Sale-to-list price ratio is the sale price divided by the list price, expressed as a percent. If it is less than 100%, the home sold for less than list price; 100% the home sold for list price; and above 100% for more than list price. Here is an example: If a seller is asking $400,000… Continue reading What is the Sale-to-List Price Ratio and Why is it Important?

Your real estate wealth rescuer

Category: Market Trends

10 Neighborhoods Where Home Values are Climbing

Home Values are Climbing…

Luxury Home Market Trends 2017

HVAC Life Expectancy

How’s the Market?

To answer this question, let’s start by looking at the year end. Since the recession, consumer confidence has increased as the economy has stabilized. Interest rates and mortgage rates are expected to increase throughout the year. In November, a new President was elected. The market is currently adjusting to expectations of policies his administration will… Continue reading How’s the Market?

Spring Housing Market: Get Ready for the Spring Housing Market

Welcome to my new series – “Get Ready for the Spring Housing Market”. Are you looking to buy or sell a home this spring? Let’s talk about the market. Our local spring market has the most sales of the year, which is why so many sellers time their home sale for the spring market (which… Continue reading Spring Housing Market: Get Ready for the Spring Housing Market

Bond Loans: What is a bond loan? What are available in the DC Metro Area?

Continuing my series, “Understanding Financing,” with this video on bond loans. What is a bond loan? And what bond loans are available to home buyers in the DC Metro Area? This video features my special guest, Ron Schwartz, Senior Loan Officer with Embrace Home Loans. Hannah: Hey everybody, I’m here today with Ron Schwartz of… Continue reading Bond Loans: What is a bond loan? What are available in the DC Metro Area?

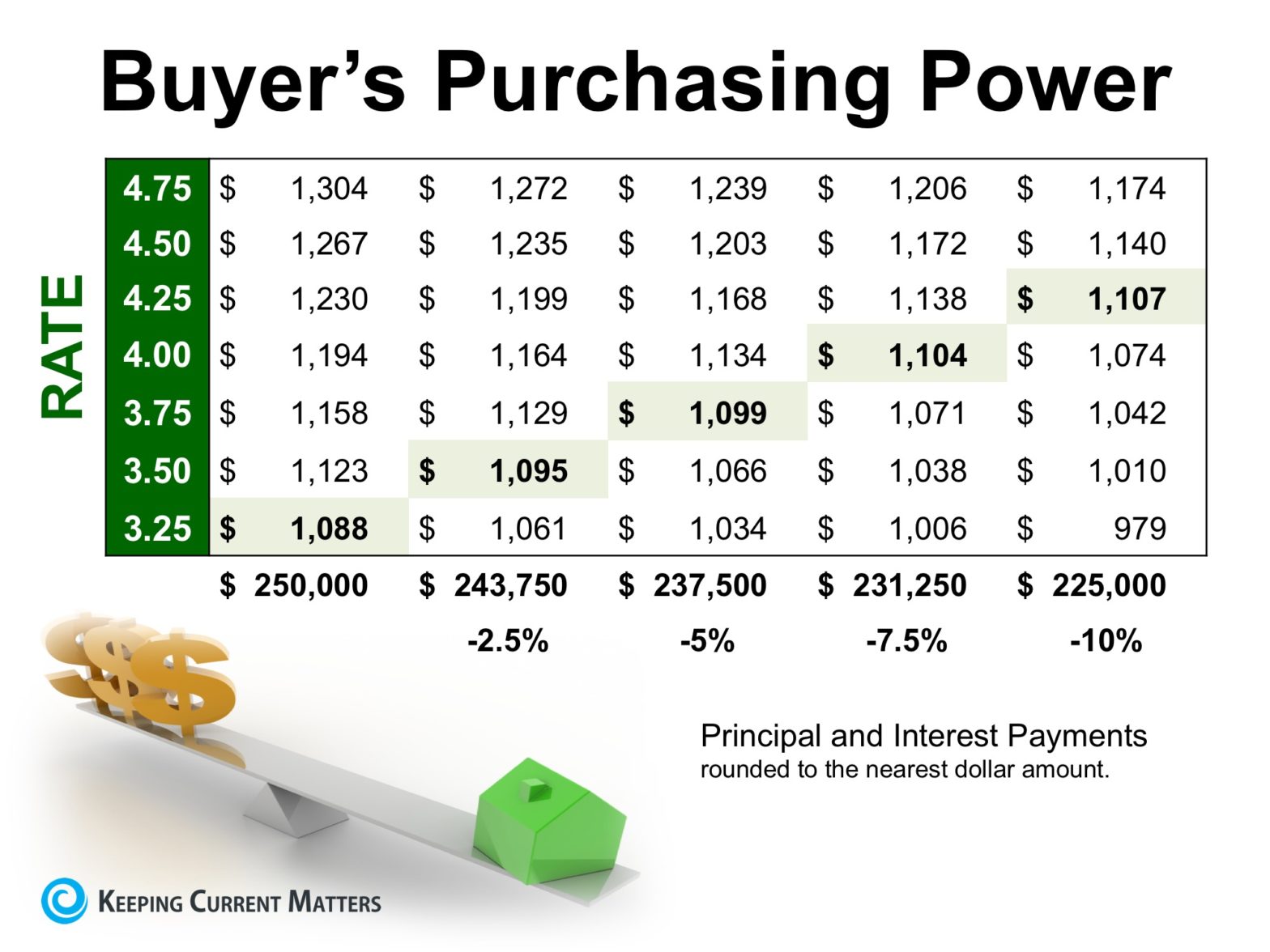

The Fed Raised Rates, What Does This Mean for You?

The Federal Reserve raised the Federal funds rate by 0.25%. They did not raise mortgage rates. Mortgage rates did respond to this though with an increase. Today, the 30 yr fixed-rate mortgage rate is 4.16%. The Fed has said that they will continue to increase the Fed funds rate maybe two or three more times this… Continue reading The Fed Raised Rates, What Does This Mean for You?

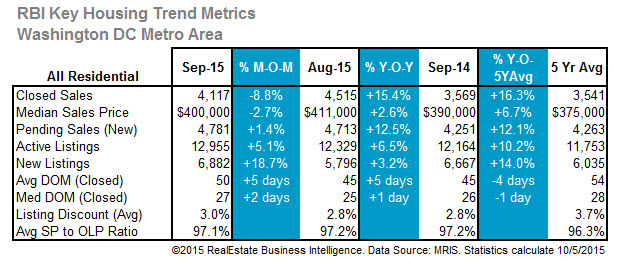

Looking Back: DC Q3 Real Estate

DC Q3 Real Estate | September data is in, so let’s look back at the third quarter real estate market in several DC neighborhoods. The fall DC market started well with the highest September sales activity since 2006. Median sales prices are up and inventory is increasing (while inventory growth is slowing). Probably the most… Continue reading Looking Back: DC Q3 Real Estate

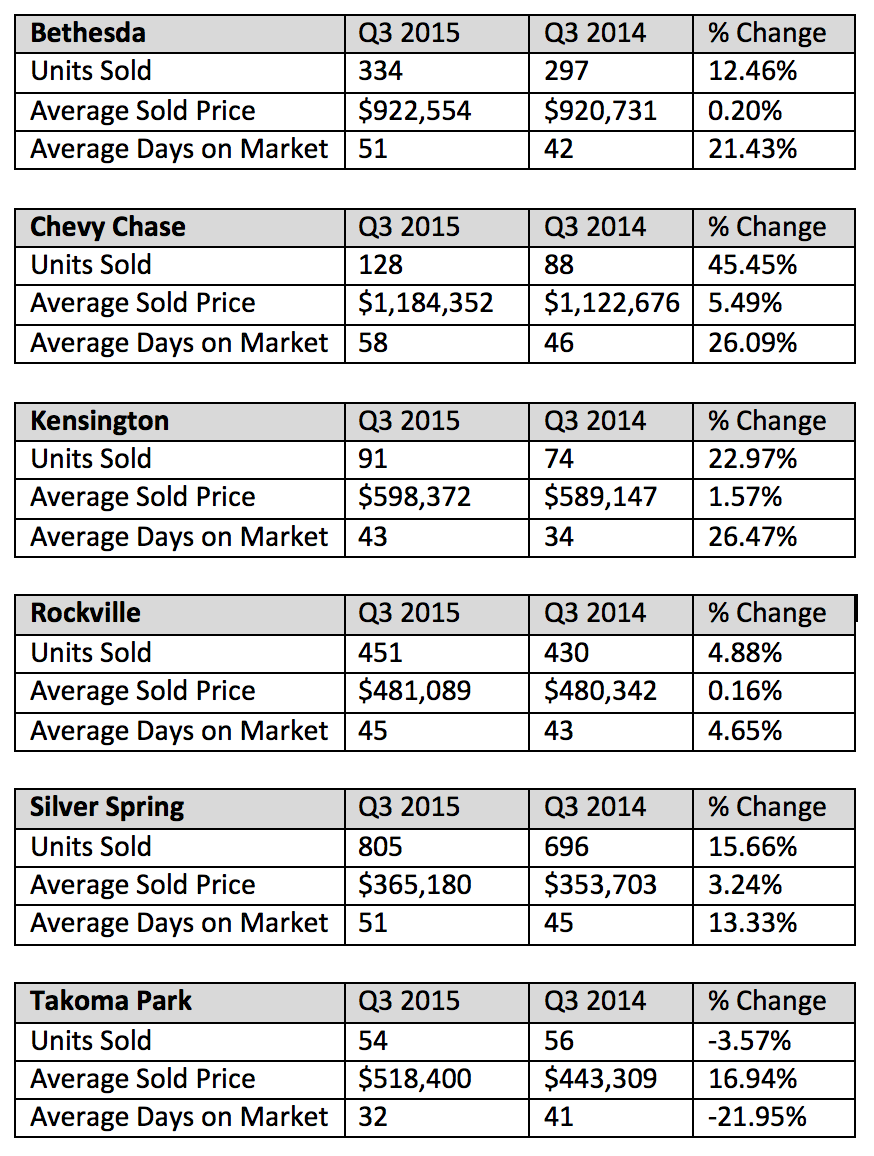

Looking Back: Maryland Q3 Real Estate

Maryland Q3 Real Estate | September data is in, so let’s look back at the third quarter real estate market in several Maryland neighborhoods. Units sold are “up” in all of the neighborhoods I studied (Bethesda, Chevy Chase, Kensington, Rockville, Silver Spring), except Takoma Park where they fell by 3.57%. The average sold price increased… Continue reading Looking Back: Maryland Q3 Real Estate