What can you expect to see in 2023? Well we don’t have a crystal ball, but let me gather together some of the important facts and trends so that you know what to expect in 2023.

How Does the Economy Look?

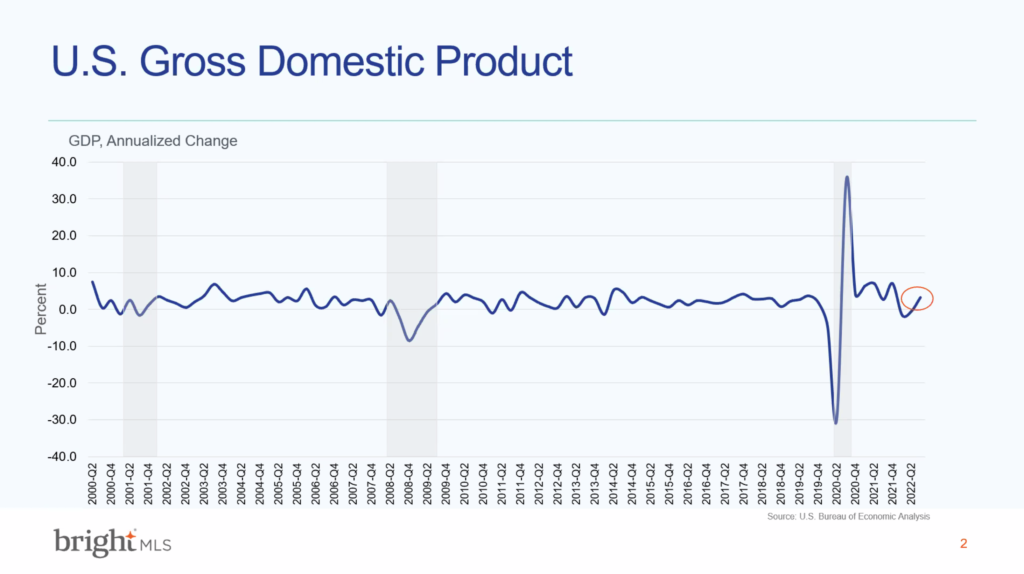

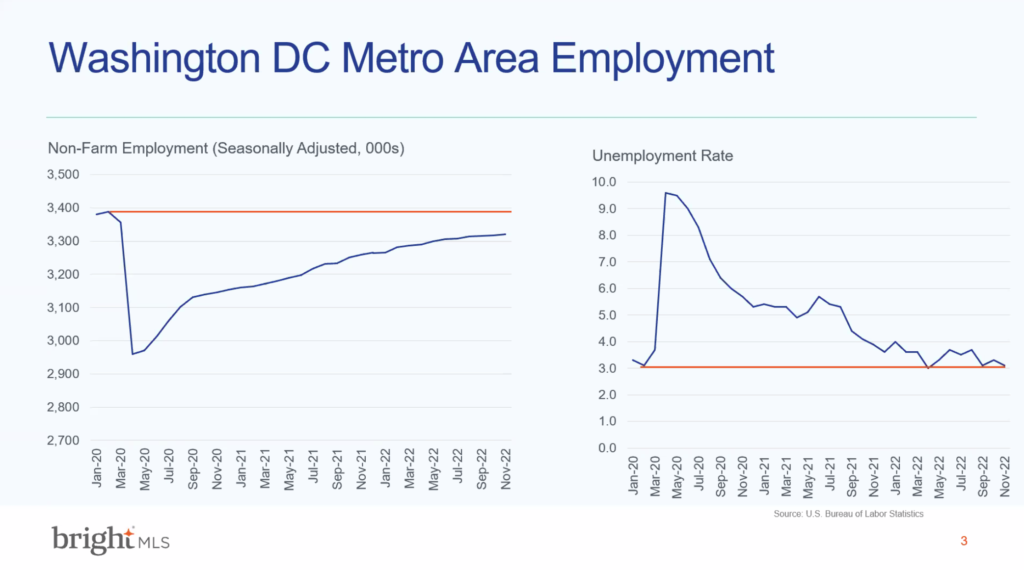

The US GDP is up, unemployment is down (down to 3% or pre-pandemic level), and inflation is down from 9% to 7.1%. These overall economic factors set the scene for our outlook on 2023.

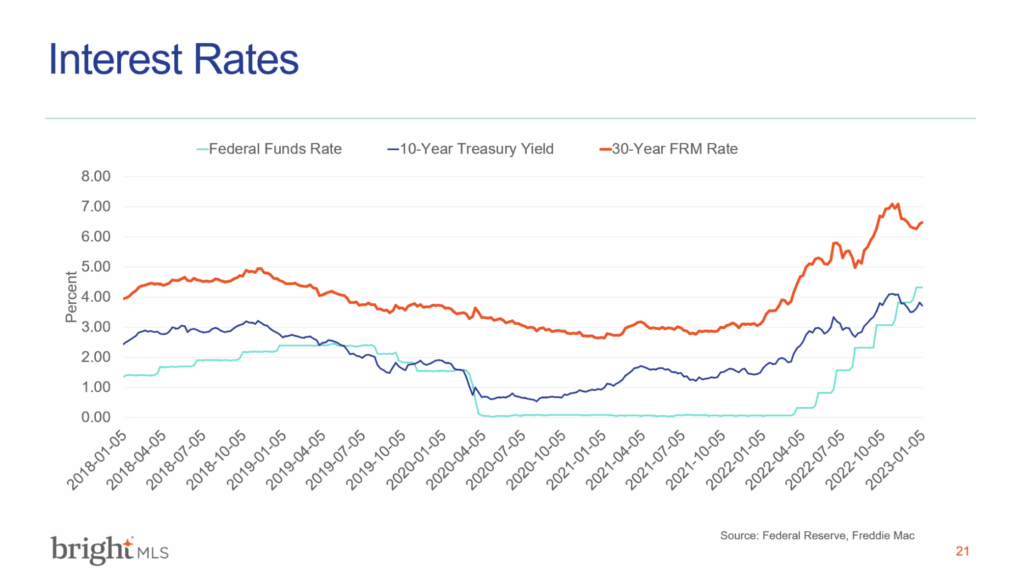

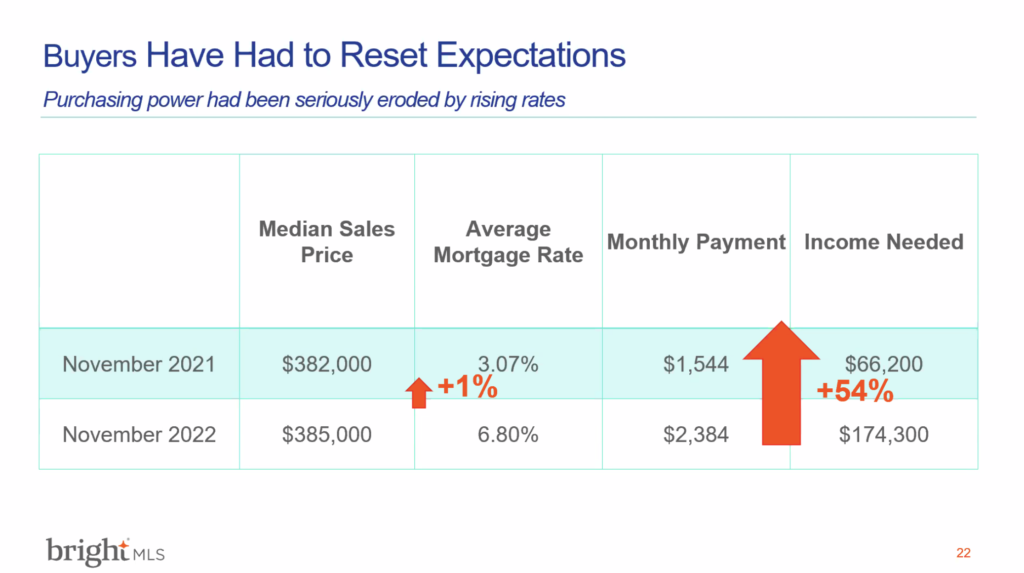

Mortgage rates have been increasing and the Fed has continued to raise the Fed rate. The inflation target is 2-4% so the Fed will likely continue to raised the Fed rate to get inflation to this point. This has already been anticipated in the existing mortgage rates.

Dr. Lisa Sturtevant, Bright Chief Economist, predicts that mortgage rates will remain in the 6-6.5% range for the first half of 2023, but that it will be 6% by the end of the year. She feels that mortgage rates have likely peaked. I have read other reports of a more optimistic 5.5% rate by the end of 2023 that is based in good data as well. Matthew Gardner, Windermere Real Estate Chief Economist, believes rates will fall to the high 5%s by the end of the year. Even this mortgage rate is 2% less than the historic average.

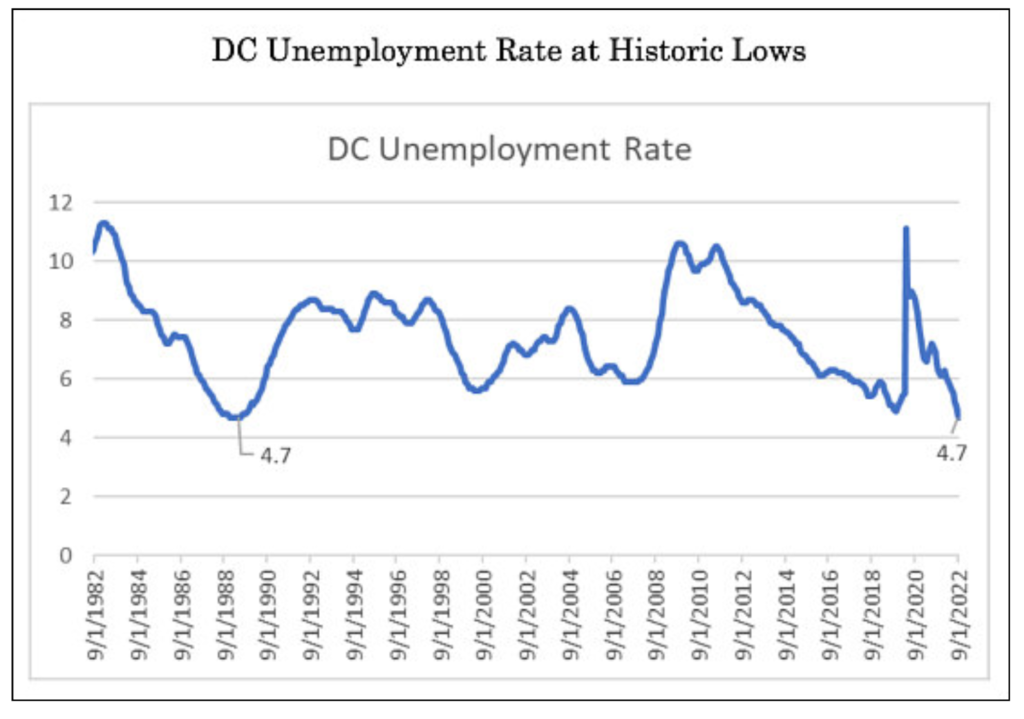

The biggest issue has been mortgage rate sticker shock and not the economy itself. We have a 50 year low in unemployment in the District. And this number is not a sign that less people are looking for work as the DC employment to population ratio is also at an all time high.

Inventory

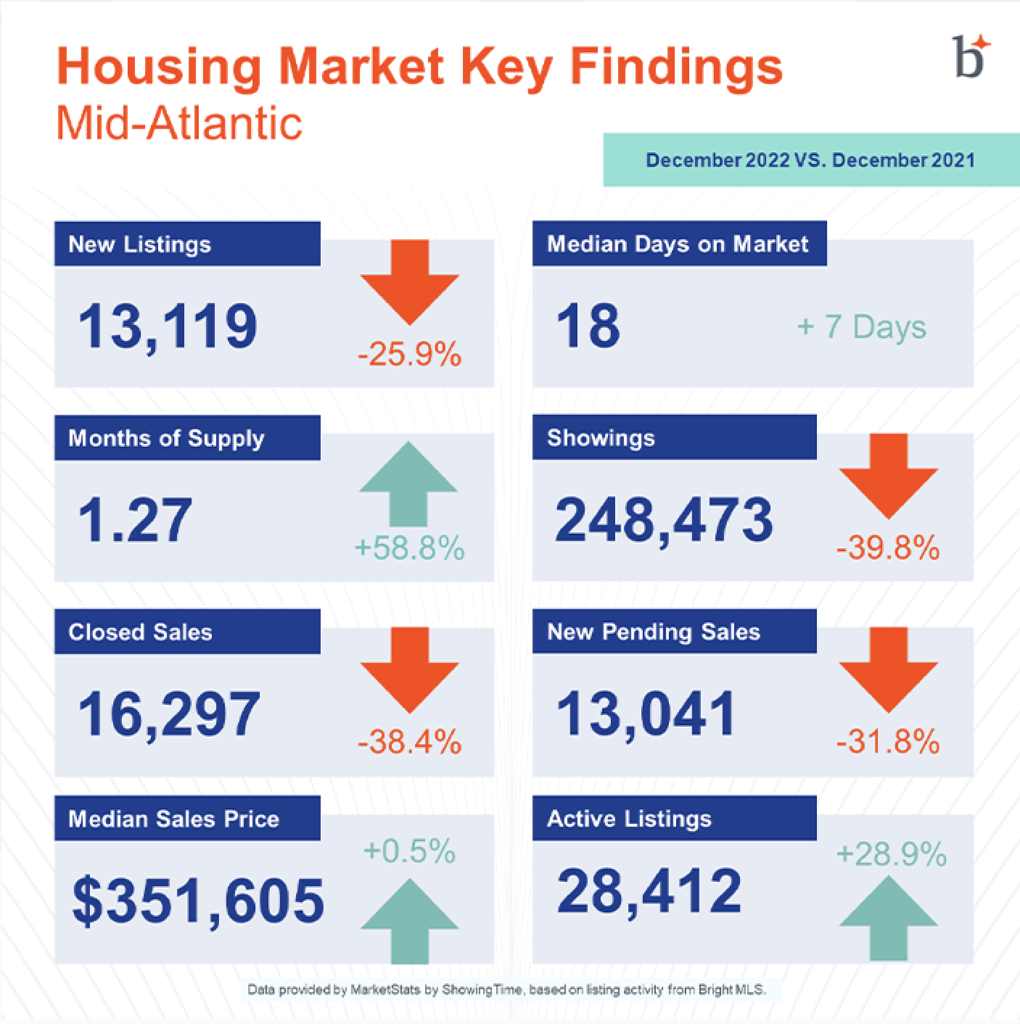

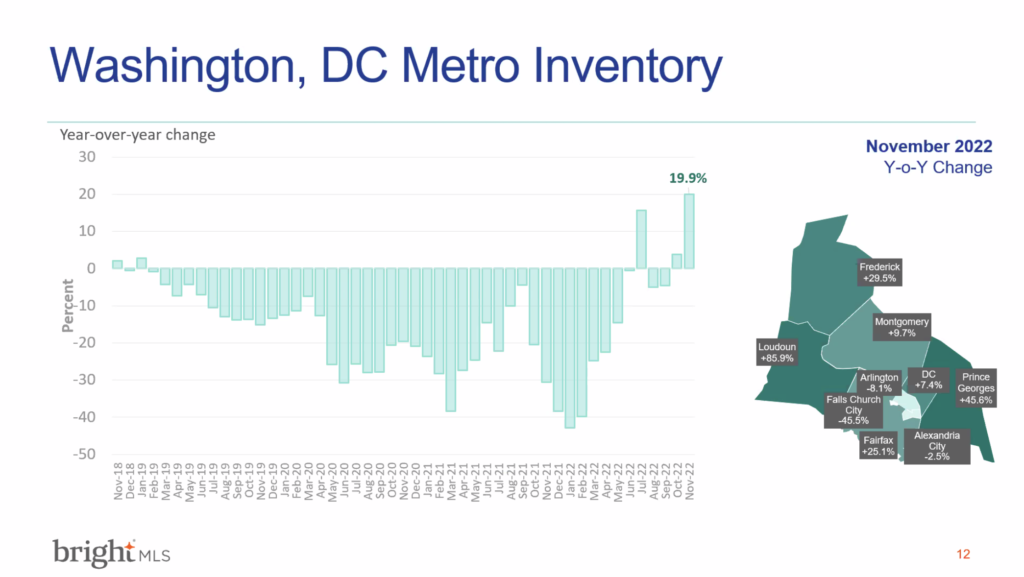

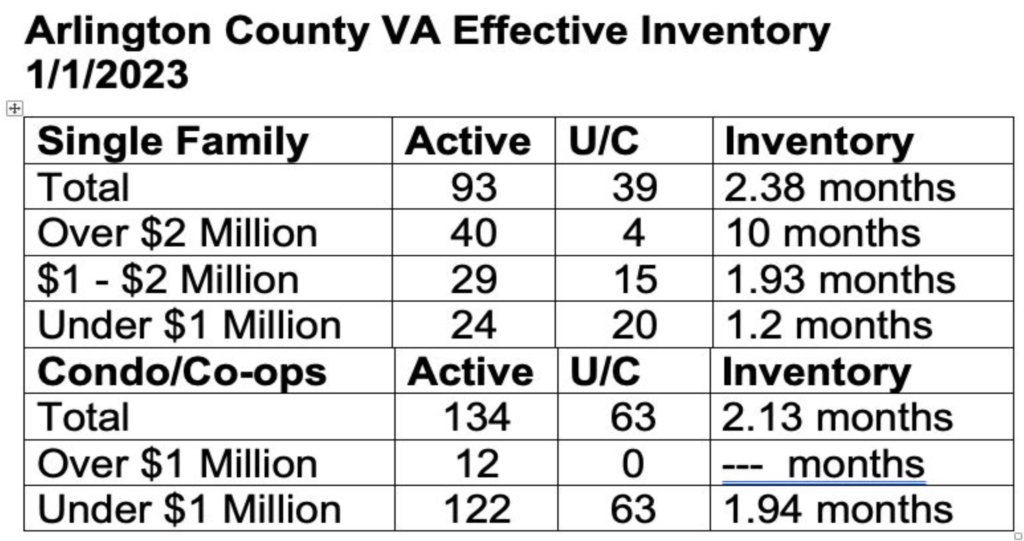

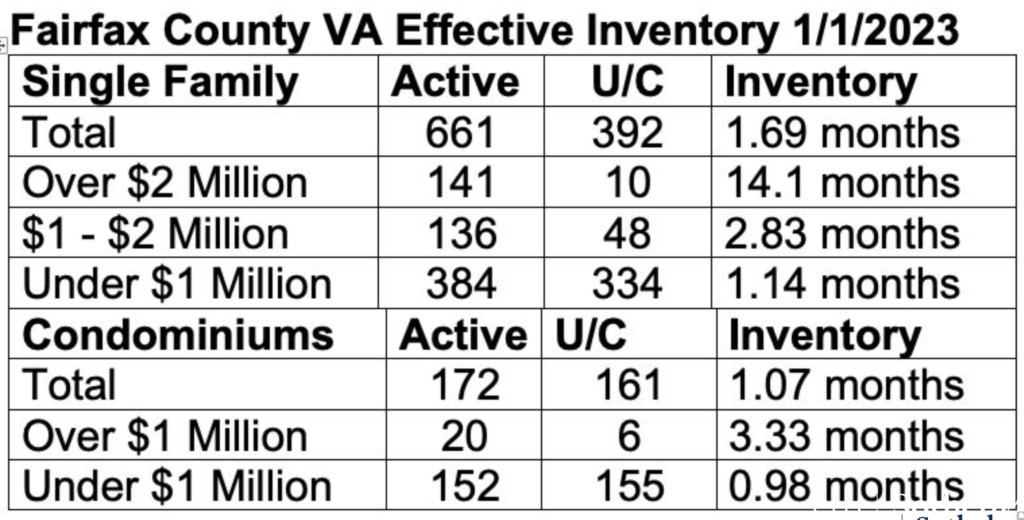

Inventory is still low. November 2022 inventory increased 20% but it happened differently across counties. We have 80% of the November 2019 inventory levels. We have not moved into a balanced market yet. We do not expect to see a buyer’s market in 2023 since supply/inventory is expected to stay below normal averages.

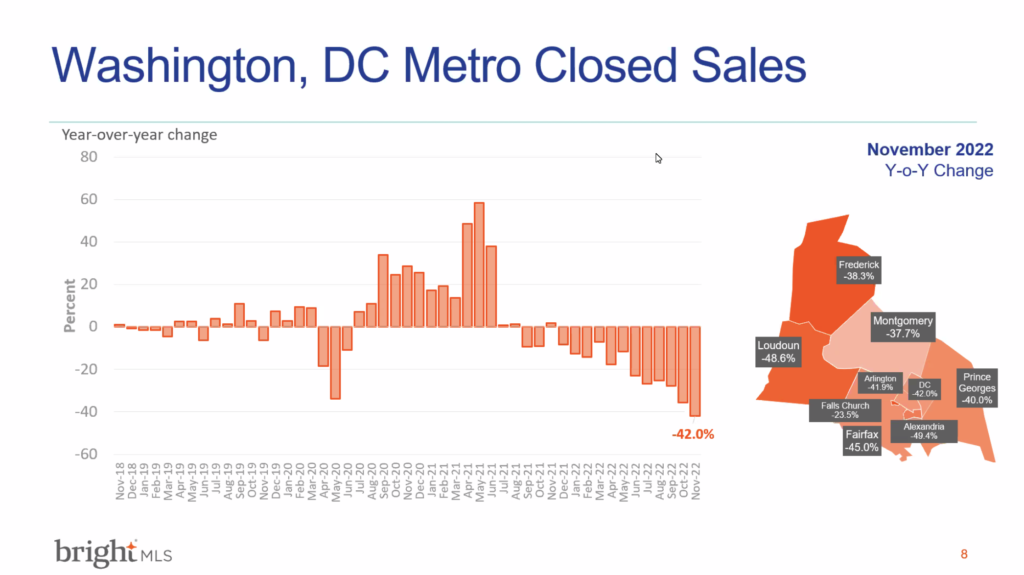

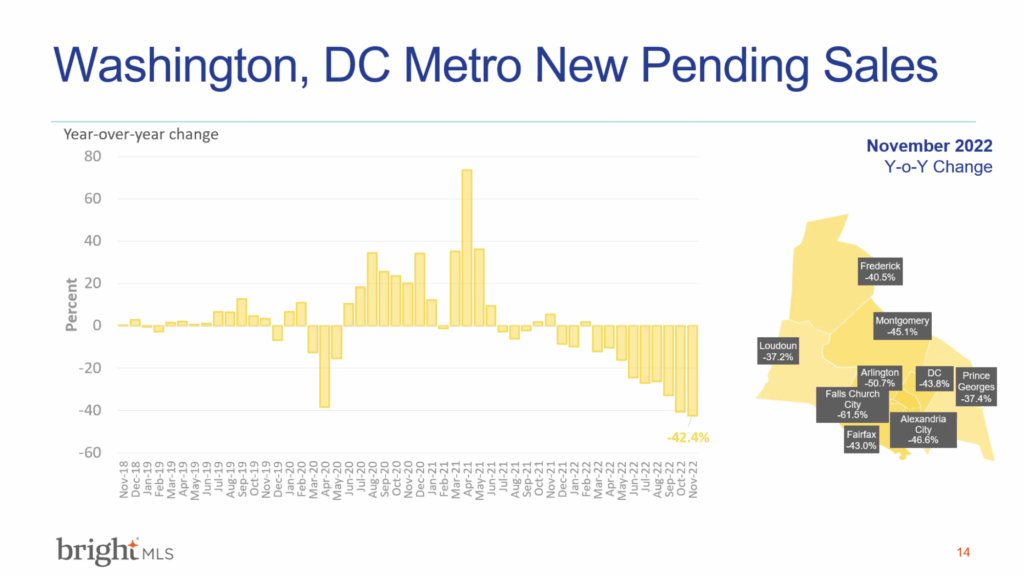

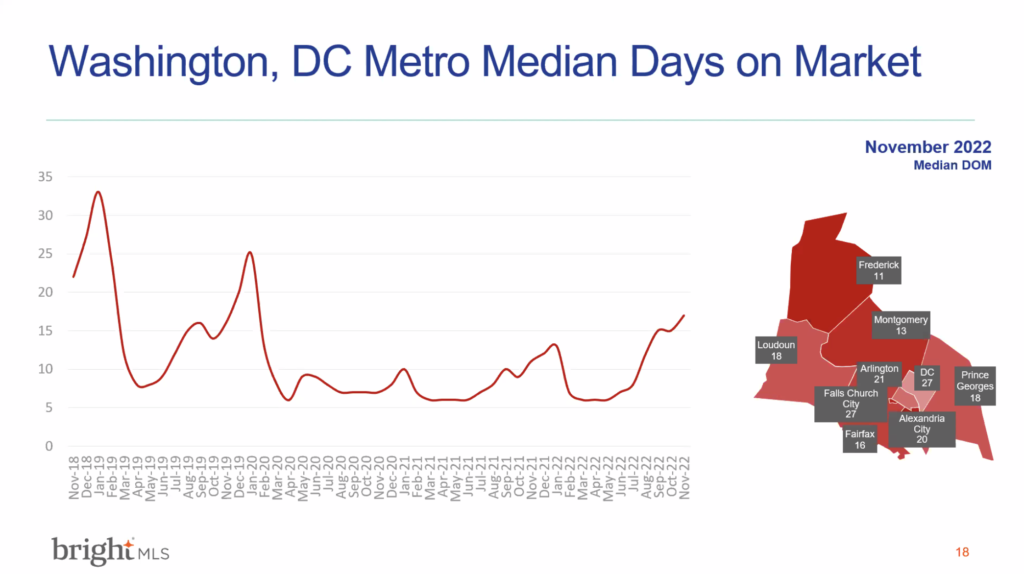

November did concern those watching the market because new pending sales were down 42%. In PG county there were 695 new pending sales in November 2022, which was the lowest since 2009. New listings were also slowing and the median days on market was increasing. We appear thought to have hit the bottom of the market and new contracts are up. In our (the “royal we” at our TTRSIR internal meeting) opinion, this was a healthy market correction.

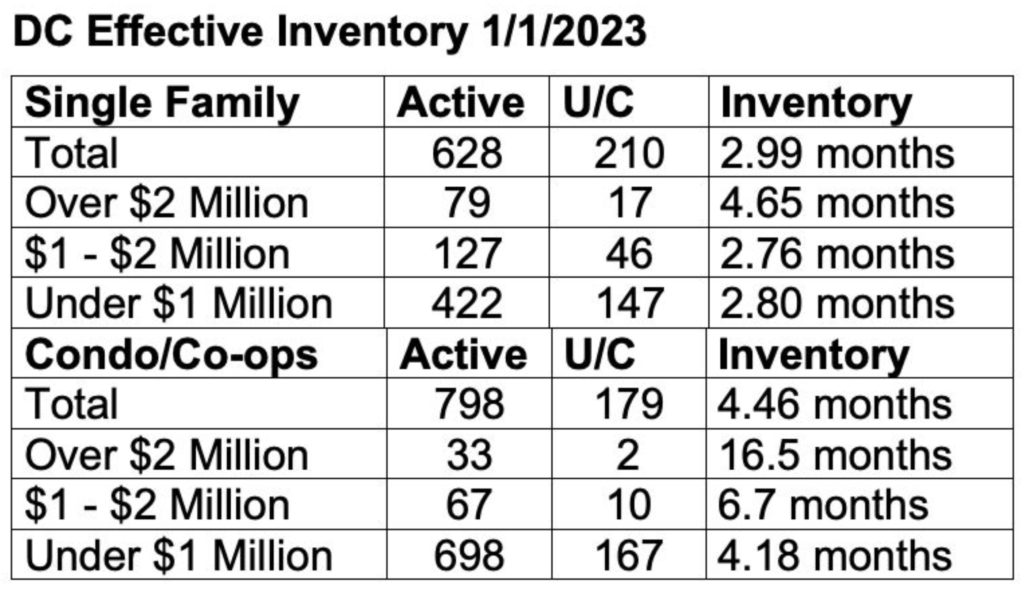

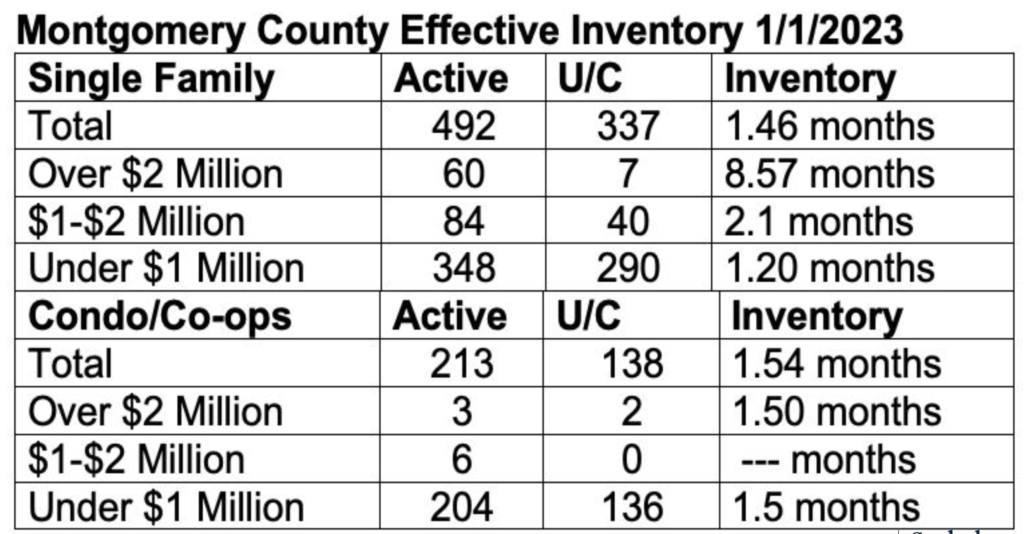

The DC condo market has 5 months of inventory but the Moco market has a much lower 1.5 months. The Fairfax condo market looks better than other areas’ condo markets because of the large amount of townhouse-style condos in that market.

Remember that months of inventory is a trailing indicator. We expect to see more inventory in March to May. The biggest question we are watching – will buyer demand kick back in?

Our current assessment is that buyers are still in the market but they only want the best houses. This means sellers need to do a good job of presenting their house beautifully for the market. Prices are not as crazy as they were but we are still seeing escalation of prices.

How can the Government help?

Because of the demand from and increasing demand coming from Millennials and Gen Z, we need new housing construction to increase. It is actually down and predicted to stay this way due to increasing supply chain costs.

In addition, the amount of available land in some markets is a big hinderance. We should expect to see Governments changing their land use policies to “make” more land available for new housing construction.

Another way we may see the Government supporting developers is with tax incentives for building.

What do we expect?

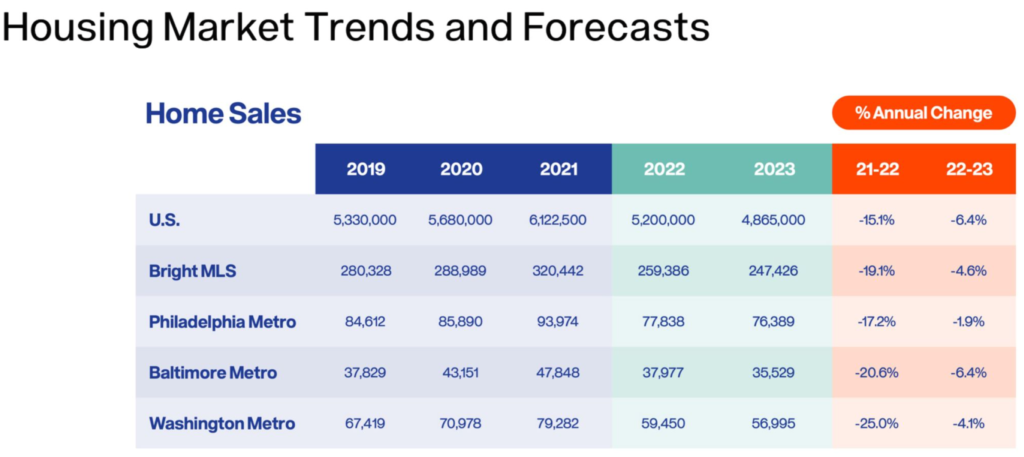

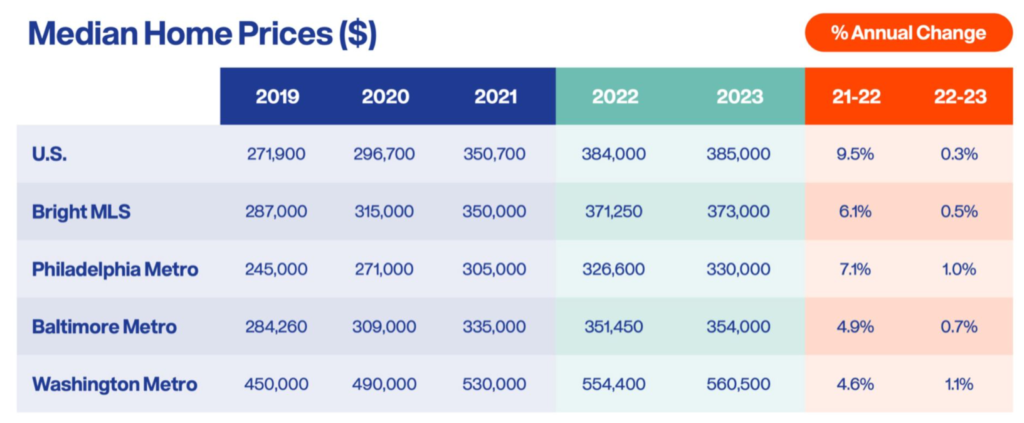

The market has reset. Important factors like demographics, economy, and pent-up demand are known. Rates are stabilizing over this year. Sellers benefited from the increasing equity of their homes but first-time homebuyers are still struggling.

As we reach our new normal, we will start focusing on the market risks that remain, namely inventory, affordability, inequality, and new construction.

We are cautiously optimistic. One of the main reasons is because of the demographics involved – millennials are a large group of individuals and the economy is pretty resilient. (I have a blog post dedicated to just this topic, so click here if you are interested in reading more about demographics.)

The biggest risk is affordability. This will be worse out west and in the Southeast of the US. We do expect slower sales activity and stable prices in our region.

Sources:

Housing Market Update, PG county. Webinar with Lisa Sturtevant, Bright MLS chief economist, January 5, 2023.

‘No housing bubble’: An economist’s top 10 predictions for 2023. Inman, November 28, 2022.

“DC’s Unemployment Rate at 34-Year Low.” Urban Turf, January 8 2023.

TTRSIR internal market review, January 18, 2023.