Mid-way through 2022 – How’s the Market? June 2022

An quick overview

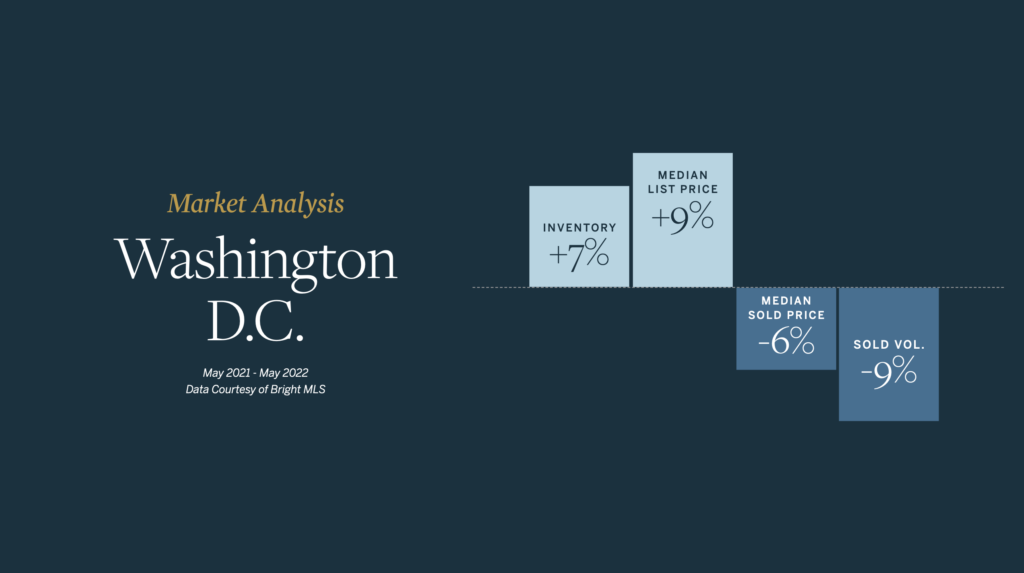

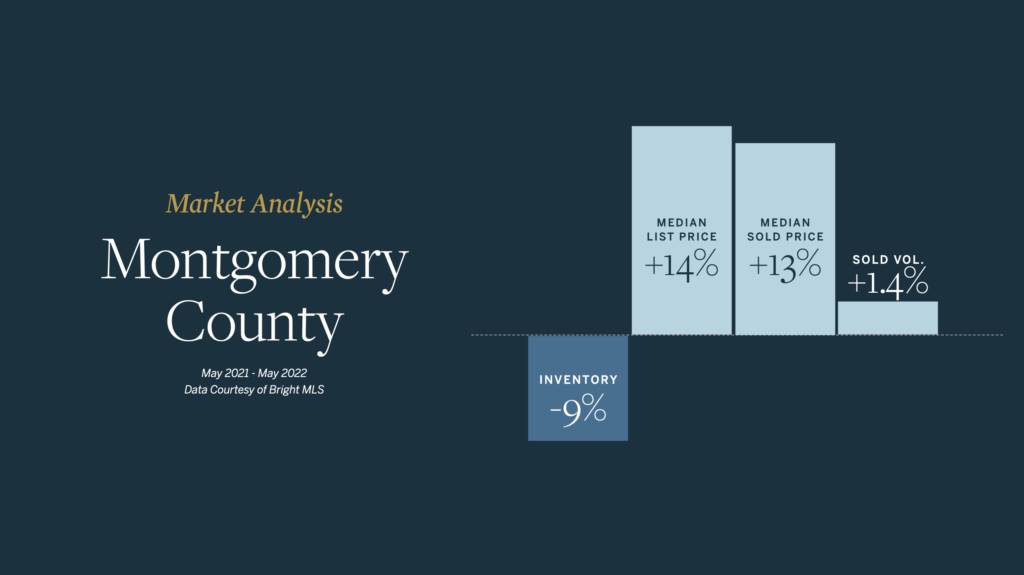

In the last year in Washington DC, inventory has increased by 7%, the median list price is up 9%, the median sold price is down 6%, and the sold volume is down 9%. In Montgomery County, inventory is down 9%, median list price is up 14%, median sold price is up 13%, and the sold volume is up 1.4%.

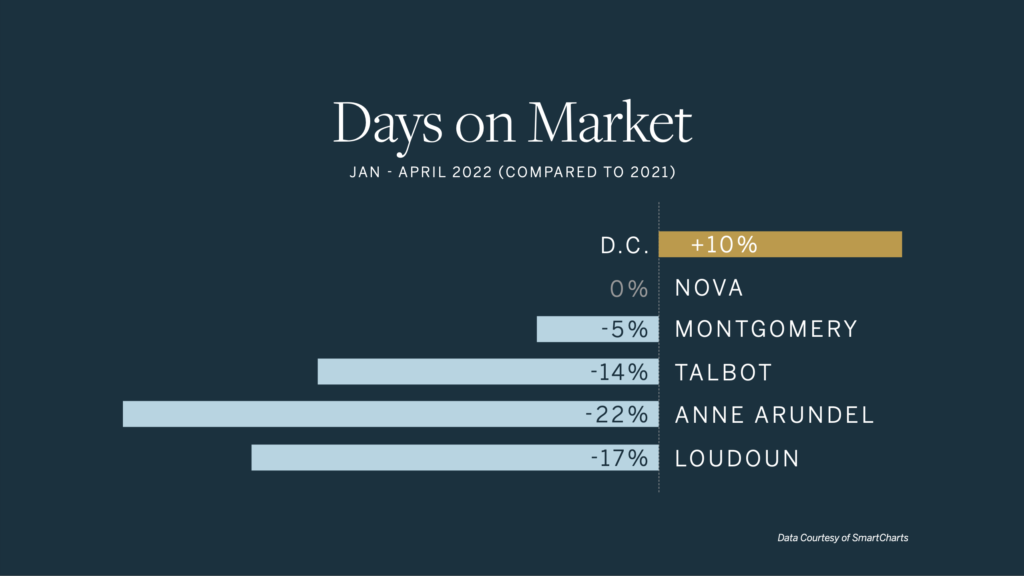

Days on Market

The days on market for Jan-April 2022 (compared to 2021) is 10% longer in DC and 5% shorter in Montgomery County.

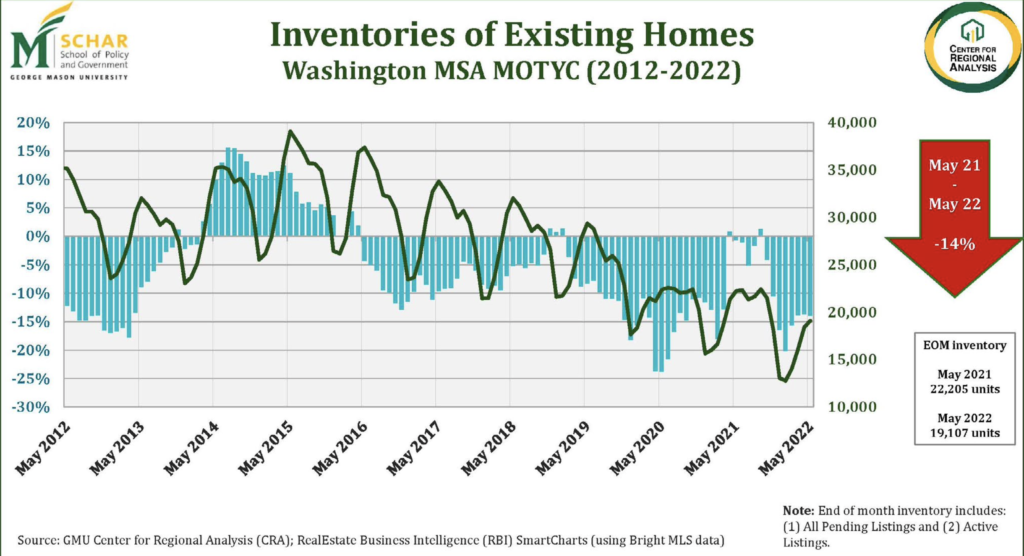

Inventory

Look at this chart from the Keith Waters of GMU of the history of inventory in the area from 2012-2022. You can see that inventory is down 14% from May 2021 to May 2022.

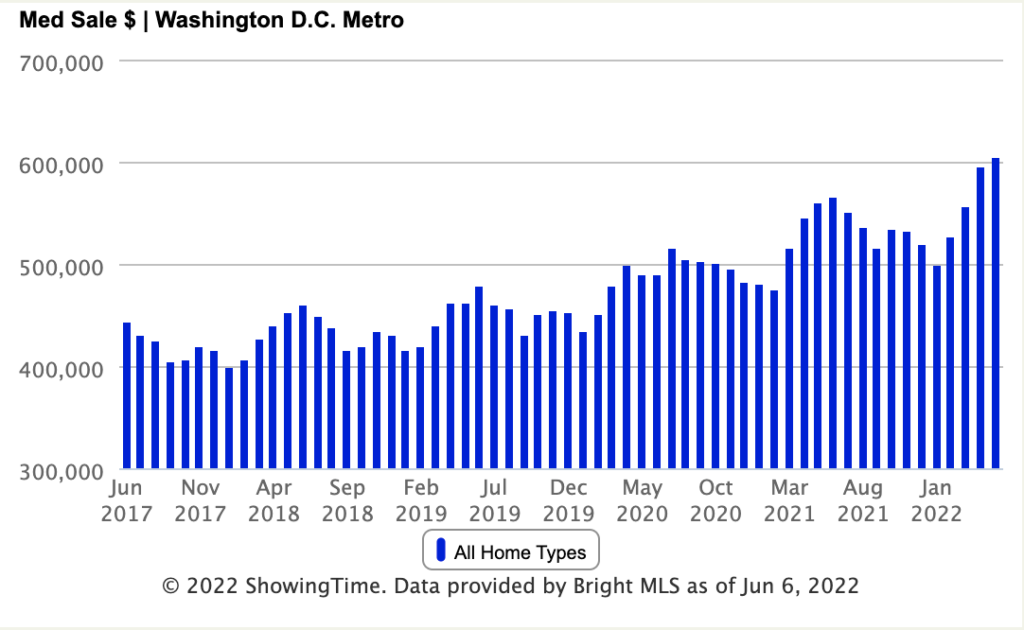

Prices

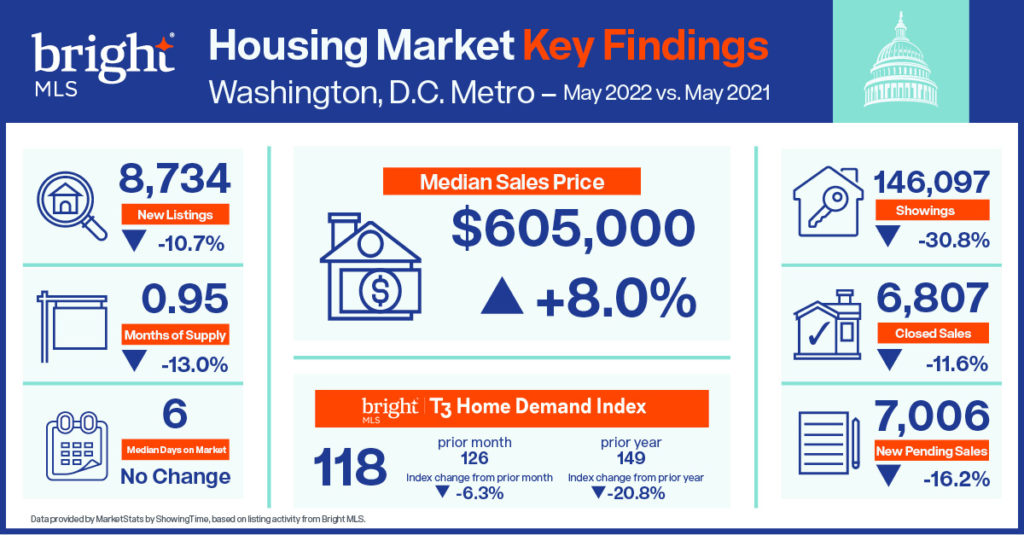

The median sales price in May rose to $605,000, an 8% increase compared to last year. It is the first time that the monthly median price is over $600,000. Home prices are $160,000 higher than in 2017.

In the months to come, expect housing market activity to be slower than the frenzied pace of last year. Prices will continue to rise, but price increases will be lower than they have been over the past two years.”

Bright MLS Chief Economist Lisa Sturtevant

We are currently expecting 3-5% increase in prices annually instead of the double digits we have been experiencing.

Fed Rate

The Federal Reserve increased the short-term federal funds rate three times since March 17 by 1.5% in an effort to decrease inflation. And it is possible they will do the same again in July.

Only when consumer price inflation tops out and starts to fall will mortgage rates stabilize or even decline a bit. That is why providing additional oil supplies will be critical in containing consumer prices and interest rates.”

NAR chief economist Lawrence Yun

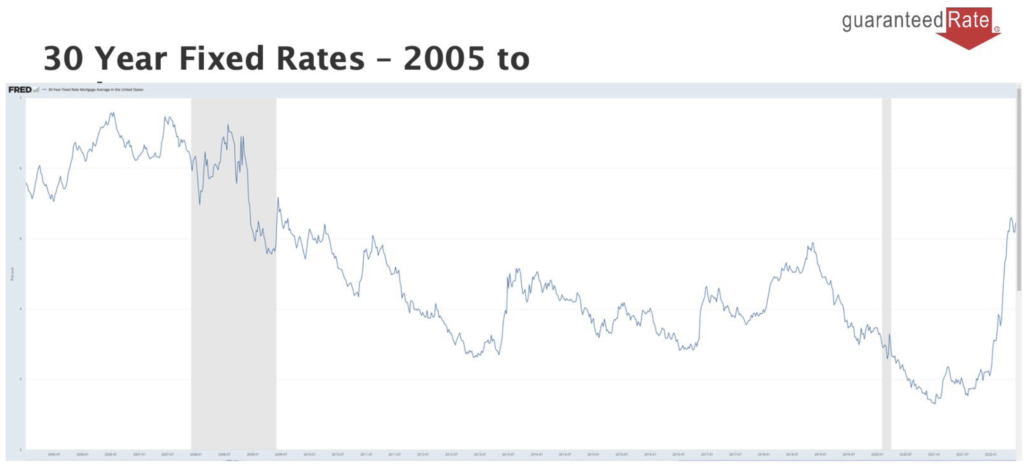

Mortgage Rates

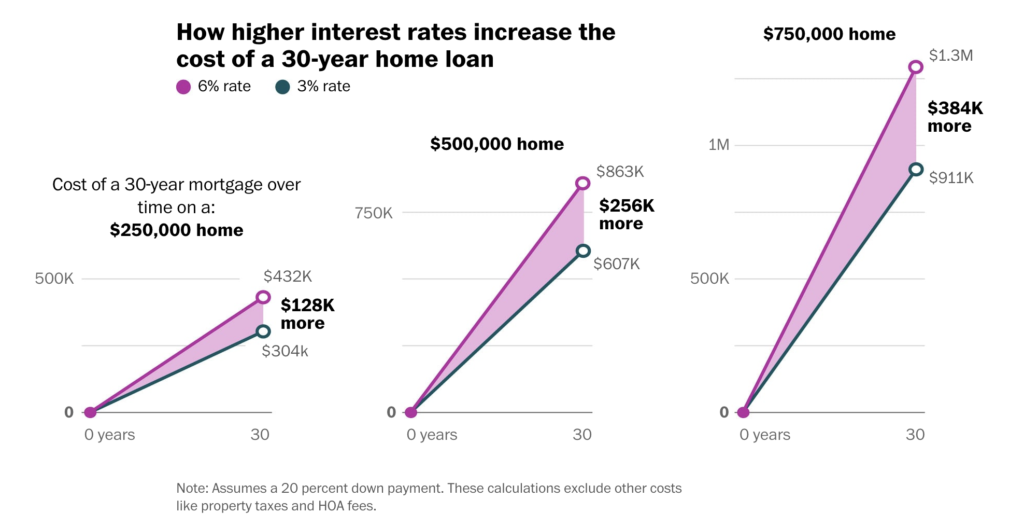

The average 30 year fixed mortgage is 5.91% (when I’m writing this). The current mortgage demand is the lowest volume in 22 years. The increasing mortgage rates are most likely to affect first time home buyers.

These 5%+ interest rates are likely going to be here for a while, think years. Right now they may be above 6% but we expect to see them around 5-5.5% when everything shakes out.

Concluding Thoughts and Predictions

Mortgage rates expected to be ~5-5.5%

Prices will increase in single digits 3-5%

Sources:

TTR Sotheby’s International Real Estate internal marketing presentation. June 2022. Including work by Keith Waters, Chief Economist, George Mason University. “Washington Area Residential Real Estate.” Center for Regional Analysis. June 16, 2022. Also including mortgage data provided by John Jones, Guaranteed Rate.

Bright MLS. “Inventory increases for first time since 2015.” June 14, 2022

Urban Turf. “As DC-Area Home Prices Break Record in May, The Market Shifts.” June 14, 2022

Taylor Anderson for Inman Connect. “Could Mortgage Rates Fall? Agents react to biggest rate hike in 28 years.” June 16, 2022

Kevin Schaul for The Washington Post. “What the Fed’s interest rate hike means for mortgages.” June 16, 2022.