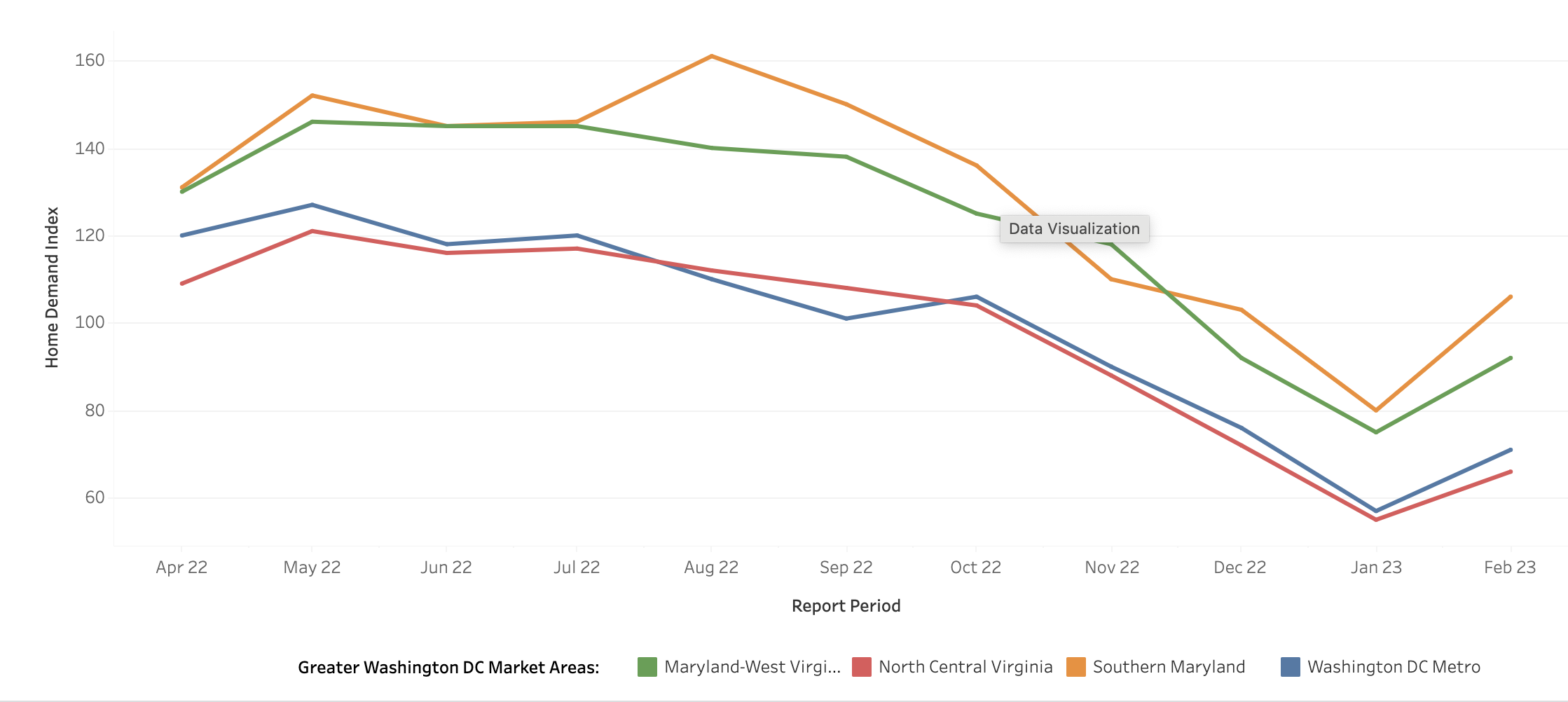

The Big Picture Housing demand is increasing in our area for all types of homes. Luxury homes and condos are increasing the most (condos above $570,000). The months of supply is around 2.4-5.5 months (single families at the low end and condos at the high end). But overall the market is fairly slow. The T3… Continue reading How’s the Market? March 2023

Your real estate wealth rescuer

Tag: FHA

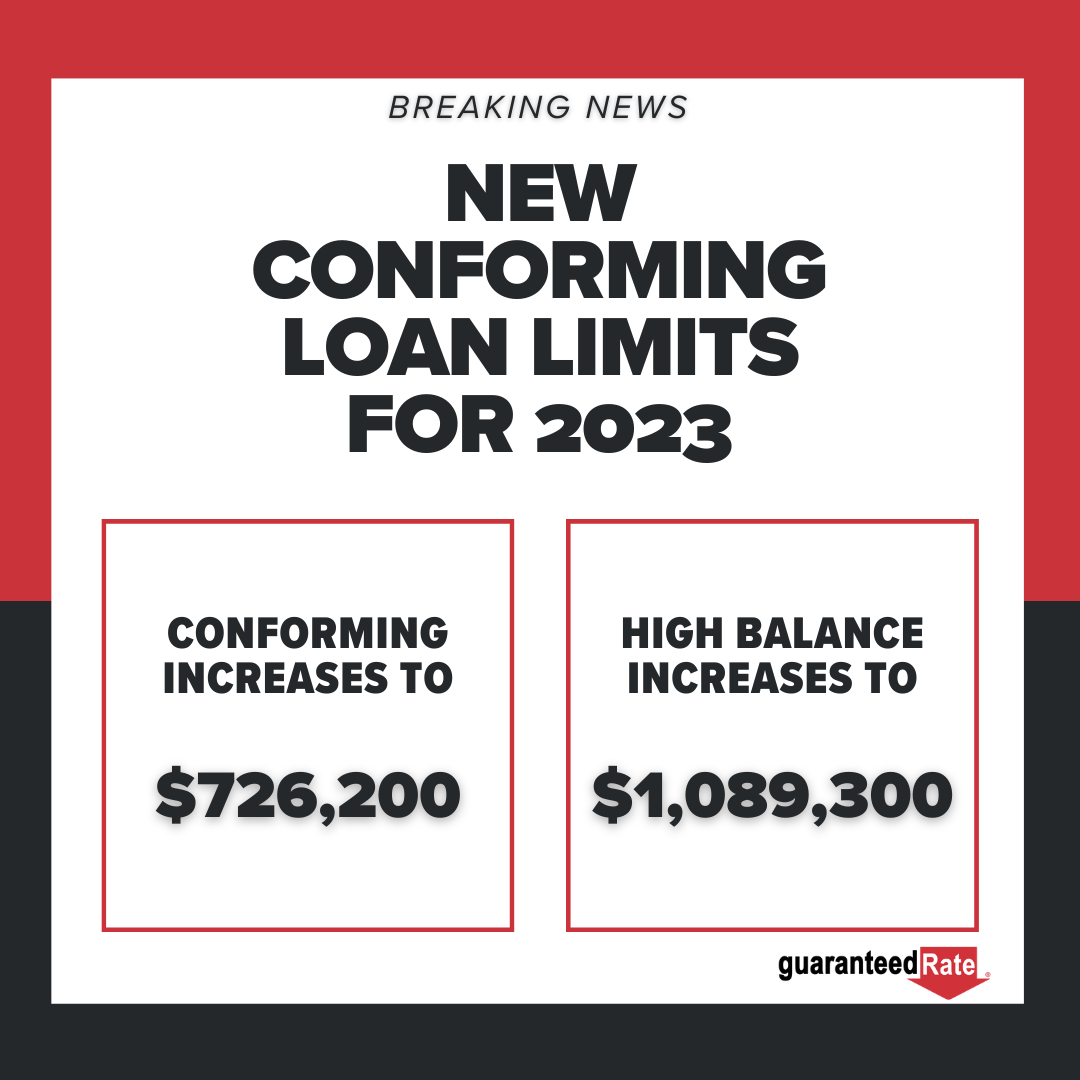

FHFA Announces New Conforming Loan Limits for 2023

Conforming Loan Limits The Federal Housing Finance Agency (FHFA) has announced it will be increasing maximum conforming loan limits in 2023.

Loan Products: An introduction to loan products for buying real estate

We are picking up our series “Understanding Financing” with today’s post, where we will look at the main loan products that most buyers use in the purchase of real estate. There are a lot of products on the market, various criteria to qualify for each, and different requirements from different lenders. My goal today is… Continue reading Loan Products: An introduction to loan products for buying real estate

FHA Reduces Mortgage Insurance Premiums

Mortgage Insurance Premiums | The Federal Housing Administration (FHA) reduced mortgage insurance premiums by a quarter of a percentage point (from 0.85% to 0.6%) starting January 27. (0.25% for 30-year loans and 0.20% for 15-year loans.) HUD says that this should decrease borrowers costs by $500 a year on average (a $200,000 loan). While this… Continue reading FHA Reduces Mortgage Insurance Premiums

Credit & How it affects your ability to secure financing

Credit and Security Financing In my last post, I discussed real estate financing 101 – what is a mortgage? and how will lenders evaluate you (the 3 C’s – credit, collateral, capacity)? Today, we are going to be talking about credit and how it affects your ability to secure financing. I said we were going… Continue reading Credit & How it affects your ability to secure financing