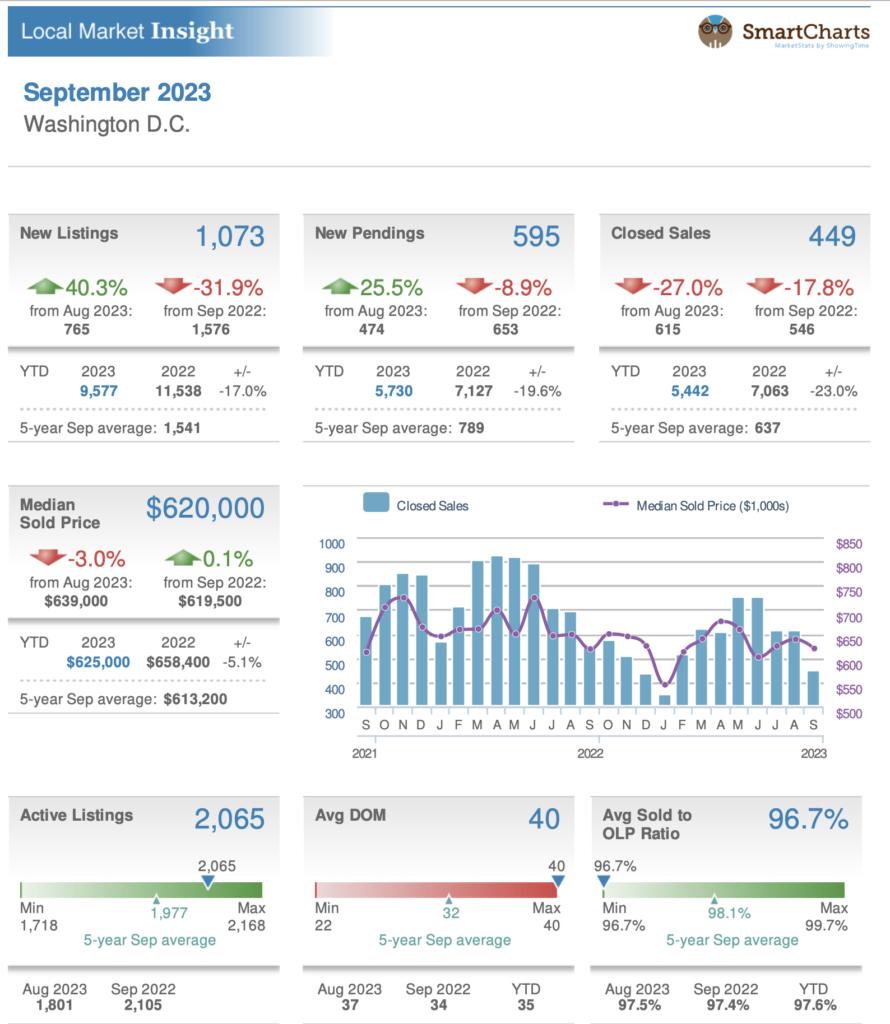

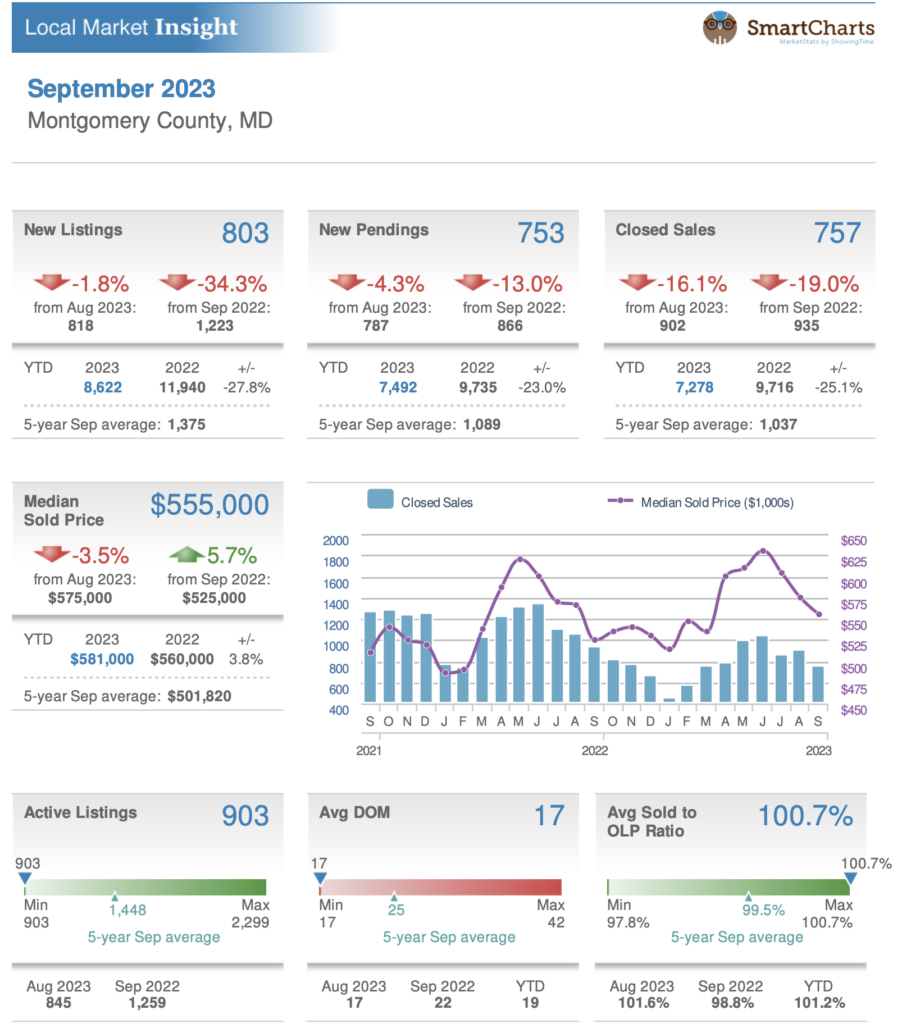

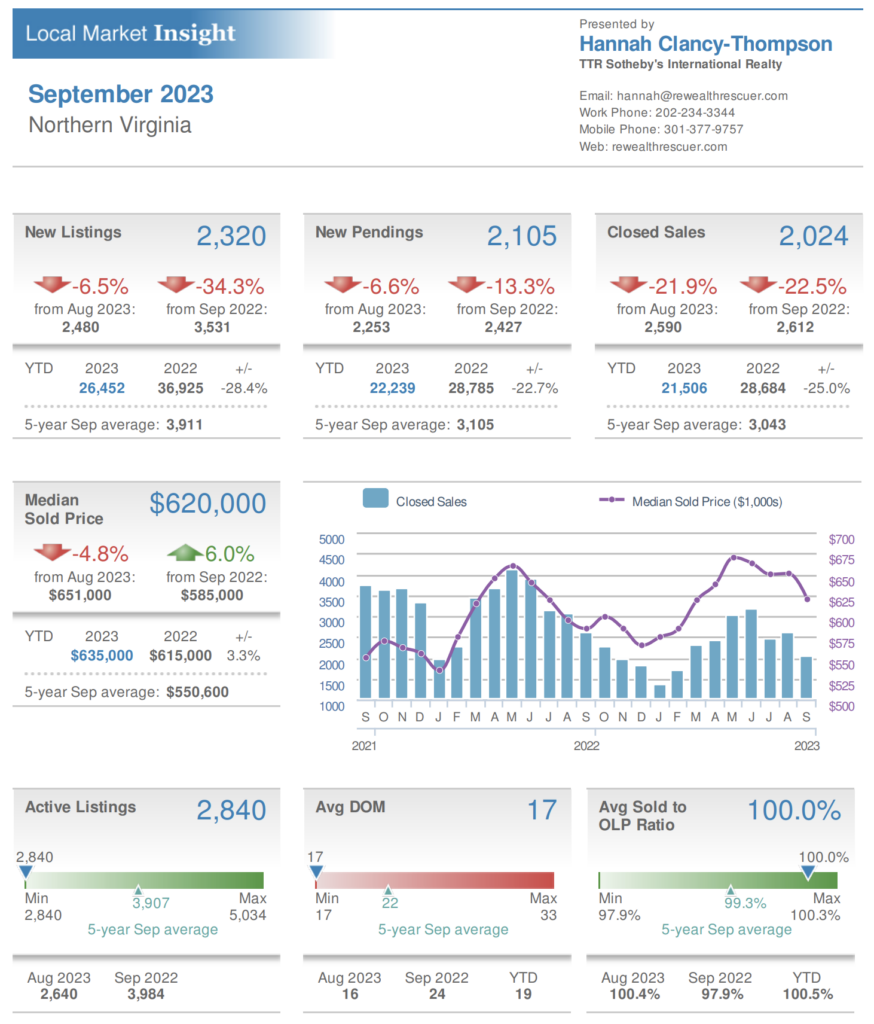

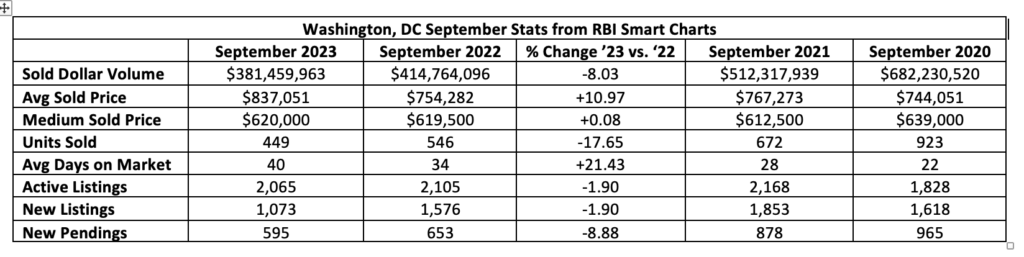

Overall Market Snapshot

Inventory

Mortgage Rates

How are interest rates affecting this? The higher interest rates are affecting the lower price end of the market more because those buyers are more impacted by financial changes.

10 year treasury bonds broke 5% which caused mortgage rates to hit 8%. The next Fed meeting was November 1. There was a less than 1% chance of a rate hike. The Fed in fact did not raise rates. The 10 year is down to 4.57% which is nearly 50bps in the last 5 days. Rates are down 0.25% today.

We are not seeing ARMs as much right now. We are seeing people use programs like 2-1 Buy Downs were a seller is helping buy down the rate. Buyers are restructuring how they write offers. Paying at or above list and asking for a seller credit, buying down rates, and demanding good condition or that the price reflects the current condition.

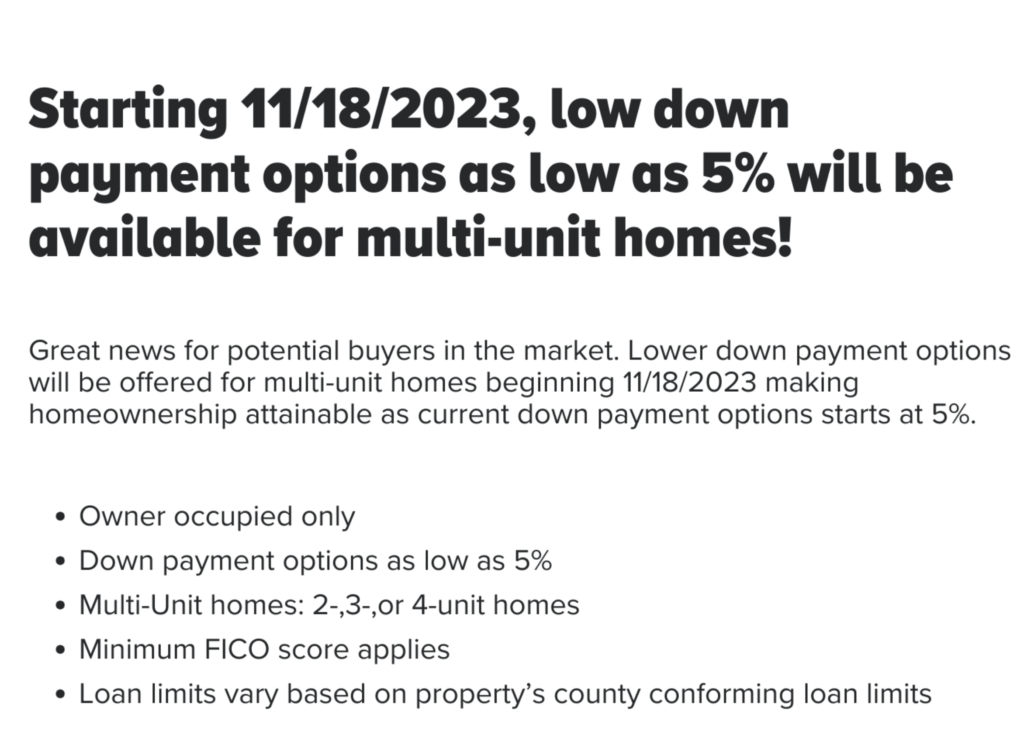

Announcement

New Loan Program for Owner Occupied Multi-families:

Sources:

TTRSIR Internal Documents – Effective Inventory

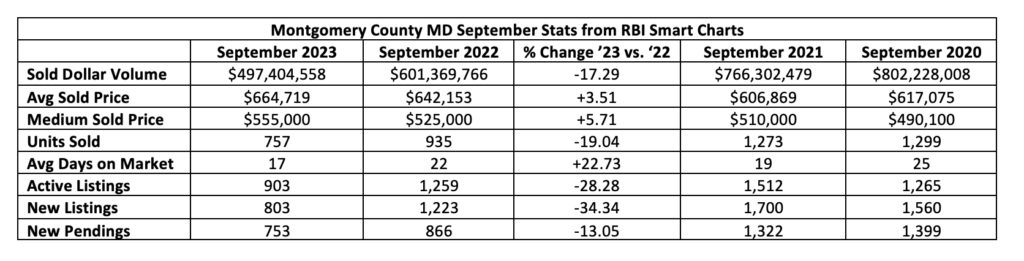

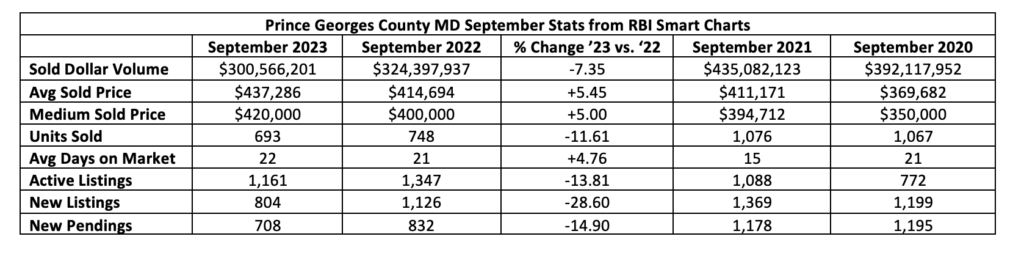

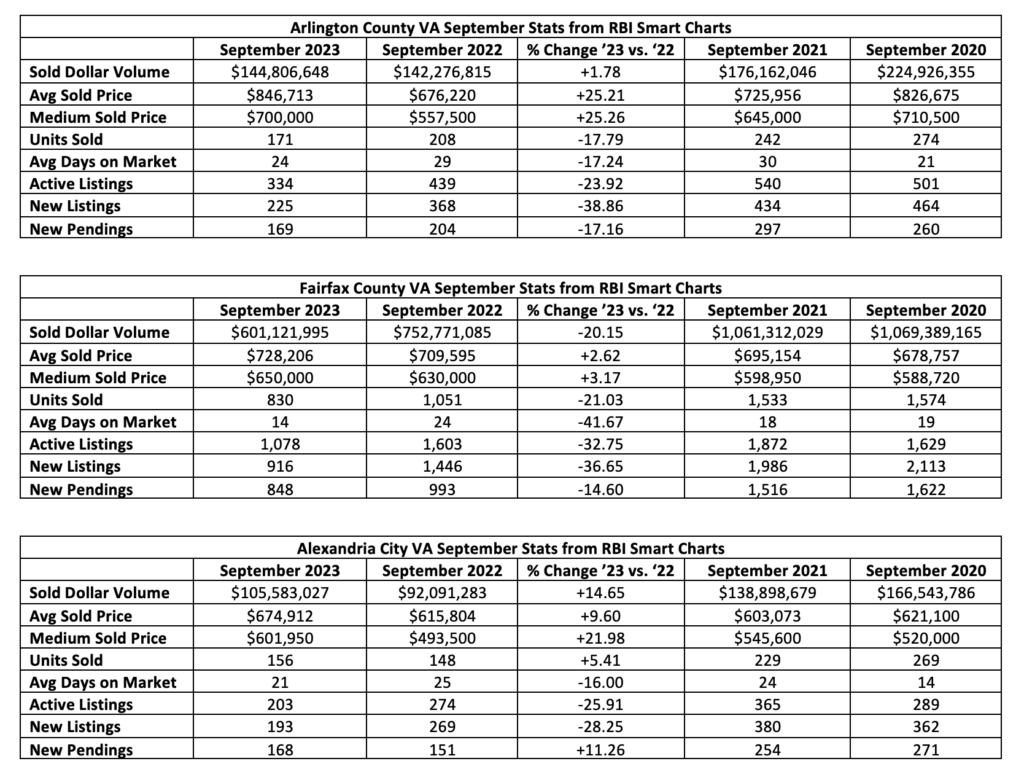

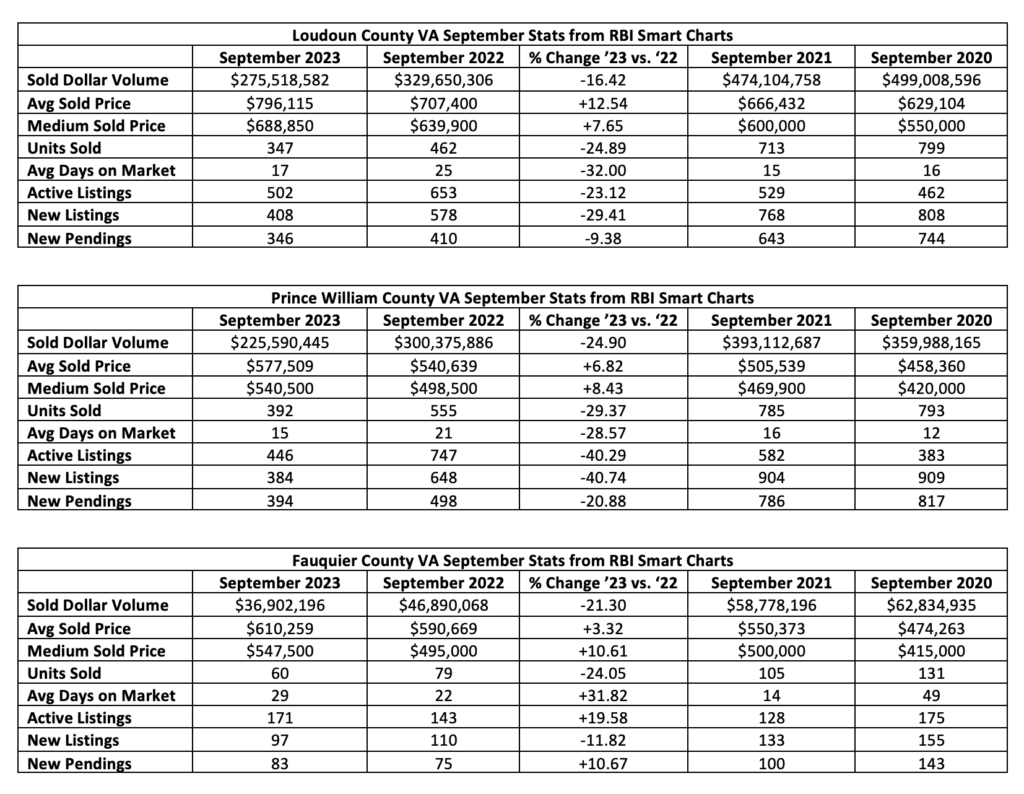

RBI Smart Charts – Market Data