How’s the Market?

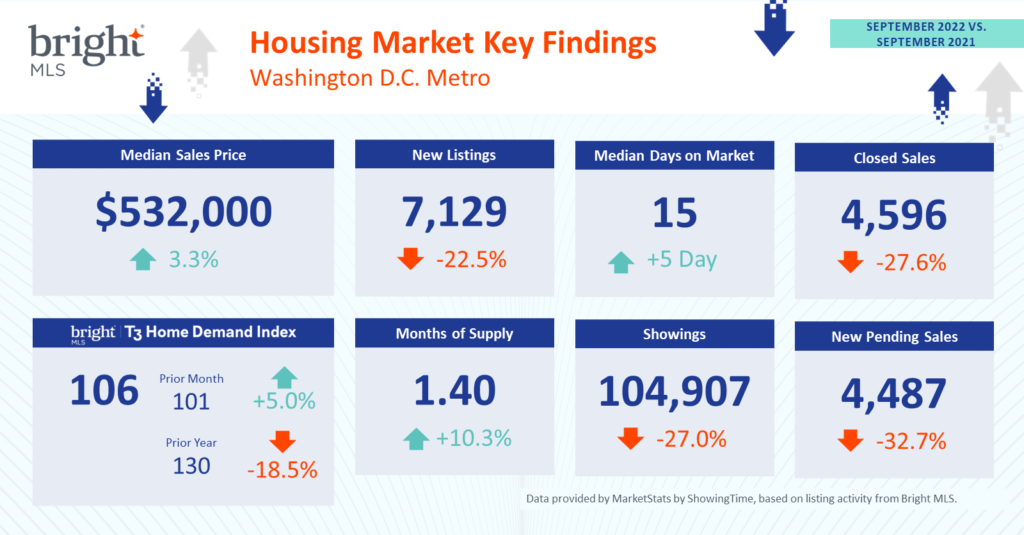

Welcome back to my monthly series “How’s the market?” where we talk about the current state of the market in the DC metro area. These are the September 2022 stats.

Let’s check in on interest rates

In June we were seeing rates around 6%. Since then the Federal fund rate has gone from about 2% to 3 1/4% and it is expected to go up another 3/4% to 4%. Interest rates are approaching 7%. John Jones from Guaranteed Rates told me that he thinks it is going to stay here for the foreseeable future. We will likely see a decrease in late spring/early summer 2023. Conforming loans are at about 7% and jumbo loans are 6% or just below 6%. A lot of people in our area are able to buy now (when uncertainty in the market can make it a good time to buy) because they can refinance later when rates settle.

What is happening with pending and closed sales?

DC has seen a 10% decrease in sold volume (11% in Montgomery County). The single family $950,000+ market is currently the strongest market. We were seeing 10% year over year increase in prices and in August it was 4.8%. Prices are stable and DC real estate is still seen as having good value.

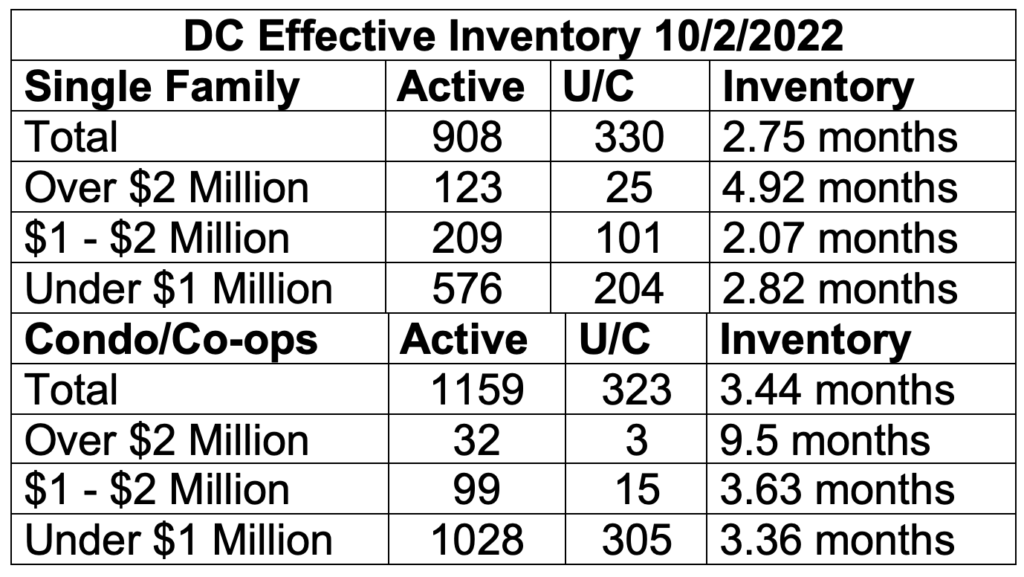

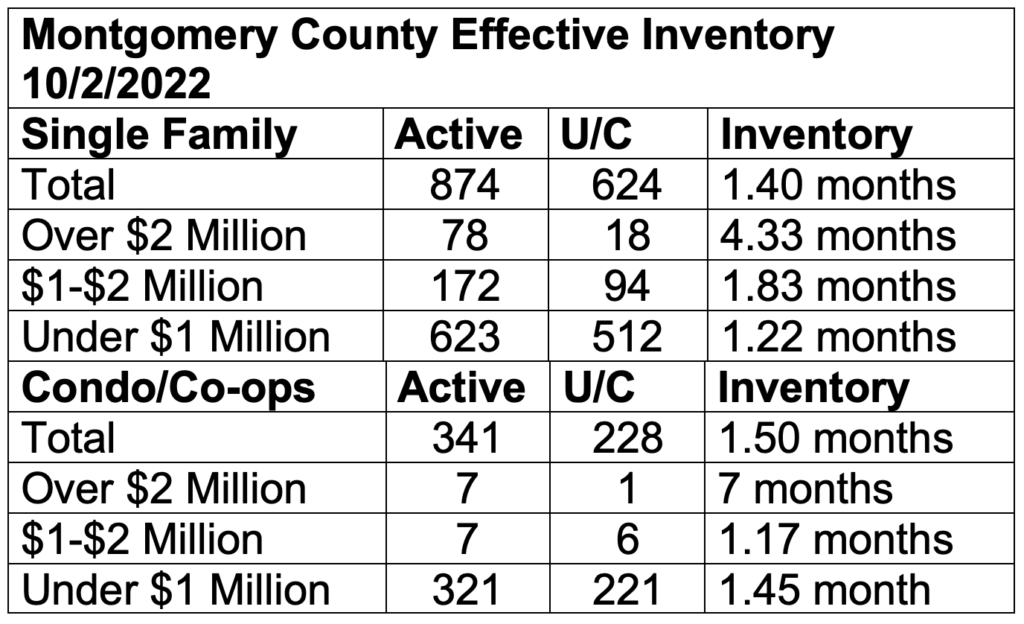

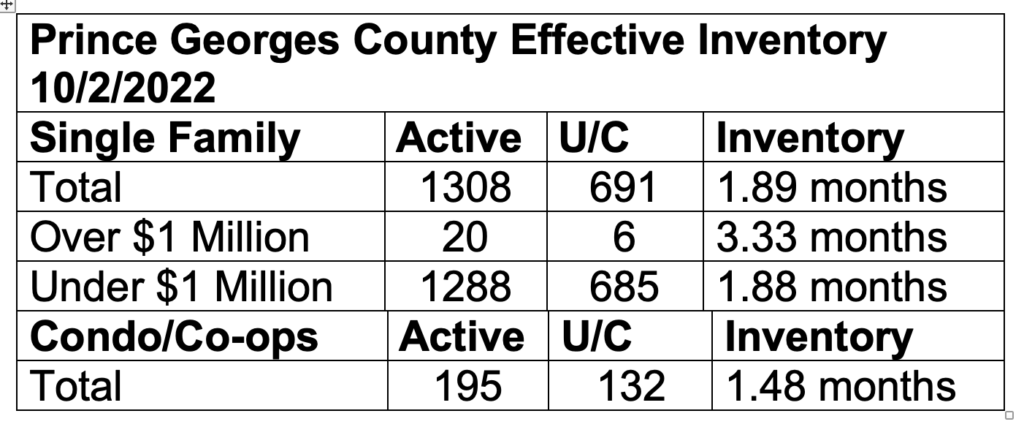

What is happening with inventory?

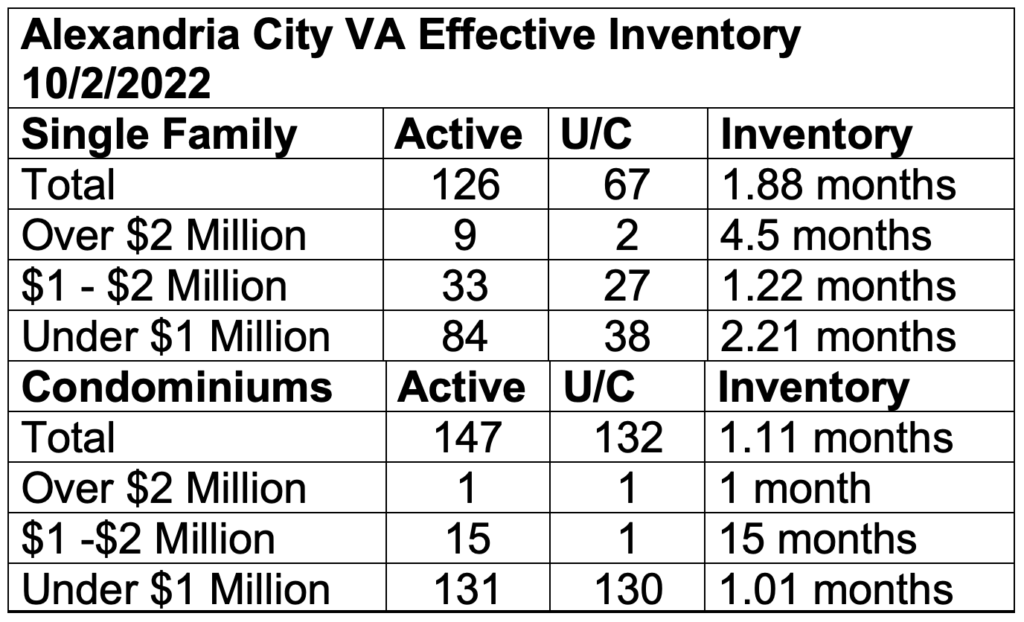

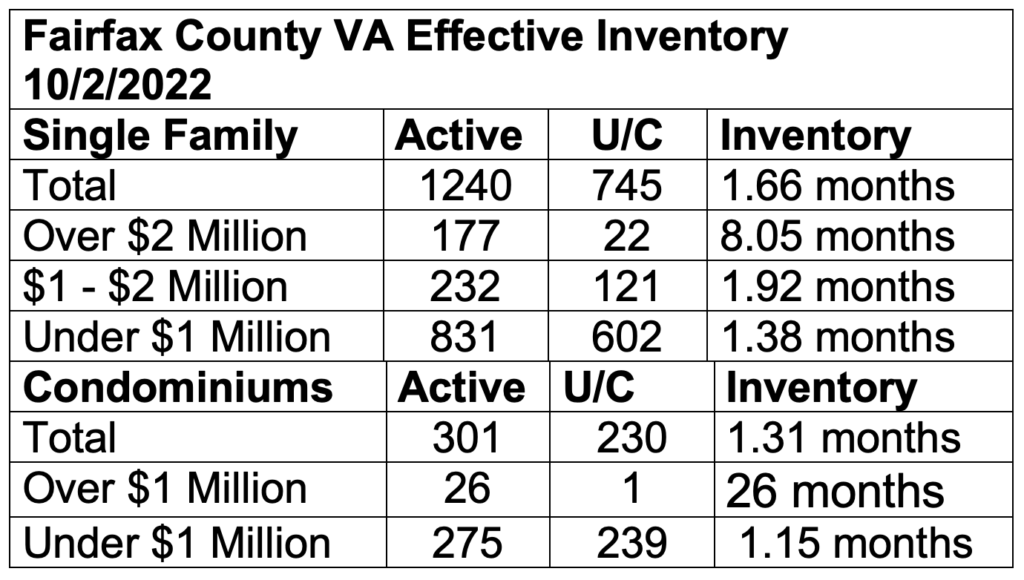

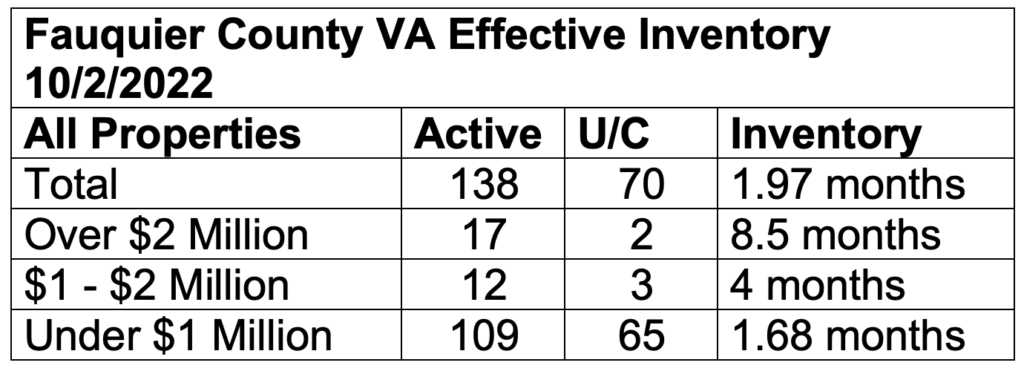

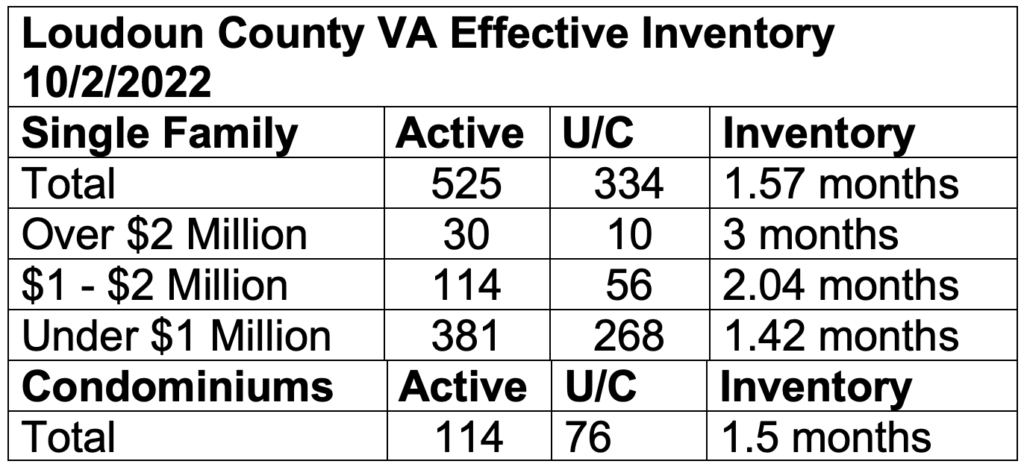

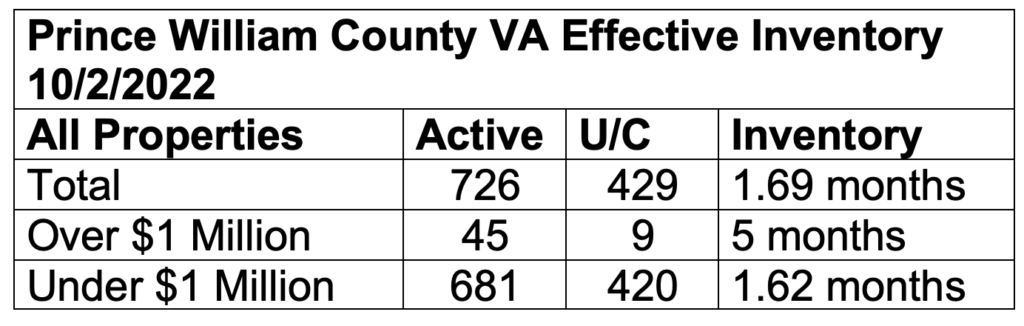

October’s effective inventory numbers was pulled on Oct 2. This information shows the pace of the market. We are not seeing increasing inventory as we are in national trends. DC is up a little bit. Montgomery County is down. Fairfax, Alexandria, and Arlington are flat. We are seeing a decrease in the number of contracts. We are close to 2019 numbers, as I mentioned last time. And 2019 was a good market!

And we have a new addition to this monthly report, VA market info! Please sit down folks… I am currently in the process of getting my real estate license in VA, so I’m going to start sharing that information with you as well. I know, I have surprised all who know me. But you gotta keep the people guessing! 😉

A chat with the President of Bright MLS

Recently TTRSIR hosted an event featuring Brian Donnellan, President and CEO of Bright MLS, our local MLS. He said that 2022’s housing market should be compared to 2019. Home sales are still above 2019 levels in most local markets. 2021 numbers were not sustainable in his opinion. The luxury market is resilient here. What markets are hurting and most at risk right now in his opinion?:

- Rural areas

- Fringes of metropolitan areas

- Markets with lower household incomes

- Coastal and second home markets.

Another interesting data point that he shared with us – homes that are sold on the MLS receive 13.8% higher sales prices than those that do not (think office-exclusive listings). While that is off-topic from this blog, it was an interesting stat and I wanted to share it with you. He said about 75% of homes are sold on the MLS.

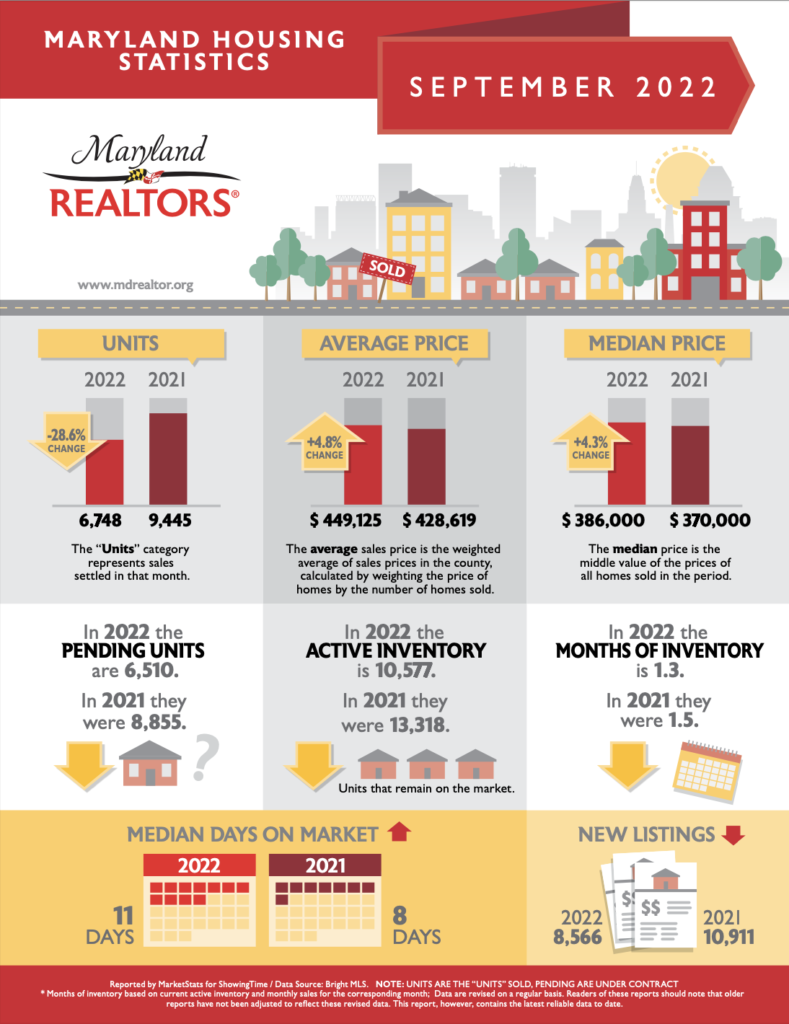

Maryland My Maryland

Don’t let the addition of a VA license fool you, I still love my home sweet home. Let’s look at just the state of Maryland.

It’s still a seller’s market with average home prices up 4.8% to $449,125 (2021 was $428,619). Median days on market is up to 11 days (in September). We still point to a market cooldown.

How is offer strategy changing?

Offers have been about winning. Now we are coming back to our pre-covid market. It is still a competitive market and a seller’s market, but 2019 competitive where you still get to keep your first born child.

What are we watching: Mortgage rates, new mortgage products, and inventory levels. One option a lot of buyers are reviewing are interest rate buydowns. Lender Alex Jaffe from First Home Mortgage explains these in detail here.

Sources:

Maryland Association of Realtors, “A Steep Drop in New Housing Listings Continues to Point to a Market Cooldown in Maryland’s September 2022 Housing Statistics,” October 12, 2022.

Dr. Lisa Sturtevant, Bright MLS, “September 2022 Market Report,” October 12, 2022.