Overall Market Snapshot Inventory Mortgage Rates How are interest rates affecting this? The higher interest rates are affecting the lower price end of the market more because those buyers are more impacted by financial changes. 10 year treasury bonds broke 5% which caused mortgage rates to hit 8%. The next Fed meeting was November 1.… Continue reading How’s the Market? October 2023

Your real estate wealth rescuer

Tag: Mortgage

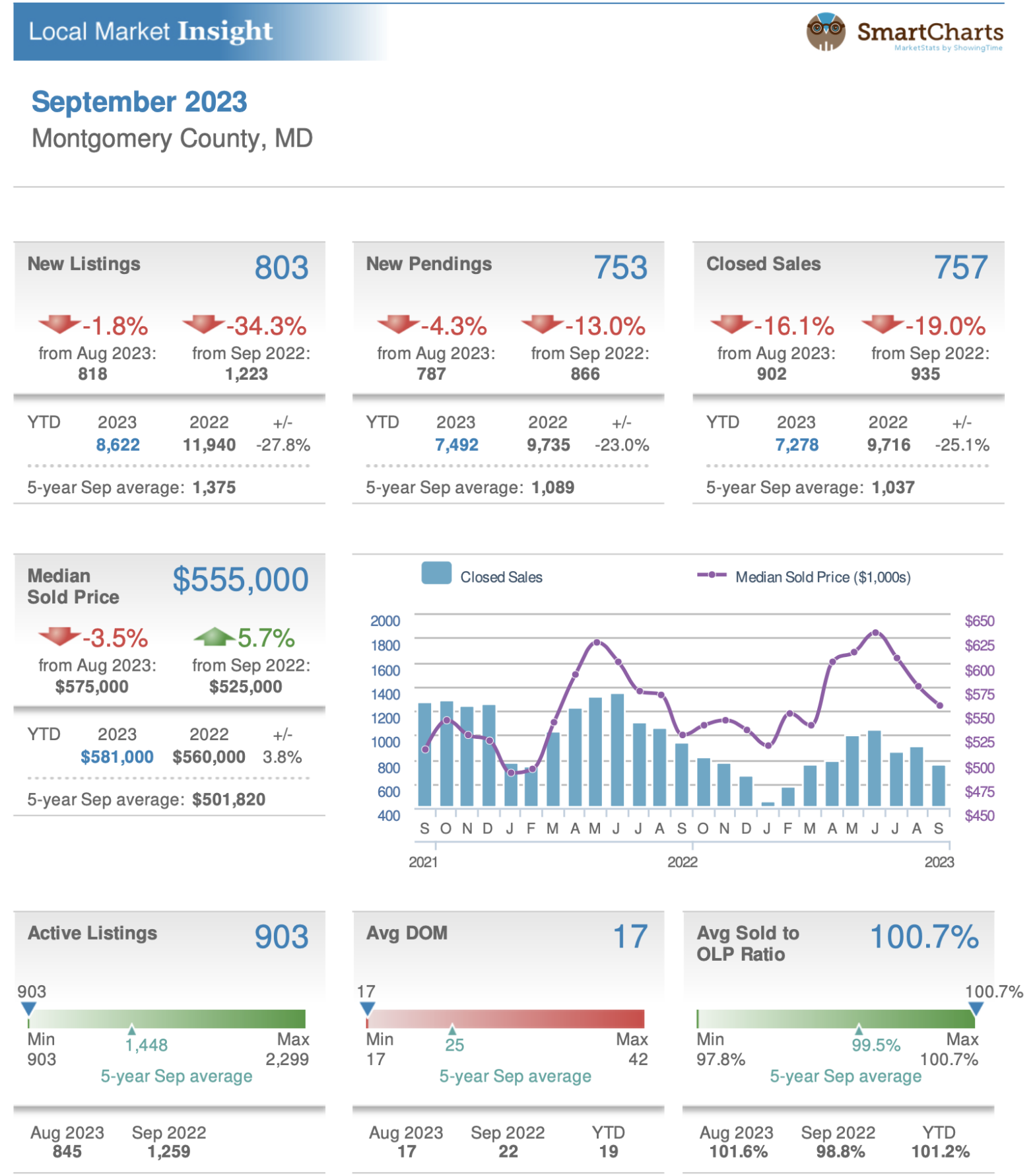

How’s the Market? September 2023

In the briefest of sentences, this is where we are – low supply (inventory) with high demand (buyers who want to buy) leads to increasing prices. As of 9/26, there was about 3.7 months of inventory in DC. The average list price was just under $1,000,000, which is up 7%. There was 1.2 months of… Continue reading How’s the Market? September 2023

How’s the Market? August 2023

Happy Fall! Now that we are entering our Fall market, let’s close out Summer 2023. The quick take: Our market has remained resilient. Our housing market demand remains strong and prices continue to rise. While home prices have fallen in some U.S. markets, prices have been consistently rising throughout our area and were up 3.9%… Continue reading How’s the Market? August 2023

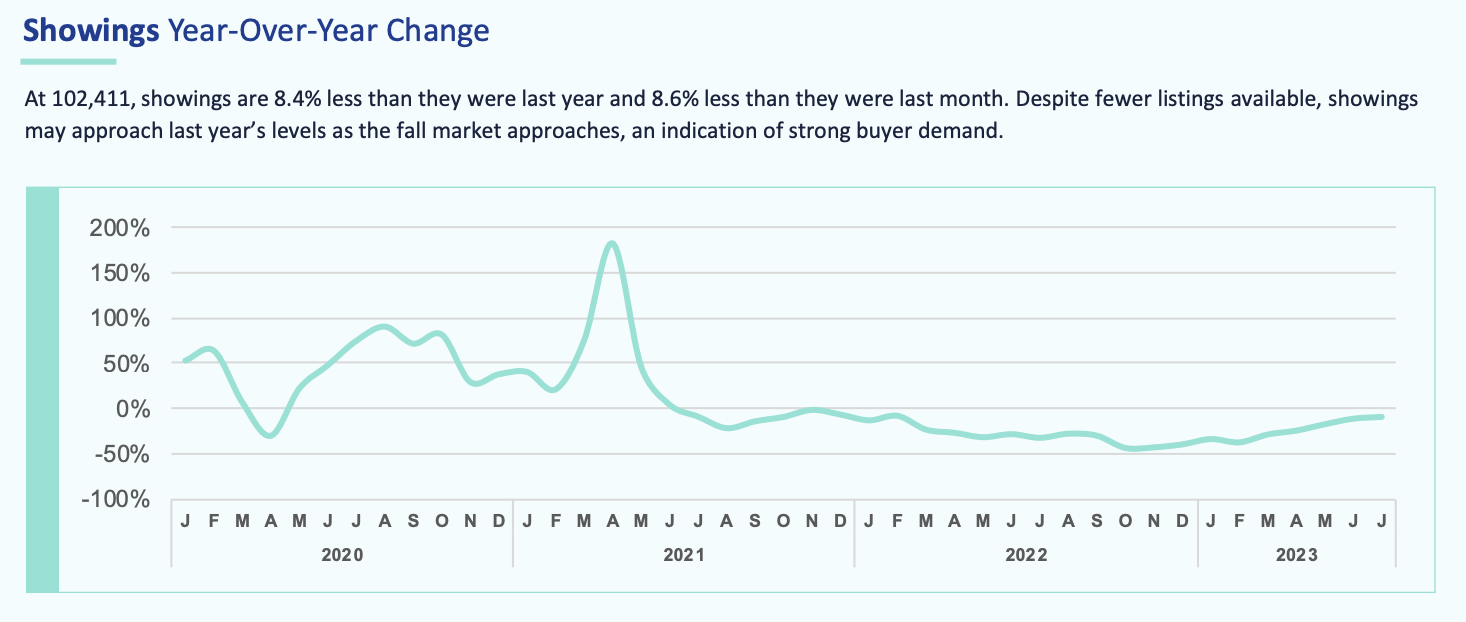

How’s the Market? June 2023

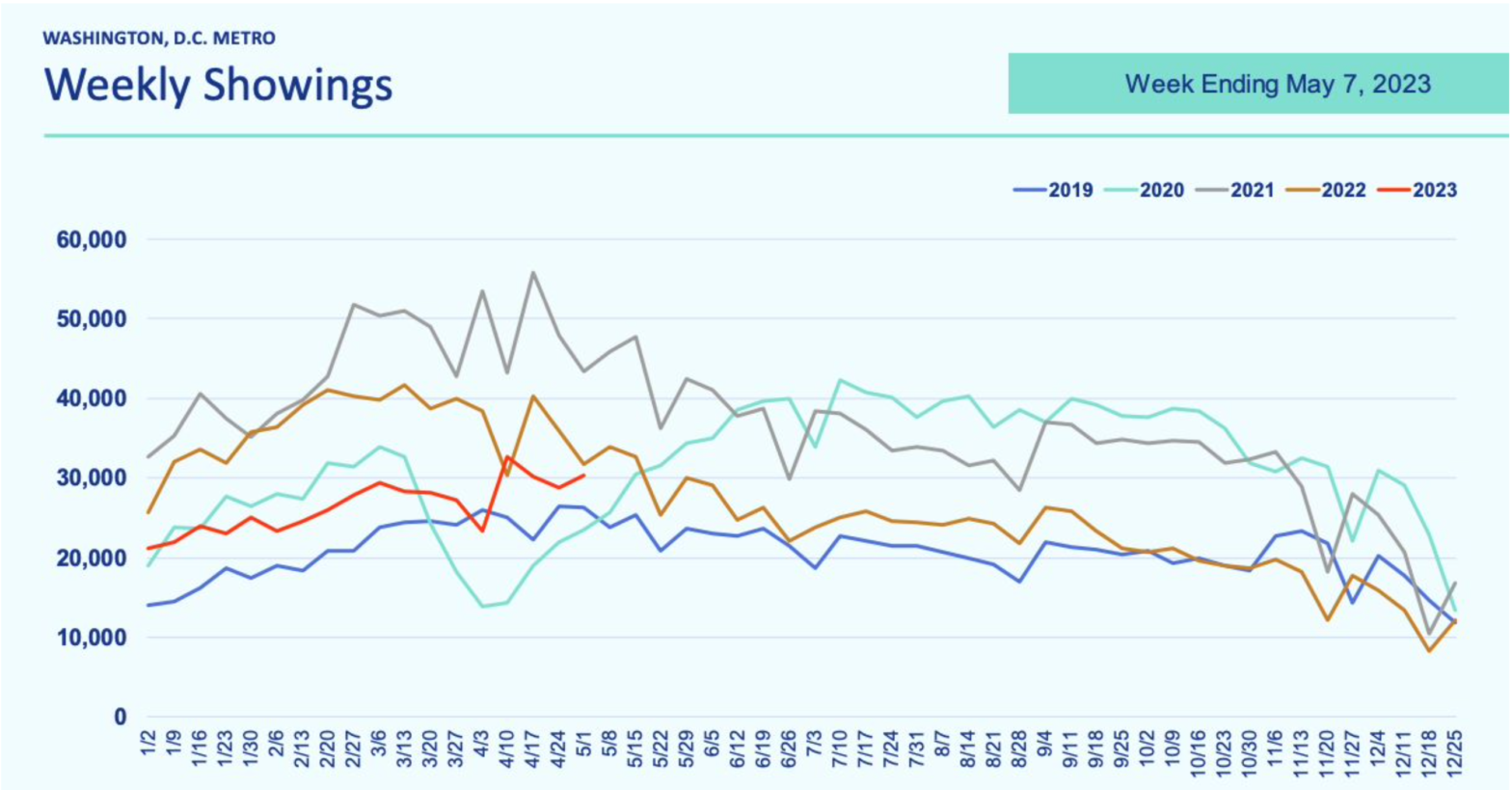

It is still a seller’s market with all that entails. Consumers are continuing to tour homes. Showing activity in the Mid-Atlantic has continued to track near 2019 levels despite the lack of inventory on the market. Buyers are motivated, but they need homes to purchase. Inventory The market has continued in much the same way… Continue reading How’s the Market? June 2023

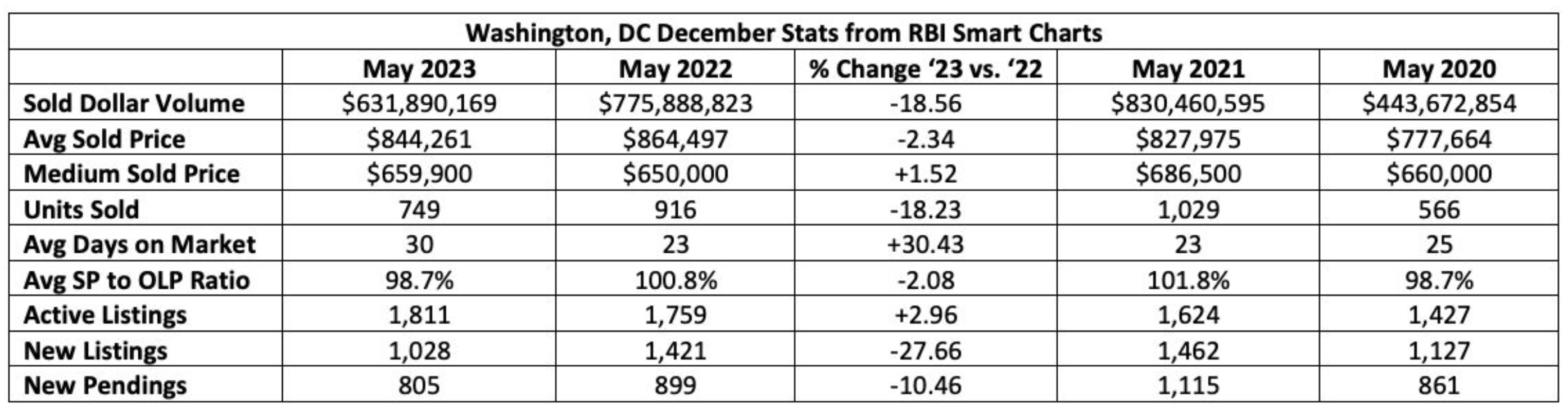

How’s the Market? May 2023

Not much has changed since last month. The amount of new listings continues to lag. New listings are down 22.6% in the Mid-Atlantic compared to the same time last year. Our area is down 40-50%. The number of showings on listings is still similar to 2019 levels. Given that inventory is so low, we are… Continue reading How’s the Market? May 2023

Housing Outlook 2023 – What can you expect?

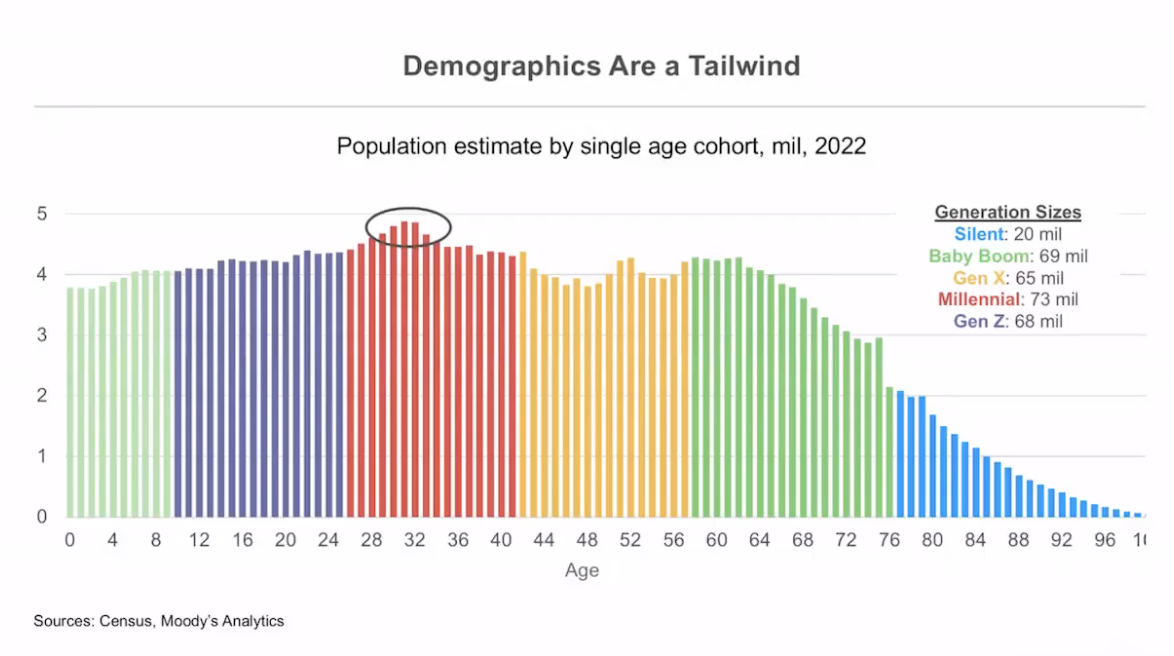

What can you expect to see in 2023? Well we don’t have a crystal ball, but let me gather together some of the important facts and trends so that you know what to expect in 2023. How Does the Economy Look? The US GDP is up, unemployment is down (down to 3% or pre-pandemic level),… Continue reading Housing Outlook 2023 – What can you expect?

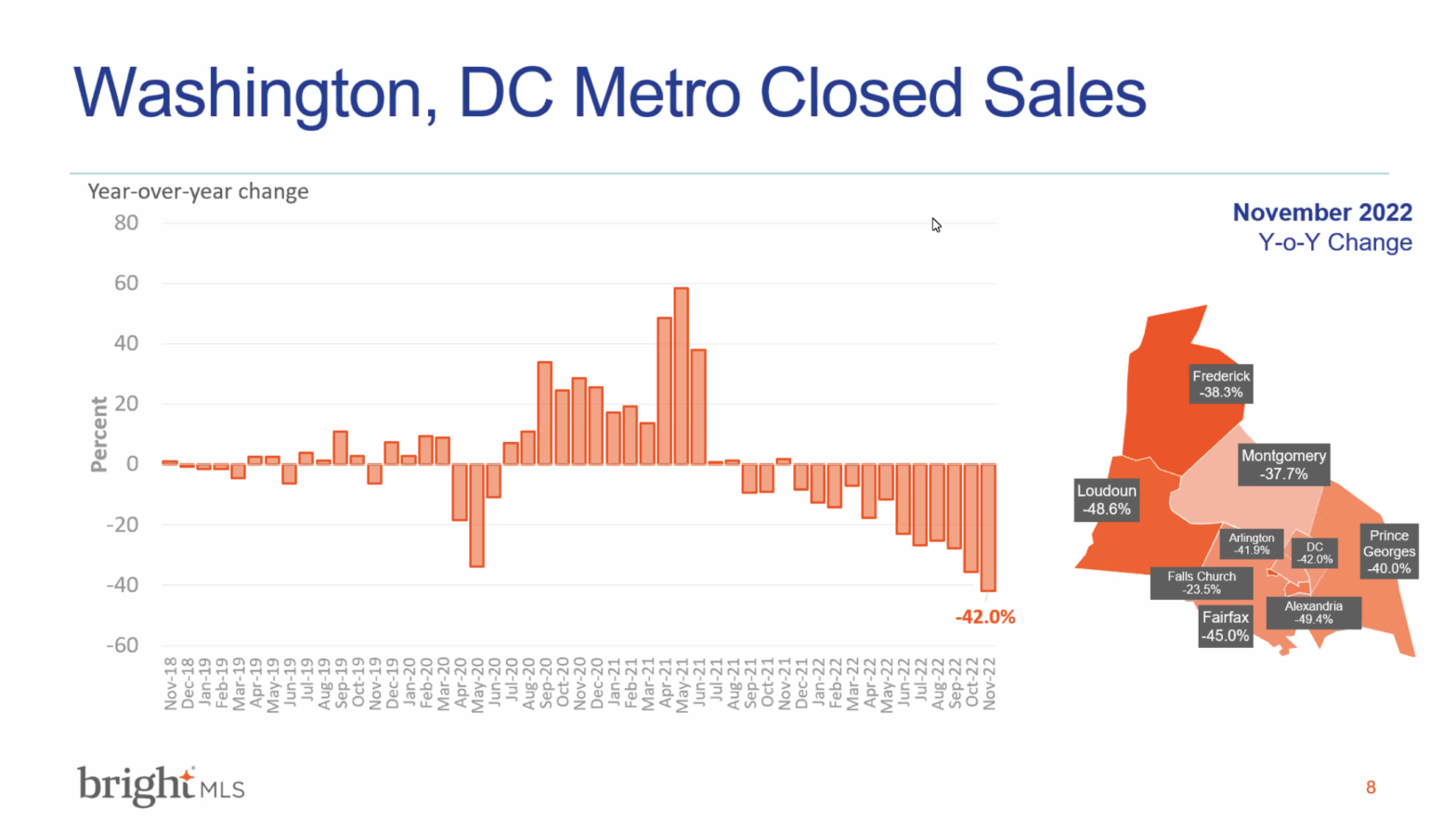

How’s the Market? Nov 2022

Welcome back to my monthly blog “How’s the Market?” This is our Nov 2022 blog post which uses Oct 2022 data. First let’s start with a look at where we are compared to where we were in 2019, 2020, and 2021. Inventory One of the top items that we are all watching — Inventory. DC… Continue reading How’s the Market? Nov 2022

How’s the Market? Is it a buyer’s market now?

Welcome back to my monthly series – “How’s the Market?” This is the August 2022 edition which covers July 2022 data. OVERALL MARKET PREDICTIONS: Where are we going for the rest of 2022 into 2023 Overall, expect the housing market activity to continue to slow through the second half of 2022 and into early 2023… Continue reading How’s the Market? Is it a buyer’s market now?

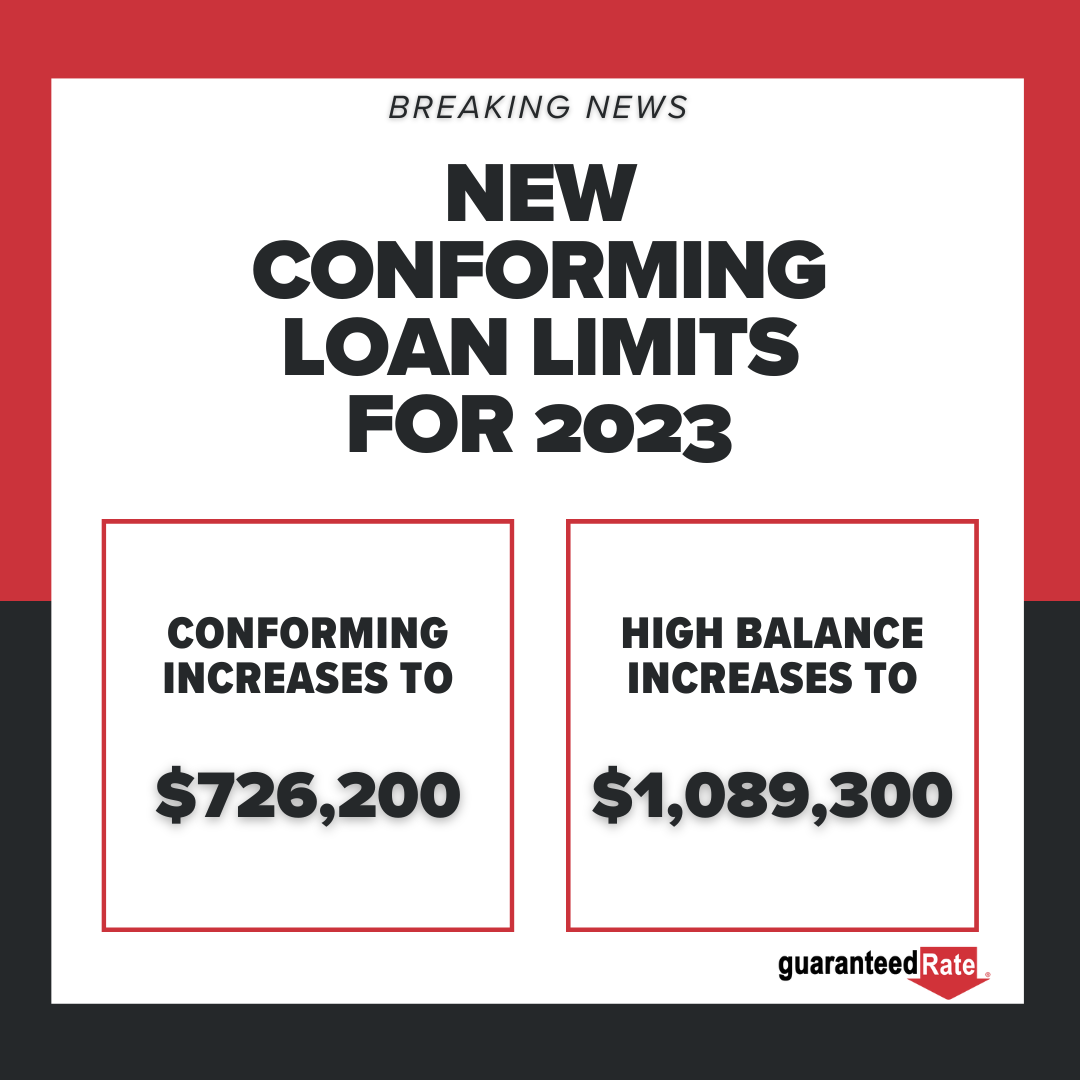

FHFA Announces New Conforming Loan Limits for 2023

Conforming Loan Limits The Federal Housing Finance Agency (FHFA) has announced it will be increasing maximum conforming loan limits in 2023.

Buying a House in our Hot Spring Market? 4 Tips on How to Get Ready

Buying a House | In my last video in this series, I discussed how competitive our spring market can be. As a buyer, now is the time to get ready. Let’s talk about how you can do that. 1. You need to get pre-approved from a local lender. This is important – I have an entire… Continue reading Buying a House in our Hot Spring Market? 4 Tips on How to Get Ready