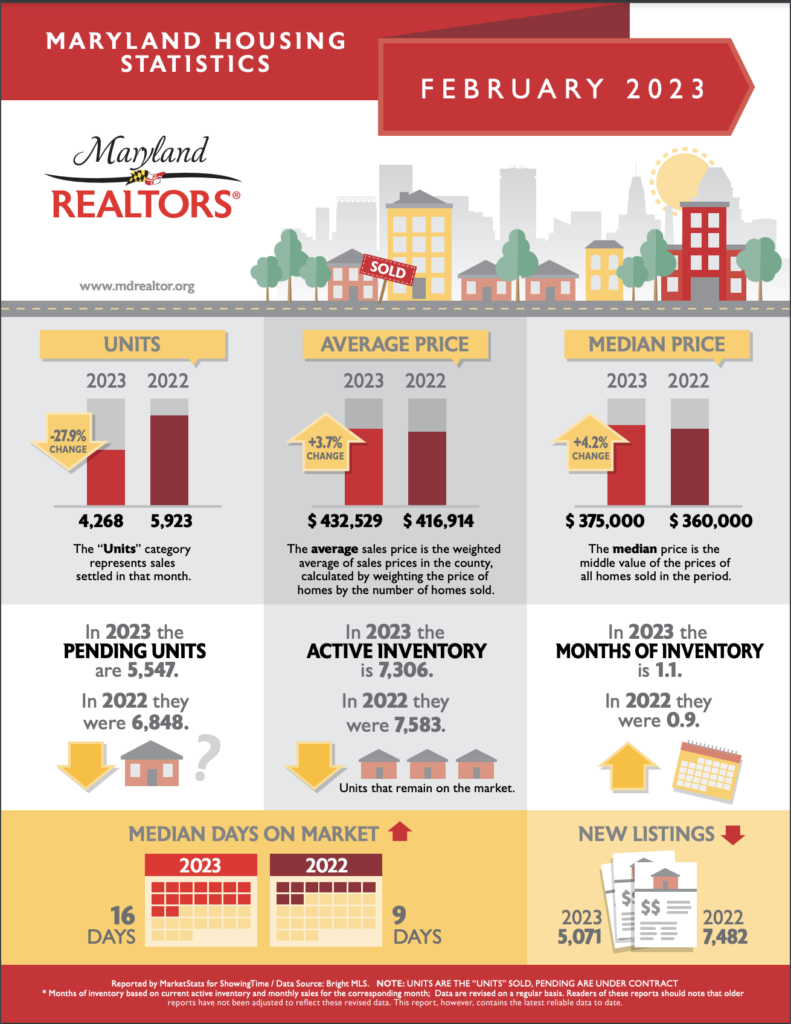

Maryland My Maryland

What I see when looking at February’s statistics are the number of new listings, 5,071 new listings last month, which is a more than a 32% drop from the previous year. To me this speaks of Maryland’s lack of ‘missing middle’ housing.”

Yolanda Muckle, 2023 President, Maryland Realtors

The “Missing middle” is housing that the groups experiencing housing shortages and affordability challenges in Maryland that would like to buy. Often the affordable housing cannot be built under current zoning regulations. We need another 122,000 homes.

We need the real estate industry as well as state and local governments to work together to address this crisis,” said Muckle. “If we can create more housing to satisfy this ‘missing middle’ segment, it would be an investment that would yield housing opportunity, enriched and diverse communities, and growing economies at the state and local level.”

Yolanda Muckle, Maryland Realtors

I Want to Sell My House – What Do I Need to Know?

Some of this may seem obvious, but follow the logic with me.

- 97% of buyers use the internet to look at homes, most people get their first impression from the listing photos.

- Buyers often spend 30 seconds looking at these photos and staged listing photos keep their attention longer.

- 82% buyers’ agents aid staging made it easier to visualize the space and 44% said home staging made an impact on buyers.

Consider staging your house or condo. Buyers have changed since the explosion of HGTV and everyone thinks they can expect a fully remodeled and staged home. Without it, unless you have the best house on the market, you may find that your house sits without offers.

Sources

Housingwire Lending Life. March 13, 2023.

Housingwire. “How the run on banks is affecting the mortgage market.” March 13, 2003. Flávia Furlan Nunes.

Bright MLS T3 Home Demand Index. Washington DC Metro February 2023.

February 2023 Market Report. March 10, 2023. Lisa Sturtevant. Bright MLS.

Urban Turf. “The 5 Most Important Stats from the February Housing Market.” March 13, 2023.

Fed Chair Powell update as broadcasted on PBS NewsHour. Mar 22, 2023

Nick Baker, GCAAR. “Home Staging 101: what you need to know.” Capital Area Realtor Magazine. Spring 2023.

Urban Turf. “What the New FHA Mortgage Fee Cut Will Mean for Homebuyers.” March 21, 2023.

Maryland REALTORS® Housing Stats for February 2023. Mar 16, 2023. Maryland Realtors.