Welcome back to my monthly blog “How’s the Market?” This is our Nov 2022 blog post which uses Oct 2022 data.

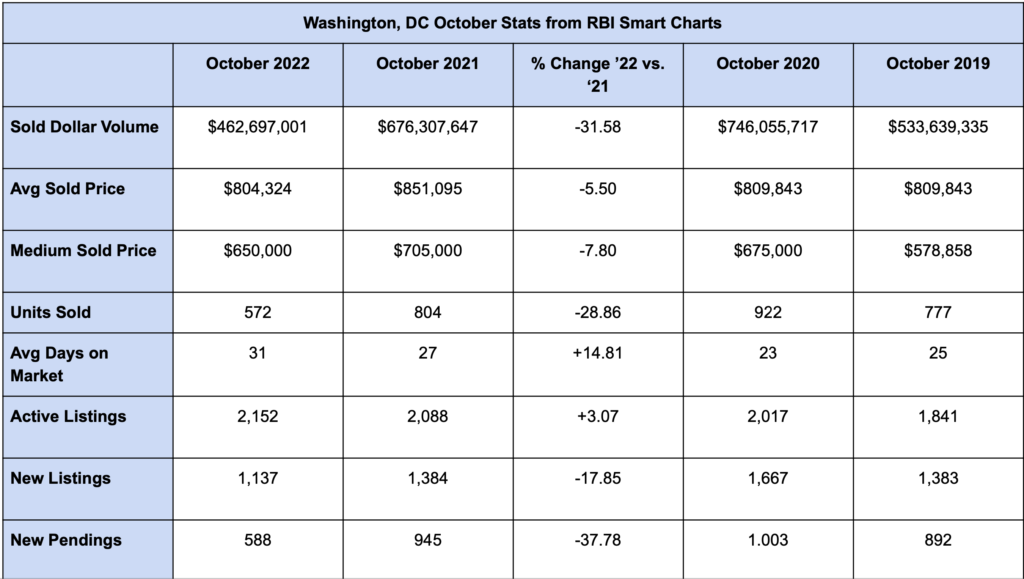

First let’s start with a look at where we are compared to where we were in 2019, 2020, and 2021.

Inventory

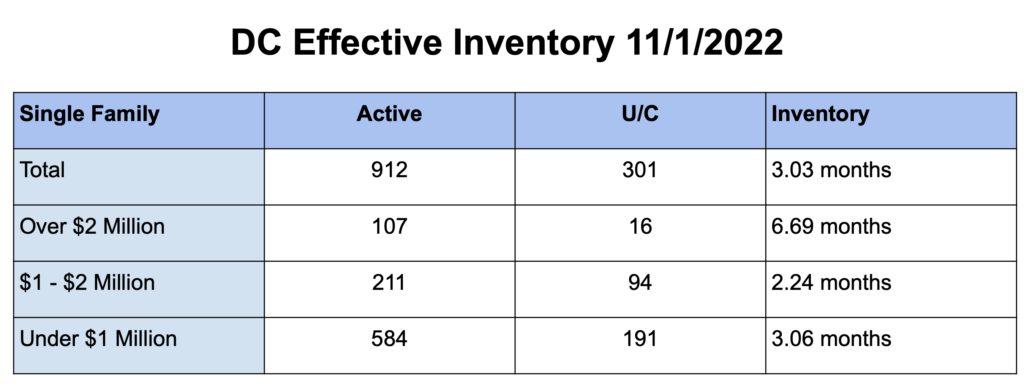

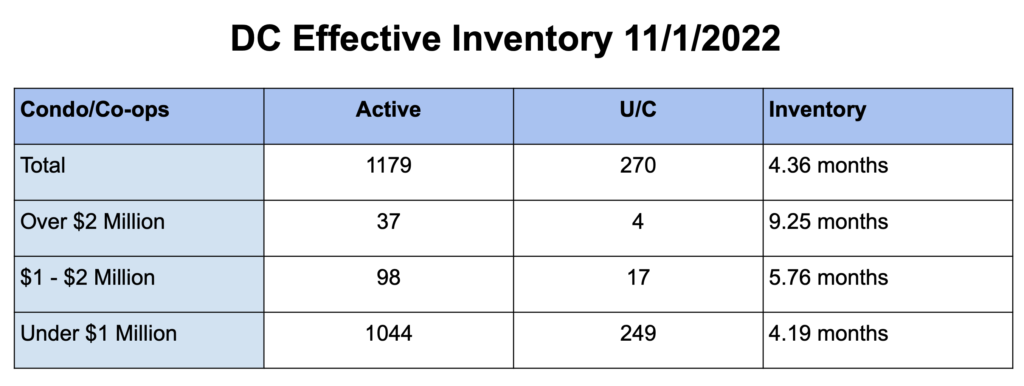

One of the top items that we are all watching — Inventory. DC inventory numbers are inching up.

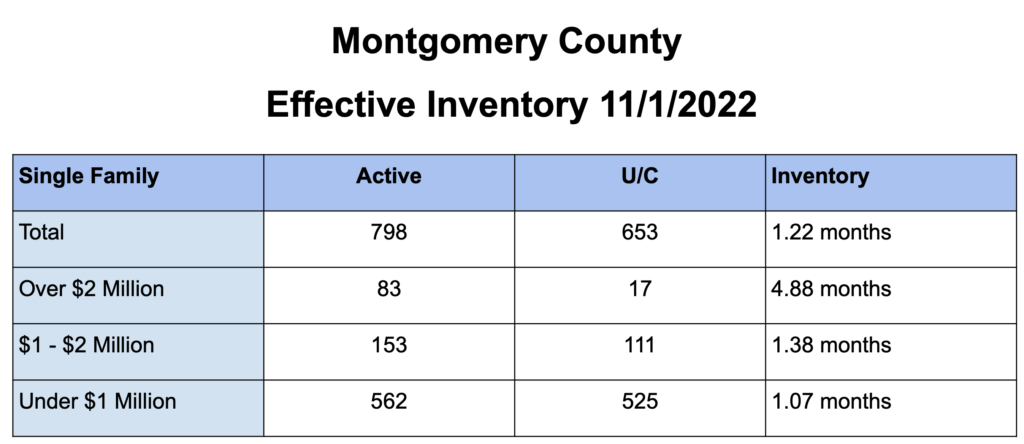

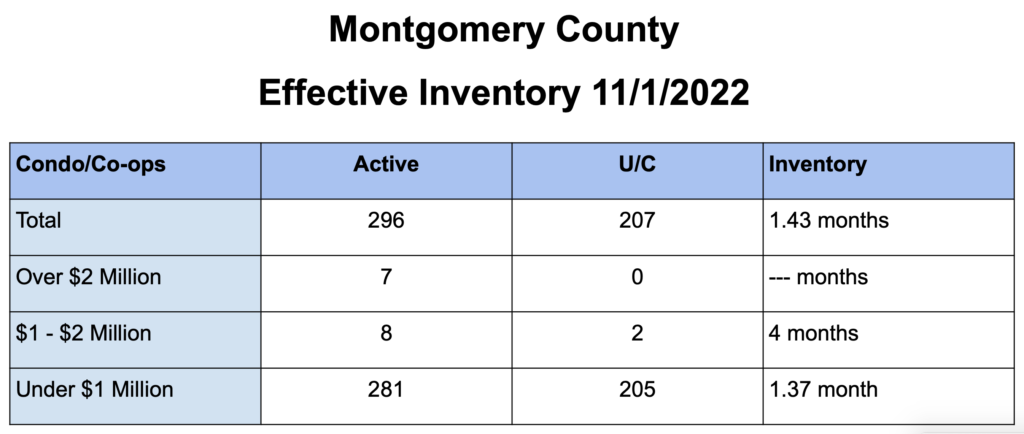

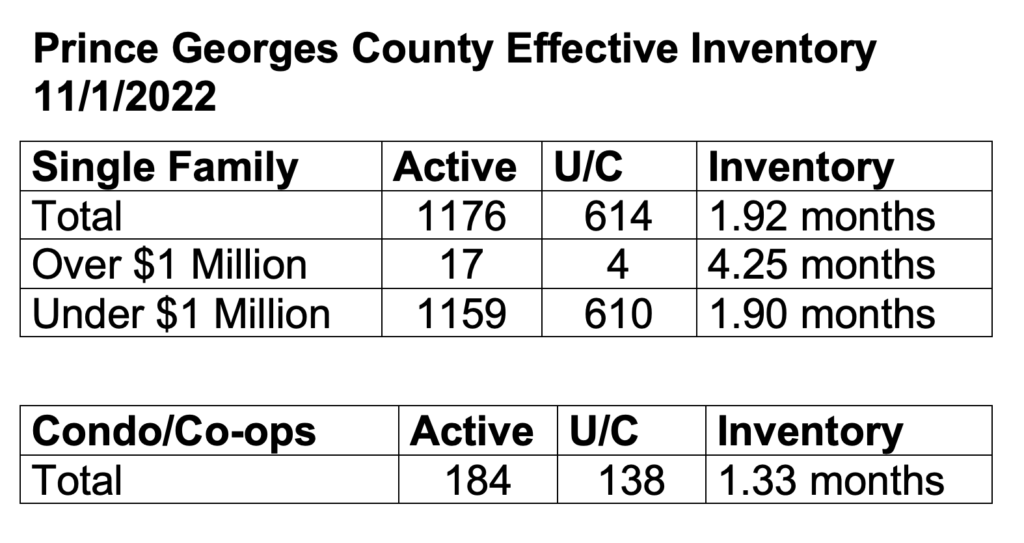

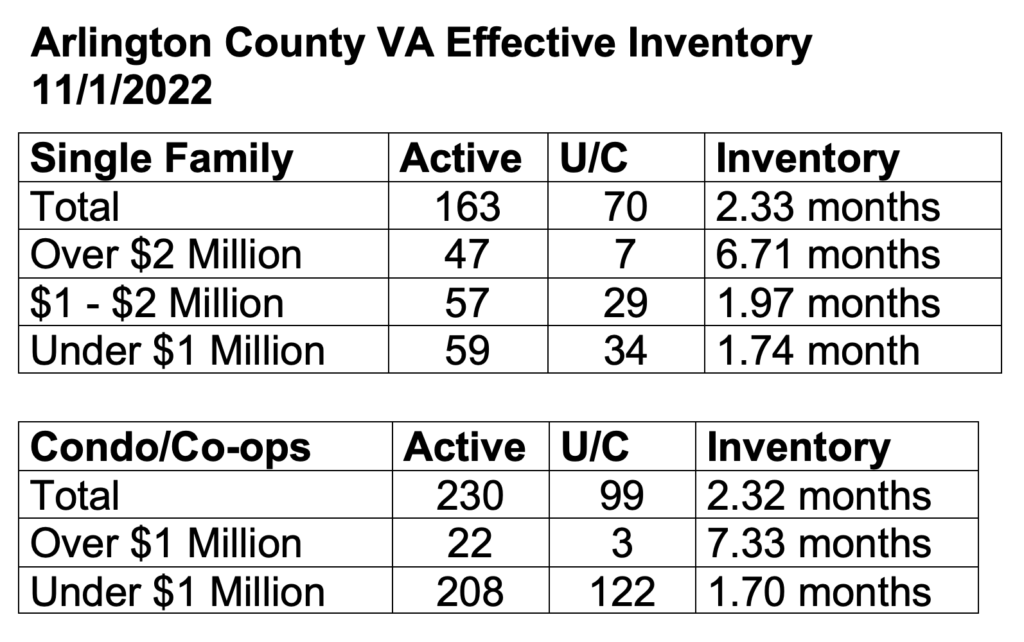

During covid, we were used to 1 month of inventory. Now we are at approximately 3 months. Remember 6 months is considered a “balanced” market – neither a seller’s market or a buyer’s market. As you can see though, Montgomery County is still at 1.22 months of inventory!

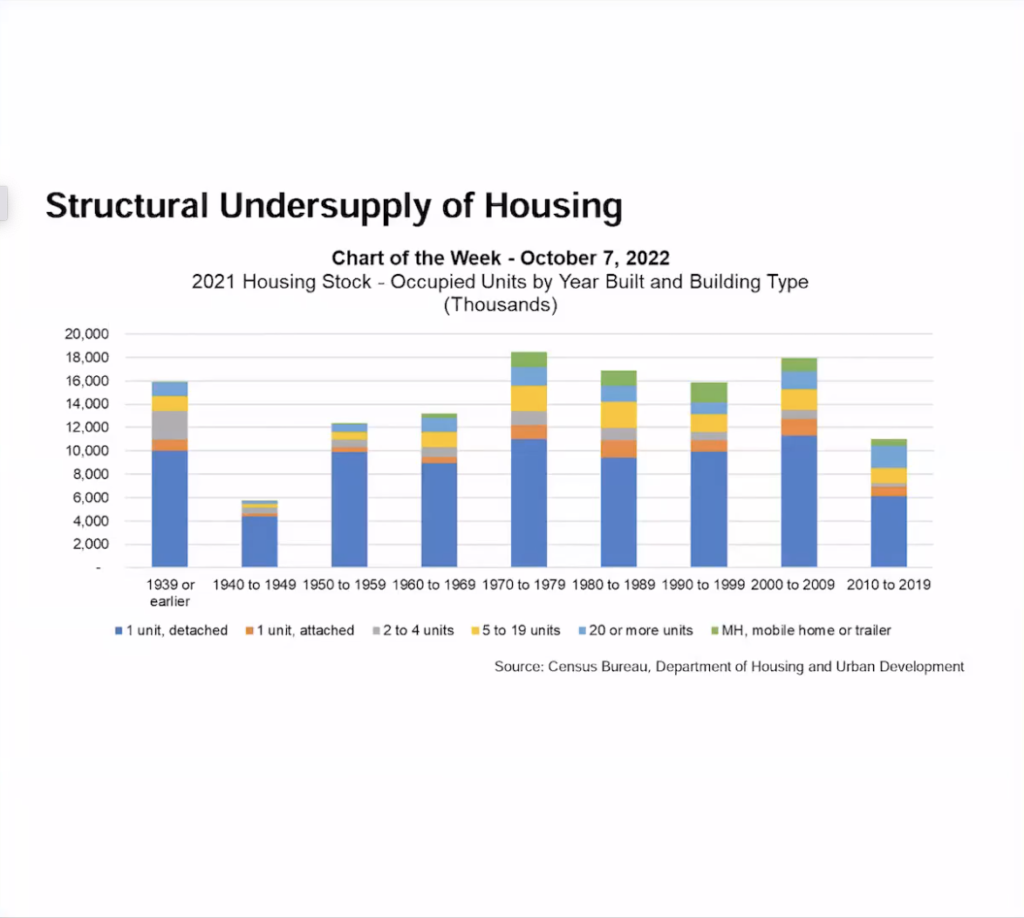

In addition to our low inventory, America is short more than 5 million homes (Building Magazine).

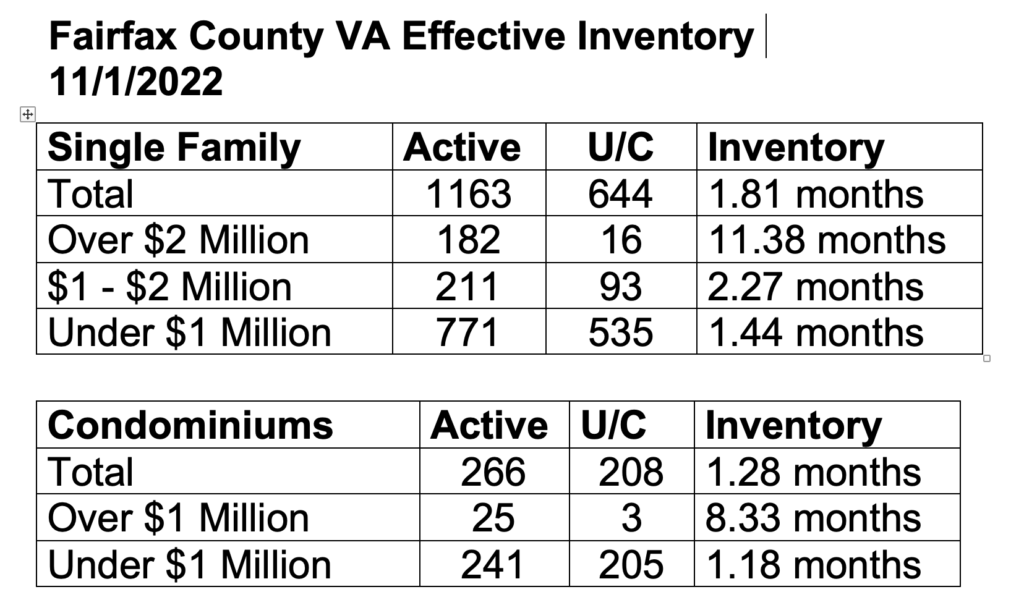

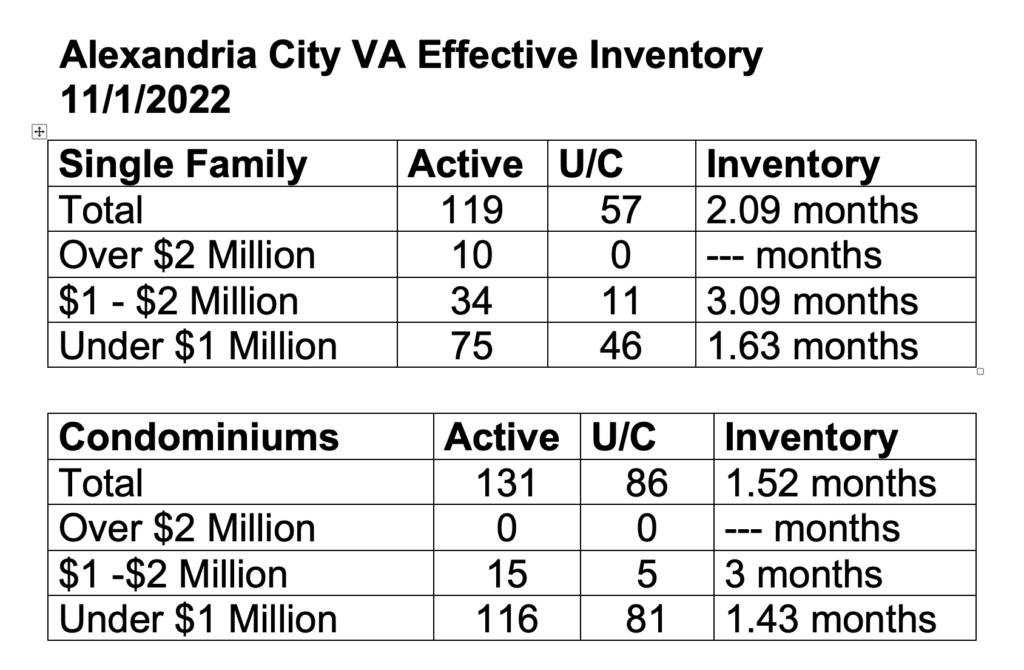

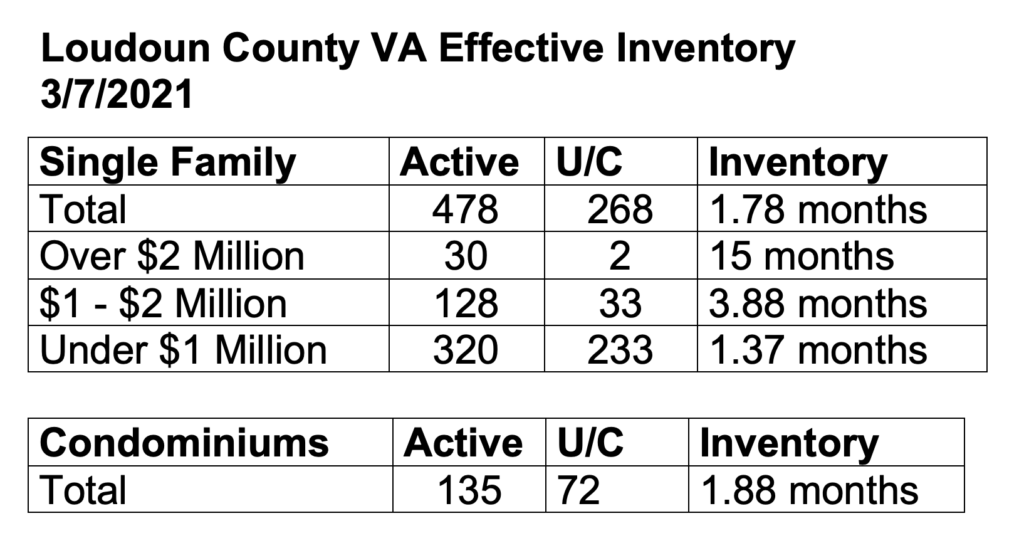

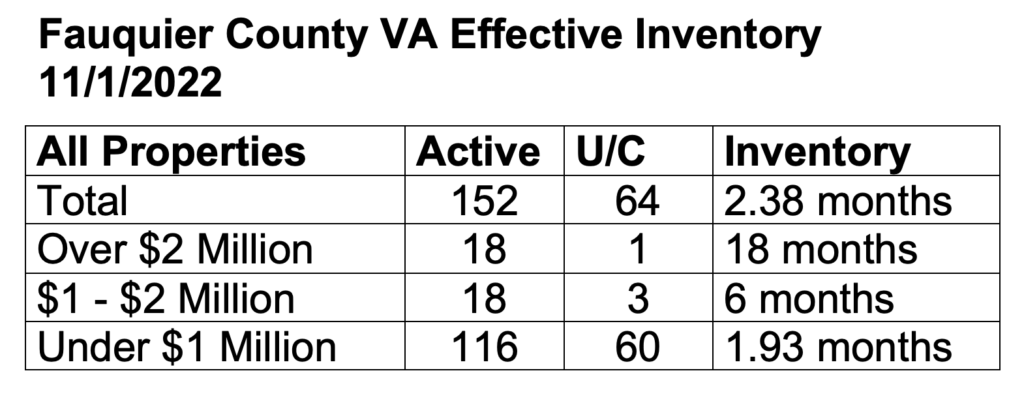

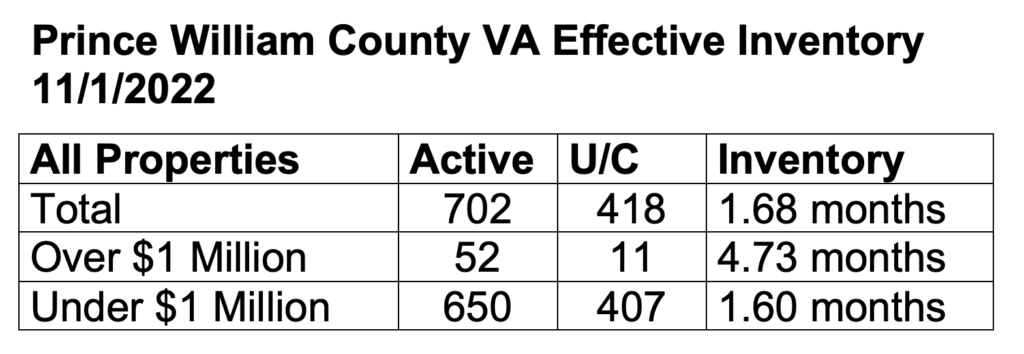

Let’s look at our effective inventory numbers:

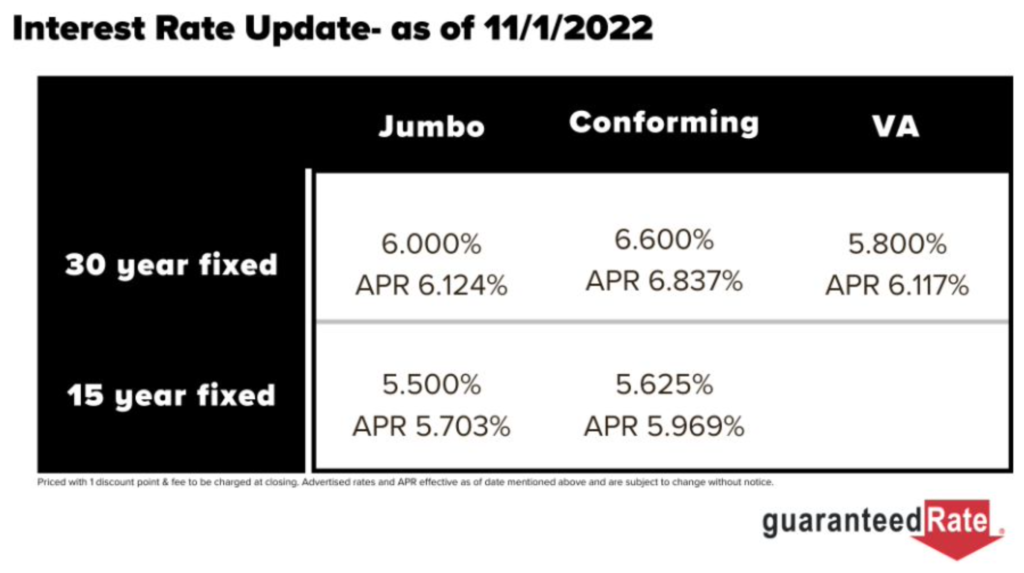

Mortgage rates

Mortgage rates are predicted to fall to 5.4% as a recession is likely to hit the US in 2023. (Mortgage Bankers Association)

There is a lot happening in the market that is affecting them right now, and here are some of the main points. The Fed increased rates on Nov 2 another 3/4 point. The Consumer Price Index increased by 0.4%, which was a lot better than expected. Inflation is down from 8.2% to 7.7%.

In response, the 10 year Treasury yield got worse by 28 basis points, 200 basis better for MBS (big move), and interest rates improved by 1-1.5% (depending on the loan product).

Mortgage rates appear to be going back to last spring’s numbers. We may see renters coming back to the market.

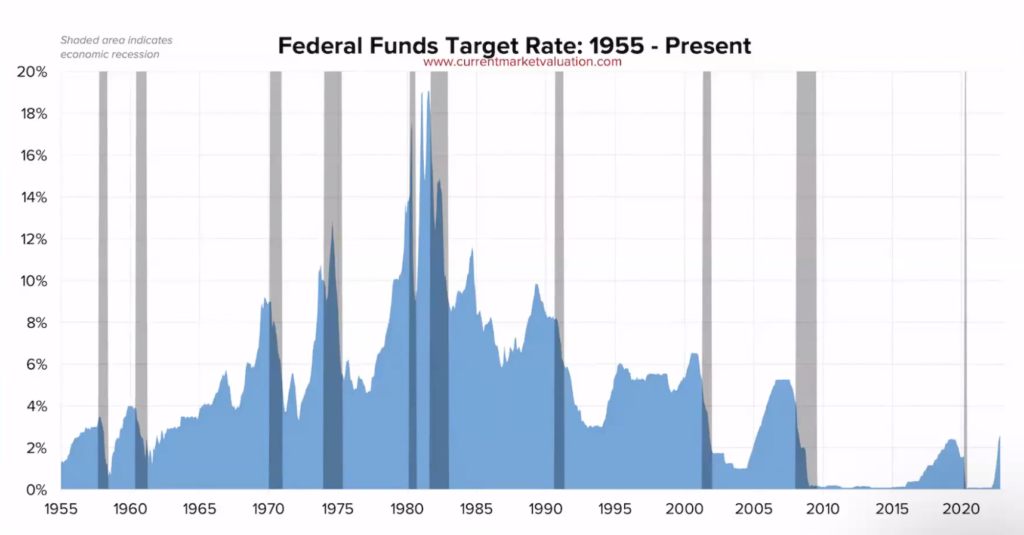

Let’s get finance-y for a minute

Every period after quantitative tightening, we see a recession. Some of them are short like our most recent one (see the grey bars).

Mortgage rates have always dropped after Fed fund tightening, and if history is going to repeat itself, that is what we expect to happen now.

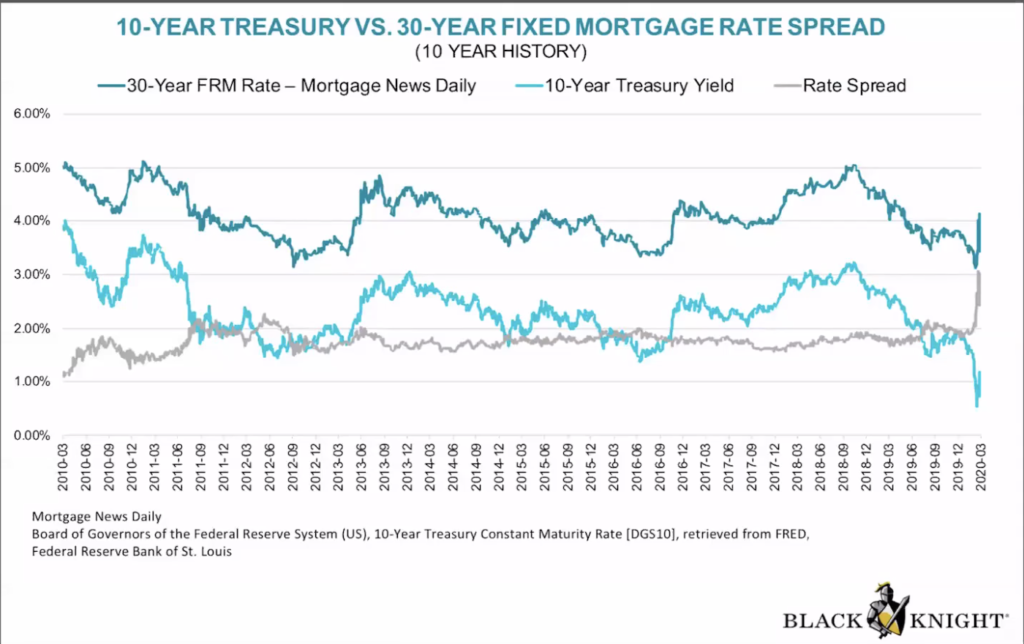

Mortgages are 1.5-2% over the 10 year rate. This spread has widened recently. A lot of people are not buying 30 year mortgage back securities — why? They know rates are going to come down. Rates are near historic lows and they are coming down.

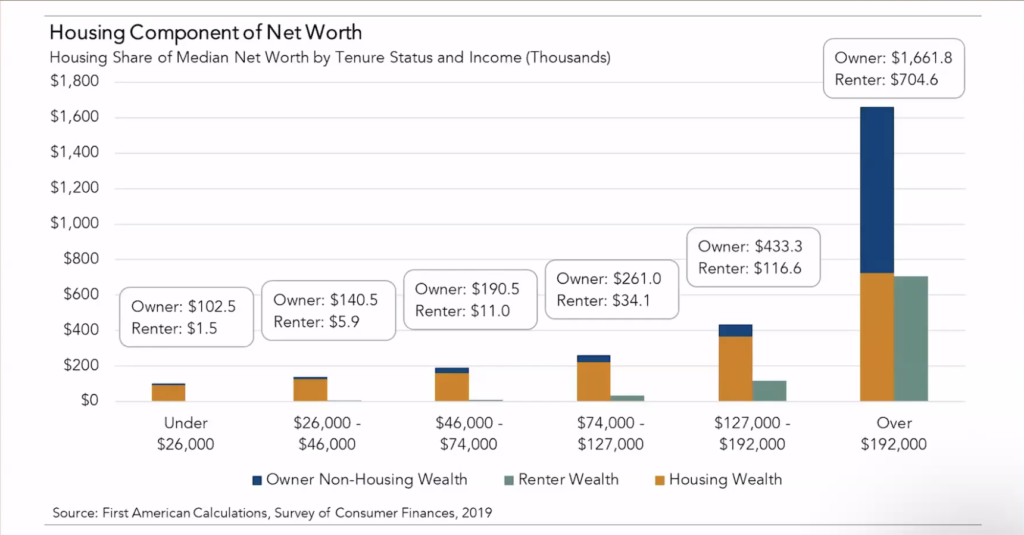

Let’s remember — the single best way to build wealth is with homeownership.

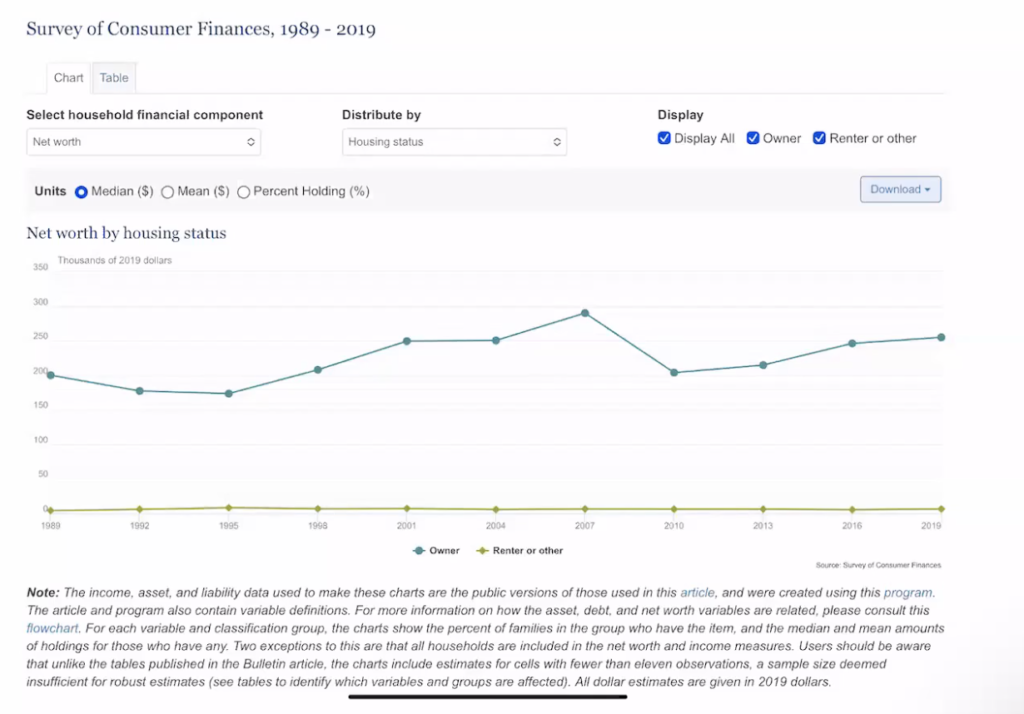

Look at this chart, see the net worth of homeowners in blue, then try to find the renters (yeah that’s the green line).

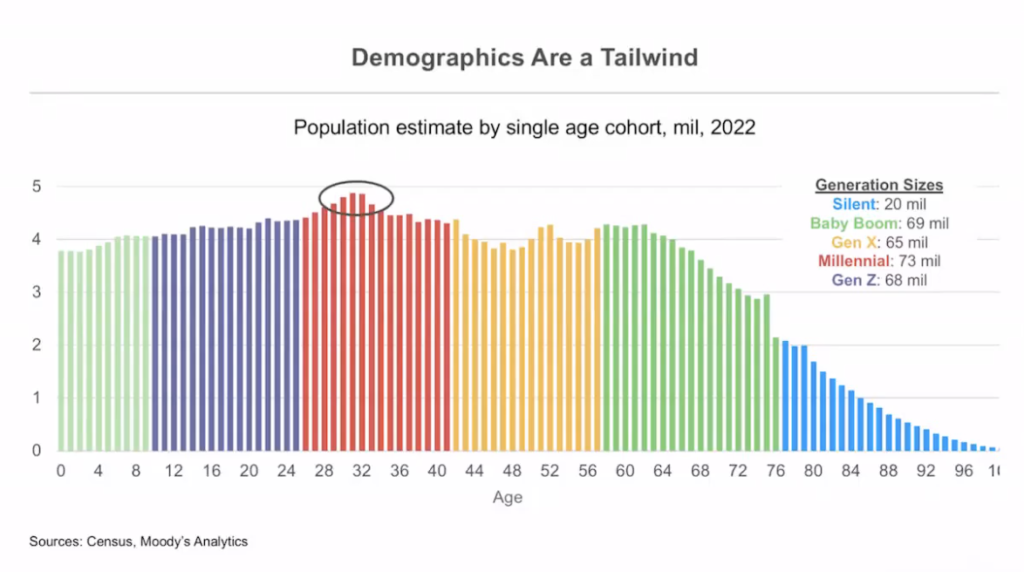

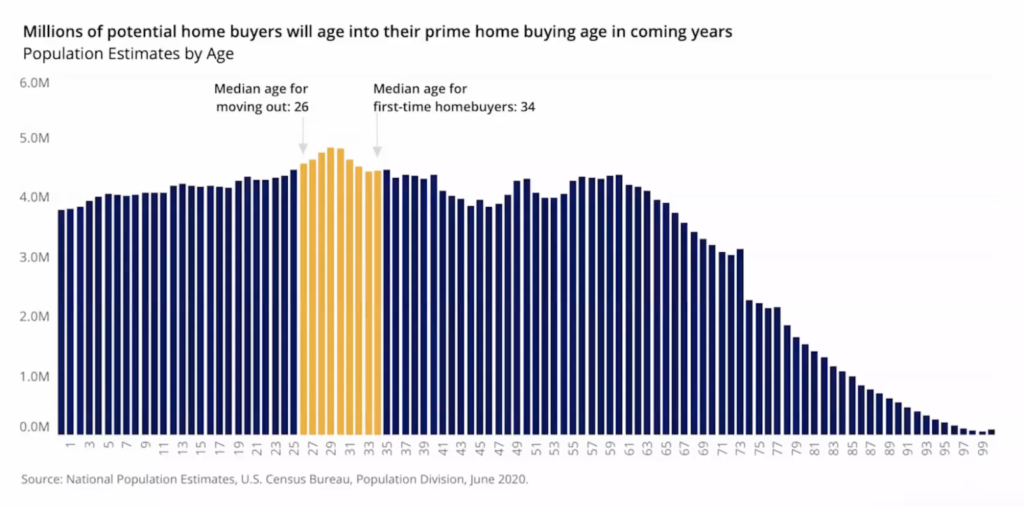

Let’s talk Demographics

The baby boomers were a big generation but the Millennials are just bigger. This means there is a big demand coming as they are just entering peak buying point (which is age 34). In the next 5-10 years, purchases should increase.

So what does this mean to you?

Buyers should buy. Affordability is not going to get any better as small housing inventory will make prices go up. Millennials will drive home prices up for years to come.

The market is going to slow, but it is better than the previous decade. Rates are predicted to drop next year – prediction 5.5% by year end.

Sources:

Fairway Independent Mortgage Corporation. “The Market” with Dave Stevens. Nov 3, 2022.

Internal TTR Sotheby’s International Realty meeting data review including effective inventory. Data from Bright MLS.