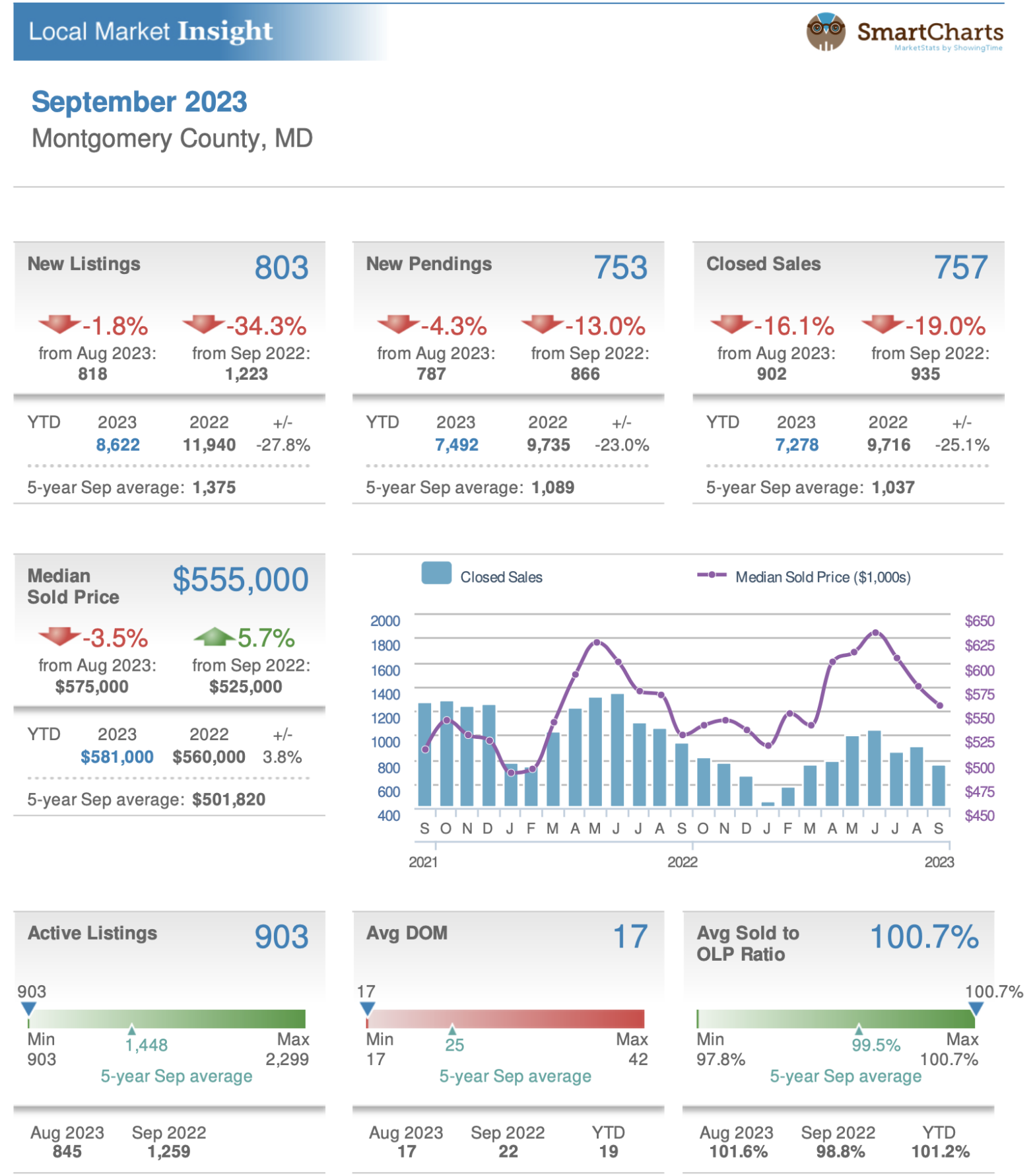

Overall Market Snapshot Inventory Mortgage Rates How are interest rates affecting this? The higher interest rates are affecting the lower price end of the market more because those buyers are more impacted by financial changes. 10 year treasury bonds broke 5% which caused mortgage rates to hit 8%. The next Fed meeting was November 1.… Continue reading How’s the Market? October 2023

Your real estate wealth rescuer

Tag: Financing

How’s the Market? Is it a buyer’s market now?

Welcome back to my monthly series – “How’s the Market?” This is the August 2022 edition which covers July 2022 data. OVERALL MARKET PREDICTIONS: Where are we going for the rest of 2022 into 2023 Overall, expect the housing market activity to continue to slow through the second half of 2022 and into early 2023… Continue reading How’s the Market? Is it a buyer’s market now?

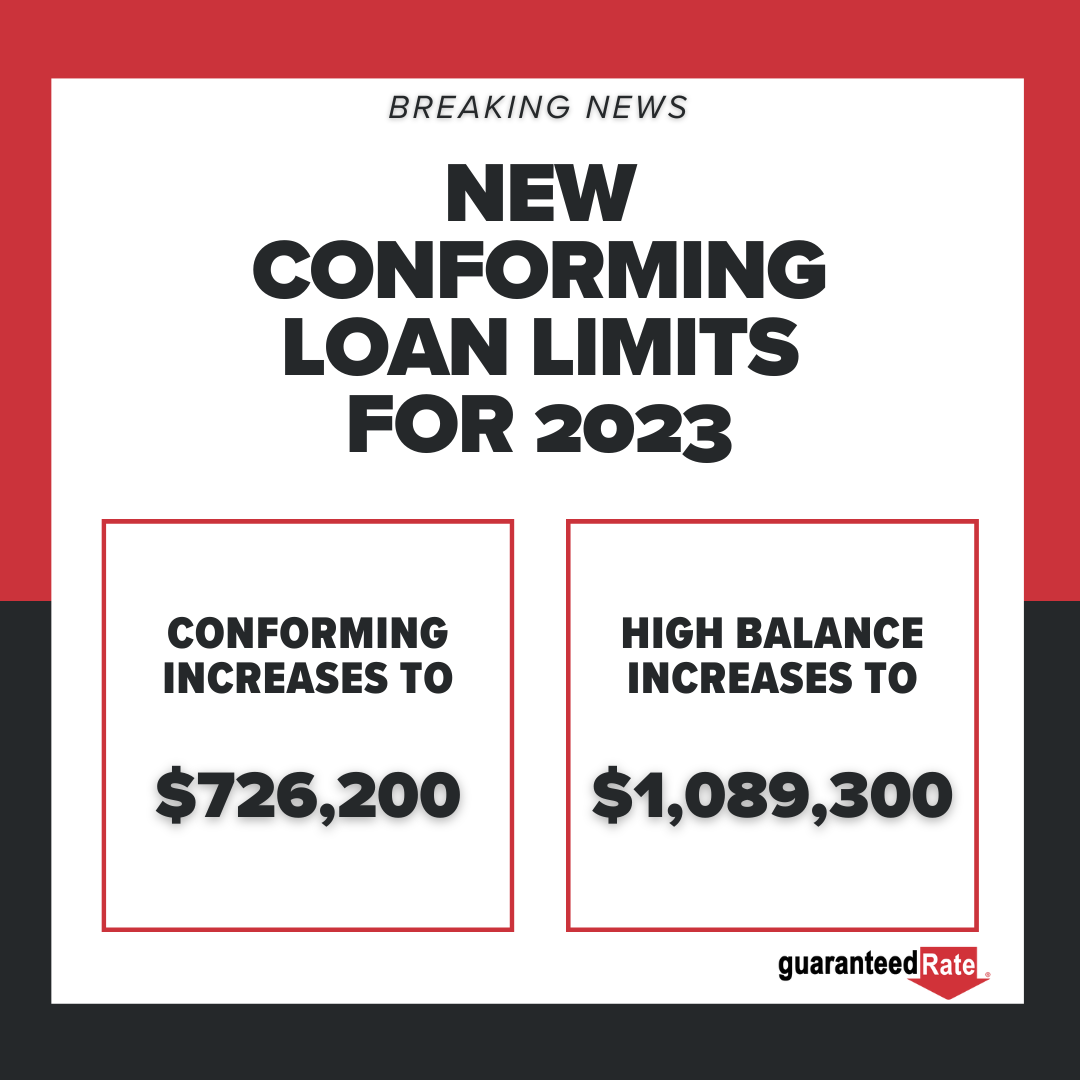

FHFA Announces New Conforming Loan Limits for 2023

Conforming Loan Limits The Federal Housing Finance Agency (FHFA) has announced it will be increasing maximum conforming loan limits in 2023.

Buying a House in our Hot Spring Market? 4 Tips on How to Get Ready

Buying a House | In my last video in this series, I discussed how competitive our spring market can be. As a buyer, now is the time to get ready. Let’s talk about how you can do that. 1. You need to get pre-approved from a local lender. This is important – I have an entire… Continue reading Buying a House in our Hot Spring Market? 4 Tips on How to Get Ready

Credit & How it affects your ability to secure financing

Credit and Security Financing In my last post, I discussed real estate financing 101 – what is a mortgage? and how will lenders evaluate you (the 3 C’s – credit, collateral, capacity)? Today, we are going to be talking about credit and how it affects your ability to secure financing. I said we were going… Continue reading Credit & How it affects your ability to secure financing

Financing a Real Estate Purchase 101

Financing Real Estate Purchase | Welcome to my new series, “Understanding Financing.” This is the first blog in this series and I am going to be covering the basics of financing a real estate purchase. As the series continues, I will cover a variety of topics related to securing financing for your real estate purchases, including info… Continue reading Financing a Real Estate Purchase 101

What is a short sale and how does it affect me?

Short Sale When you are searching for your new home, you will most likely come across some listings that are potential short sales. What does this mean and how will it affect you? A short sale occurs when the owners owe more money on the house than what they can sell it for. They… Continue reading What is a short sale and how does it affect me?

Understanding Jumbo Mortgages

Understanding Jumbo Mortgages | If you are in the market for a home priced over $765,000 and you also want to get a mortgage, understanding jumbo mortgages is key! What is a jumbo mortgage? Jumbo mortgage loans are large mortgages, specifically larger than conforming loan limits. In Montgomery County, the 2020 conforming loan limit is… Continue reading Understanding Jumbo Mortgages

Want to Buy a House? Top 3 Things You Should Be Doing

In my last blog post, I wrote about 3 things you shouldn’t do if you want to buy a house. Today, I am telling you 3 things you should do! 1. Talk to a lender and get pre-approved for a mortgage. Whether or not you are a first-time homebuyer, you should talk to a lender… Continue reading Want to Buy a House? Top 3 Things You Should Be Doing

Buying Homes | Don’t Do These 3 Things

Buying Homes | So you are thinking about buying a house… That’s exciting! You are probably spending a lot of time looking a houses online and google-mapping your commute. But let’s talk about the top 3 things you shouldn’t be doing. 1. Don’t apply for a new credit card or start buying furniture and tools… Continue reading Buying Homes | Don’t Do These 3 Things